Whales Set to Benefit as New Crypto Traders Panic Amid Market Decline

24.12.2024 16:00 1 min. read Kosta Gushterov

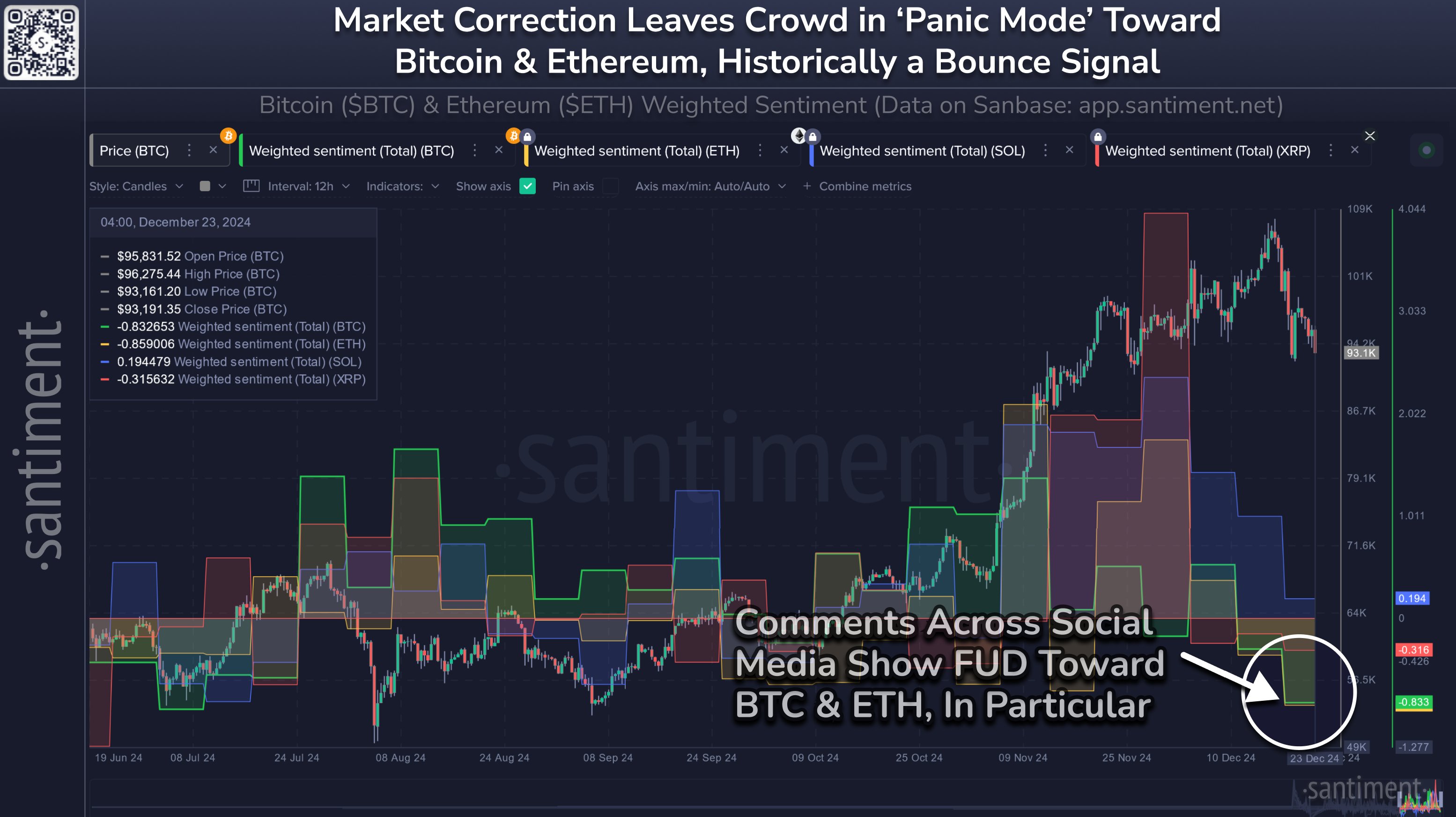

As the cryptocurrency market continued its downward trend on Monday, Santiment, a crypto analytics firm, released an insightful report on the prevailing market sentiment.

The firm observed rising panic among individual investors, particularly new traders who have entered the market in the past few months.

This wave of uncertainty and fear, often referred to as FUD, has heavily impacted Bitcoin and Ethereum, causing widespread concern.

Santiment attributed this panic to the lack of experience among recent market entrants, who are unfamiliar with typical market corrections.

Historically, such situations often trigger emotional selling from retail investors, allowing larger players, such as whales and sharks, to capitalize by purchasing assets at lower prices.

This accumulation can set the stage for price rebounds, although analysts cautioned that predicting the timing of these movements remains uncertain. The right conditions for a potential rally, however, appear to be forming.

-

1

Eclipse Labs Bans Team from ES Token Airdrop to Prevent Insider Abuse

26.06.2025 21:00 1 min. read -

2

Binance to Delist Five Tokens on July 4

02.07.2025 20:00 2 min. read -

3

What Are the Most Talked-About Words in Crypto Today?

28.06.2025 7:30 2 min. read -

4

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

30.06.2025 18:00 2 min. read -

5

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

30.06.2025 19:00 1 min. read

Solana Price Prediction: SOL Could Jump to $200 After This ‘Buy’ Signal

Solana (SOL) has gone up by 7% in the past 7 days after the approval of the first exchange-traded fund (ETF) linked to this token in the United States. The REX-Osprey SOL + Staking ETF (SSK) is already nearing the $100 million mark in assets under management (AUM), which favors a bullish Solana price prediction. […]

Has BTC Topped? Key Signals Suggest The Rally isn’t Over

Despite Bitcoin soaring past $120,000 and testing new all-time highs, several high-frequency market indicators suggest that the current bull run may still be gathering momentum.

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

A major development in the world of crypto ETFs has just been confirmed, as NYSE Arca has officially certified the approval for listing the ProShares Ultra XRP ETF (UXRP).

Top Crypto Trends Dominating Discussions This Week

As Bitcoin smashes through all-time highs, crypto-related conversation is surging across social media.

-

1

Eclipse Labs Bans Team from ES Token Airdrop to Prevent Insider Abuse

26.06.2025 21:00 1 min. read -

2

Binance to Delist Five Tokens on July 4

02.07.2025 20:00 2 min. read -

3

What Are the Most Talked-About Words in Crypto Today?

28.06.2025 7:30 2 min. read -

4

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

30.06.2025 18:00 2 min. read -

5

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

30.06.2025 19:00 1 min. read