Which Are the “Zombie Cryptocurrencies”, According to a Forbes report

29.04.2024 7:30 2 min. read Alexander Stefanov

The cryptocurrency market has over 2.4 million tokens and a staggering market capitalization of $2.4 trillion.

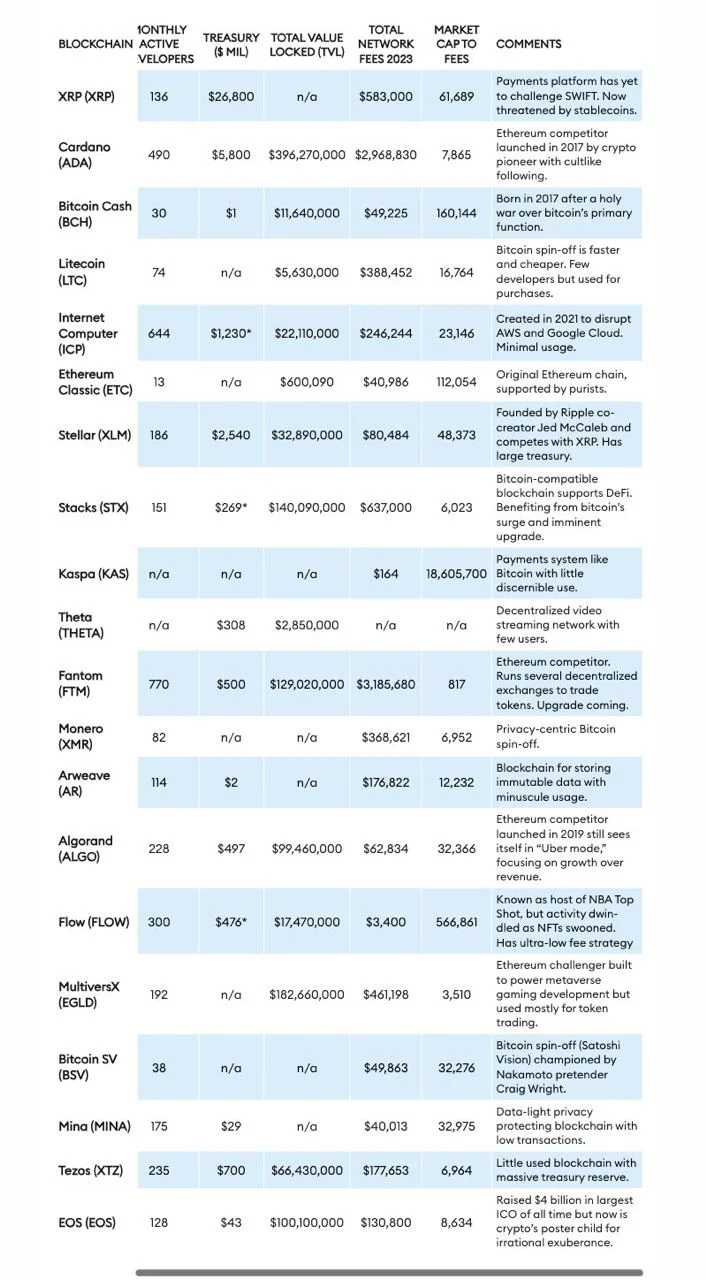

However Forbes identified a cohort of 20 cryptocurrencies called “zombie blockchains” that maintain significant market valuations despite having no real utility or widespread adoption.

Among the listed significant names are XRP, Cardano (ADA), Litecoin (LTC), Bitcoin Cash (BCH) и Ethereum Classic (ETC). These cryptocurrencies are characterized by sustained commercial activity and market presence without demonstrating practical applications.

The term “zombie blockchain” refers to projects that exist without showing signs of life in terms of utility or substantial user bases. Despite their lack of practical use, these tokens persist due to speculative trading and significant seed funding, rather than achieving their intended goals.

For example, Ripple’s XRP was created to compete with the SWIFT banking network by enabling fast and cheap international transfers. However, it has not been able to disrupt SWIFT and relies heavily on speculative trading for its market value.

Similarly, hard forks such as Litecoin, Bitcoin Cash, Bitcoin SV and Ethereum Classic maintain high ratings but are underutilized, serving mostly for speculative investments rather than practical applications.

The resilience of these “zombie blockchains” is due to liquidity, with trading activity keeping them afloat. Additionally, cryptocurrencies such as Tezos (XTZ), Algorand (ALGO) and Cardano (ADA), which are often touted as “killers of Ethereum‘, face challenges in achieving widespread adoption despite technological advances and significant evaluations.

The Forbes report also highlights governance and financial accountability issues within these blockchain projects, which operate without regulatory oversight or obligations to shareholders. This lack of oversight complicates efforts to assess their viability or financial health, as seen in cases like Ethereum Classic, which continues to trade actively despite significant security breaches.

-

1

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

2

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

3

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

4

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

5

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read

XRP Eyes Next Target as Bullish Crossover Sparks 560% Surge

XRP is back in the spotlight after crypto analyst EGRAG CRYPTO highlighted a powerful historical pattern on the weekly timeframe—the bullish crossover of the 21 EMA and 55 SMA.

Top 5 Most Trending Cryptocurrencies Today: Zora, Pudgy Penguins, SUI and More

Crypto markets are buzzing with momentum as several altcoins post double-digit gains and surging volumes.

Sui Price Jumps 14% to $4.26 amid ETF Hopes

Sui (SUI) surged 14% in the past 24 hours, reaching $4.26 as bullish technical patterns, Bitcoin’s rebound, and renewed ETF speculation pushed the altcoin higher.

HBAR Mirrors 2021 Cycle as Key Breakout Test Approaches

Hedera Hashgraph (HBAR) is closely tracking its 2021 price behavior, according to crypto analyst Rekt Capital.

-

1

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

2

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

3

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

4

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

5

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read