Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Whales Are Accumulating Ripple (XRP), Hedera (HBAR), and Solana (SOL) Ahead of a Potential Breakout While PlutoChain Sees Whale Interest

13.02.2025 18:30 5 min. read Kosta GushterovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Major cryptocurrencies are showing promising developments. XRP benefits from growing institutional adoption, HBAR strengthens its enterprise presence with Mondelēz joining its council, and Solana gains momentum through Visa's integration of USDC.

Meanwhile, PlutoChain ($PLUTO) is gathering whale attention as a potentially groundbreaking Layer-2 solution for Bitcoin. The platform might be able to transform Bitcoin from a store of value into a practical payment system through enhanced scalability and functionality.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Let’s have a closer look at each project and why it stands out.

Ripple (XRP): Fast Cross-Border Payments with Growing Institutional Adoption

XRP is currently trading at approximately $2.43, which marks a 0.9% increase in the last 24 hours. Daily trading volume reached around $4.9 billion.

Ripple recently minted 9.1 million RLUSD tokens following listings on Bitstamp and Bullish, with ongoing discussions to bring its stablecoin to Binance and Coinbase.

Meanwhile, its legal dispute with the SEC continues and creates uncertainty around XRP’s long-term prospects. Despite this, Ripple is considering an IPO and potentially joining Circle and Kraken in going public if U.S. regulations become more favorable.

Excitement is also building around BlocScale’s $BLOC token, which runs on the XRP Ledger and could attract more projects and investors. Crypto analyst STEPH IS CRYPTO suggests XRP has formed a double bottom pattern and sets a bold price target of $30.

Hedera (HBAR): Scalable Enterprise-Grade Blockchain for Secure Transactions

Hedera is currently priced at approximately $0.2374, with a 24-hour trading volume of about $282 million.

Speculation is growing around the possibility of an HBAR-focused ETF. If approved, it could bring more institutional attention to Hedera.

Beyond ETF talks, Hedera continues enhancing its network. A recent update introduced the Tiered HBAR Rate Limiter for its JSON-RPC Relay, which organizes users into different spending tiers. This system aims to make transaction fees more predictable and cost-effective.

Hedera is also strengthening its governance. Mondelēz International, a global food industry leader, recently joined its Governing Council. According to Gilmore Estates, HBAR could skyrocket to $250 by 2050, especially with its involvement in a SpaceX-powered satellite launch.

Solana (SOL): Ultra-Fast Blockchain for Scalable Applications

Solana is now priced at about $203.13, down 0.58% in the last 24 hours. Throughout the day, its value has ranged between $194.02 and $204.64, with a trading volume of approximately $4.5 billion over the same period.

Visa recently announced plans to use Solana’s blockchain for payments with the stablecoin USDC, to improve transaction speed and efficiency for merchants.In the DeFi space, Solana’s Total Value Locked (TVL) has grown by 8.25% and reached $8.95 billion.

Platforms like Hyperliquid have seen a surge in activity, and stablecoin holdings on Solana have increased by $1 billion, which pushed the total to nearly $5 billion.The developer community is also active, with projects like Wormhole and Pyth Network driving innovation. Wormhole connects Solana with other blockchains, while Pyth Network provides real-time data for DeFi applications.

Analyst Juan Cena believes Solana could hit $1,000 this cycle and estimates its market cap to range between $450 and $500 billion.

PlutoChain ($PLUTO): A Layer-2 Solution that Might Make Bitcoin Faster, Cheaper, and More Practical

Bitcoin revolutionized digital finance, but it still isn’t ideal for everyday use. Transactions take too long, fees are high, and businesses hesitate to accept them due to the lack of refund options.

All this has kept Bitcoin from becoming a truly global payment system. PlutoChain ($PLUTO) is a Layer-2 solution that could make Bitcoin faster, cheaper, and more practical for daily transactions.

