Which Are The Best Performing Cryptocurrencies from Top 100 Today?

29.07.2024 15:05 2 min. read Kosta Gushterov

The recent market recovery has sparked optimism among cryptocurrency investors, with some altcoins registering significant gains.

Bitcoin Cash (BCH) recently broke out of the inverted “head and shoulders” pattern, a bullish technical formation that has caused its price to jump 15.3% in the last 24 hours.

As of July 29, BCH is trading at a price of approximately $454, which along with BSV makes it the best performing among the top 100 cryptocurrencies. This increase boosted its market capitalization to $8.973 billion,

Several key factors led to this recent price spike. One significant catalyst was Bitcoin and Bitcoin Cash’s recovery of the amounts of injured customers affected by the Mt. Gox hack in 2014.

This resolution of a long-standing issue has renewed interest in BCH. In addition, there was significant activity on the whales, with several large purchases reported.

Trading volume is also considered to be an important factor, with around $503.3 million recorded over the last day.

High trading volumes often correlate with strong price movements, supporting the bullish trend and confirming the strength of the price increase.

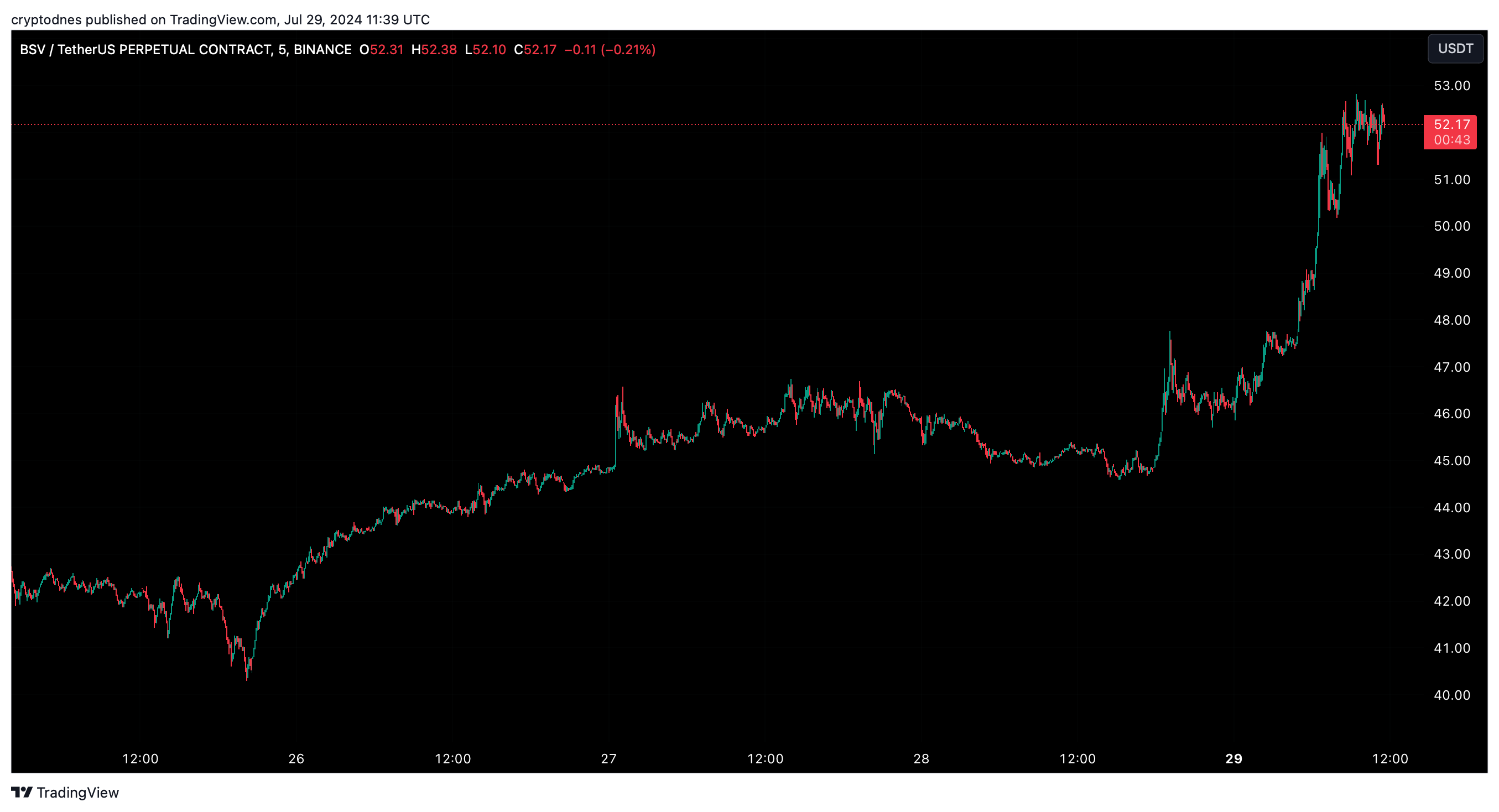

The other best performing asset today (July 29) is Bitcoin Cash’s hard fork, Bitcoin SV (BSV). Over the past 24 hours, BSV has surged just over 15.4% and recorded a trading volume of $68.53 million.

Attention is also focused on 2 cryptocurrencies with a smaller market capitalization, but with a larger intraday jump.

AIOZ Network (AIOZ), for example, gained 27% over the same time period, followed by meme cryptocurrency Book of Memes (BOME) with a 20% increase.

-

1

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

2

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

3

Ethereum Price Prediction: ETH Ongoing Accumulation Favors Bullish Outlook – Can It Rise to $5,000?

08.07.2025 16:35 3 min. read -

4

Sui Price Prediction: SUI Surpasses BNB and HYPE Trading Volumes in June – $10 by July?

02.07.2025 18:40 3 min. read -

5

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read

Weekly Crypto Roundup: Bitcoin Hits ATH, Ethereum Surges, Trump Advances Crypto Reforms

Analyzing the latest updates shared by Wu Blockchain, this past week underscored a pivotal shift in the crypto landscape. Bitcoin surged to a new all-time high of $123,226, pushing the overall crypto market cap beyond $4 trillion—a milestone reflecting renewed investor confidence and accelerating institutional flows.

Dogecoin Soars 11% as Bit Origin Bets $500M on Meme Coin Reserves

Dogecoin posted an 11% surge in 24 hours, powered by institutional moves, bullish chart signals, and growing altcoin momentum.

Dogecoin Price Prediction: DOGE Volumes Nearly Double – Can It Get to $1 In This Cycle?

Dogecoin (DOGE) has gone up by 10% in the past 24 hours and currently sits at $0.2360 as the top meme coin is playing catch-up with newcomers to maintain its leadership. In the past 30 days, DOGE has shined as it has delivered gains of 40.5%. Trading volumes in the past day have surged by […]

Binance to Support Maker (MKR) Token Swap and Rebranding to Sky (SKY)

Binance has officially announced its support for the upcoming token swap, redenomination, and rebranding of Maker (MKR) to a new token named Sky (SKY).

-

1

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

2

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

3

Ethereum Price Prediction: ETH Ongoing Accumulation Favors Bullish Outlook – Can It Rise to $5,000?

08.07.2025 16:35 3 min. read -

4

Sui Price Prediction: SUI Surpasses BNB and HYPE Trading Volumes in June – $10 by July?

02.07.2025 18:40 3 min. read -

5

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read