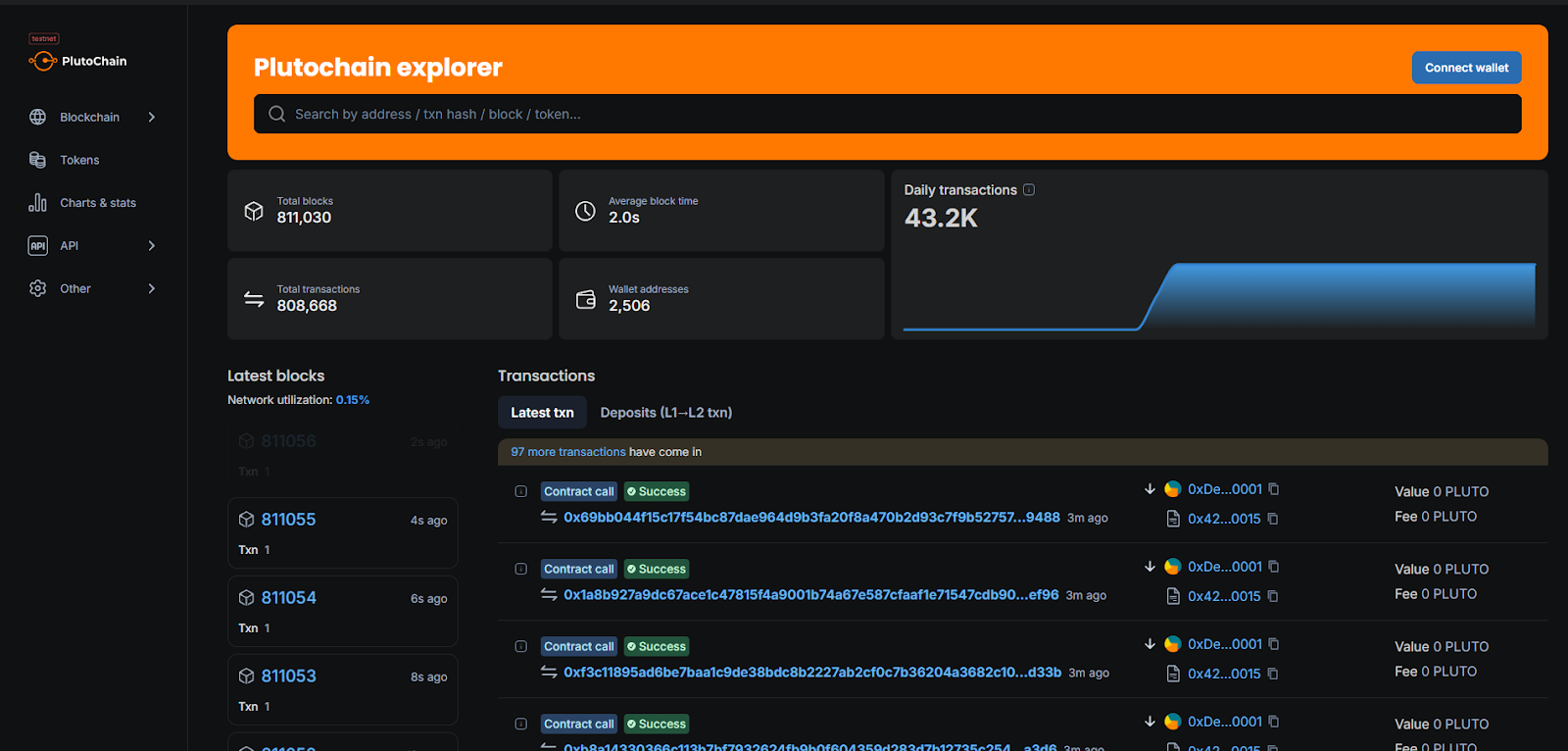

Instead of waiting up to 10 minutes for a transaction to confirm, PlutoChain has block times of just two seconds. This could make Bitcoin much more convenient for things like online shopping or international transfers.

Lower fees are another major benefit. High transaction costs often discourage smaller payments, but PlutoChain is designed to significantly reduce fees, which could make Bitcoin more affordable for everyone.

Beyond payments, PlutoChain could expand Bitcoin’s potential by introducing Ethereum-compatible smart contracts. This means Bitcoin could support DeFi applications, NFTs, and even AI-powered blockchain projects — use cases that were previously limited to Ethereum.

Security is a top priority. PlutoChain has undergone audits by SolidProof, QuillAudits, and Assure DeFi, to make sure the network remains reliable and secure.

During the testnet phase, it processed 43,200 transactions in a single day without issues, which demonstrates its ability to scale efficiently.

Unlike Bitcoin’s miner-controlled upgrade process, PlutoChain takes a more decentralized approach and gives users a say in network changes through a voting system.

The Takeaway: Which Project Shows the Most Promise?

All of these projects are advancing in their respective lanes, but PlutoChain ($PLUTO) might stand out as the most transformative project.

This Layer-2 solution could solve Bitcoin’s biggest issues by making transactions faster, cheaper, and more flexible with smart contracts.

If it continues to grow, PlutoChain could be the key to helping Bitcoin reach a much larger audience.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now as XRP’s Legal Saga With Ripple Ends

28.06.2025 22:31 7 min. read -

2

3 Crypto Presales That Could Generate 100x Returns in Q3

29.06.2025 12:27 4 min. read -

3

Bitcoin Records Another All Time High as Bitcoin Hyper Presale Soars: Best Crypto to Buy?

11.07.2025 12:05 6 min. read -

4

Best Crypto to Buy Now After Trump’s $220 Million Bitcoin Power Play

02.07.2025 19:23 7 min. read -

5

5 Best Crypto to Buy for Q3 Altcoin Season as Bitcoin Dominance Dips

29.06.2025 12:31 5 min. read

Best Crypto to Buy Now as Bitcoin Market Cap Rises Higher Than Google and Amazon

Bitcoin’s latest milestone saw it vault past tech giants Google and Amazon to rank as the fifth most valuable asset on earth. Clocking in at roughly $2.4 trillion in market capitalization, just above Amazon and comfortably ahead of Alphabet, this achievement underscores a turning point for cryptocurrencies. This publication is sponsored. CryptoDnes does not endorse […]

Pump.fun Token Price Prediction: PUMP Tanks After Launch, Traders Rotate Into Snorter Token Presale

The Solana-based crypto launchpad Pump.fun recently made headlines by raising roughly $500 million in just 12 minutes during its PUMP token sale, achieving a fully diluted valuation of $4 billion. But the hype quickly fizzled away after PUMP became available for trading, as its price dropped almost 55% from its peak and fell to around […]

Bitcoin Price Prediction: Here’s When BTC Could Hit $150,000 as Bitcoin Hyper Presale Goes Viral

After Bitcoin (BTC) hit a new all-time high just above $123,000 yesterday, investor attention is now turning to the $150,000 milestone. Polymarket’s prediction markets show a roughly 46% chance of BTC hitting $150,000 this year, and a 74% probability for the $130,000 level. A few market commentators are even more bullish. For instance, the analyst […]

Ethereum Price Prediction: ETH to Could Soar to $3.5K as Trading Volumes Hit $33.7B

Ethereum (ETH) just broke $3,000 for the first time since February, with volume and open interest jumping in tandem. But can ETH continue rising to $3,500 or will this rally fizzle out? Meanwhile, the rest of the Ethereum ecosystem is benefiting from ETH’s latest surge. Best Wallet Token (BEST) is one project that is taking […]

-

1

Best Crypto to Buy Now as XRP’s Legal Saga With Ripple Ends

28.06.2025 22:31 7 min. read -

2

3 Crypto Presales That Could Generate 100x Returns in Q3

29.06.2025 12:27 4 min. read -

3

Bitcoin Records Another All Time High as Bitcoin Hyper Presale Soars: Best Crypto to Buy?

11.07.2025 12:05 6 min. read -

4

Best Crypto to Buy Now After Trump’s $220 Million Bitcoin Power Play

02.07.2025 19:23 7 min. read -

5

5 Best Crypto to Buy for Q3 Altcoin Season as Bitcoin Dominance Dips

29.06.2025 12:31 5 min. read