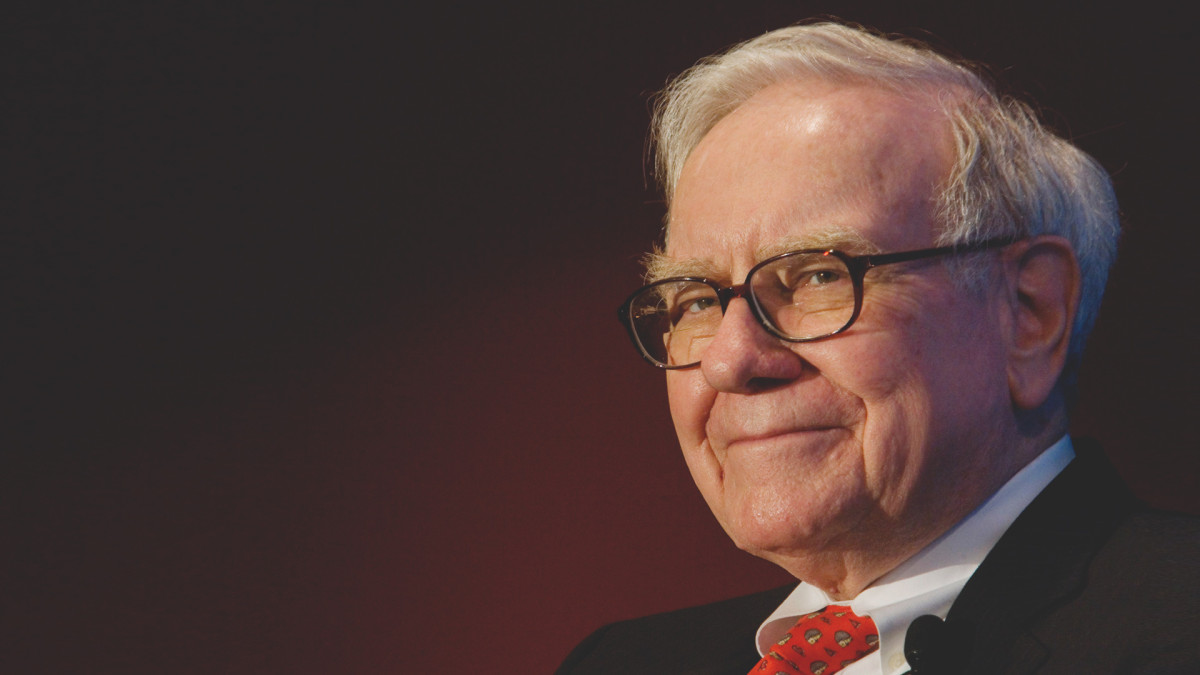

Warren Buffett Narrows His Bets as He Prepares to Step Down

14.06.2025 16:00 2 min. read Alexander Stefanov

As Warren Buffett edges closer to ending his six-decade reign at Berkshire Hathaway, the legendary investor has tightened his focus, placing nearly $197 billion into just a handful of stocks.

With his retirement set for the end of 2025, Buffett appears to be consolidating Berkshire’s portfolio into companies that reflect his enduring investment philosophy—resilient businesses with recognizable brands, strong cash flows, and long-term value.

Currently, over 70% of Berkshire’s stock portfolio is concentrated in just seven firms. Despite this focused approach, the conglomerate continues to hold an enormous cash reserve of nearly $348 billion, underscoring Buffett’s cautious stance in uncertain markets.

At the top of the list is Apple, still Berkshire’s largest equity position at just under $59 billion, even after Buffett dramatically reduced the firm’s exposure to the tech giant over the past year. American Express, valued at $43.6 billion, remains another cornerstone of the portfolio, highlighting Buffett’s confidence in premium financial services.

Consumer-facing giants like Coca-Cola and Kraft Heinz, valued at $28.4 billion and $8.4 billion respectively, represent Buffett’s long-held belief in the power of recognizable brands and reliable dividends. Meanwhile, Bank of America, still among the top holdings at $27.8 billion, has seen its stake reduced as Buffett cautiously scales back from the banking sector.

On the energy front, Chevron and Occidental Petroleum, with allocations of $17.3 billion and $12.3 billion respectively, reflect Buffett’s ongoing interest in oil and gas firms that deliver consistent returns.

As Buffett prepares to pass the torch to Greg Abel, his chosen successor, the streamlined portfolio signals a back-to-basics approach—one that leans on legacy convictions rather than riskier bets. It’s a parting strategy rooted in discipline, consistency, and the kind of patience that defined Buffett’s career.

-

1

U.S. Bank Advises Clients to Drop These Cryptocurrencies

29.06.2025 10:00 2 min. read -

2

FTX Halts Recovery Payments in 49 Countries: Here Is the List

04.07.2025 18:00 2 min. read -

3

Chinese Tech Firms Turn to Crypto for Treasury Diversification

26.06.2025 17:00 1 min. read -

4

What Are the Key Trends in European Consumer Payments for 2024?

29.06.2025 8:00 2 min. read -

5

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read

JPMorgan Lawsuit Threatens Crypto Access and Open Banking Rights

JPMorgan and other major U.S. banks are under fire for a lawsuit aimed at dismantling the Consumer Financial Protection Bureau’s (CFPB) newly established “Open Banking Rule.”

Greed Holds as Market Momentum Builds: What is the Market Sentiment

The crypto market remains firmly in “Greed” territory, with CoinMarketCap’s Fear & Greed Index clocking in at 69/100 on July 19. Despite a modest 24-hour dip from 71, the index has now held above 60 for 11 consecutive days.

Top 7 Crypto Project Updates This Week

The crypto industry saw major advancements this past week across DeFi, NFT, Layer 2, and AI-powered platforms.

Peter Thiel-Backed Crypto Exchange Files for IPO

Cryptocurrency exchange Bullish, backed by billionaire investor Peter Thiel, has officially filed for an initial public offering (IPO), marking a major step toward entering the public markets.

-

1

U.S. Bank Advises Clients to Drop These Cryptocurrencies

29.06.2025 10:00 2 min. read -

2

FTX Halts Recovery Payments in 49 Countries: Here Is the List

04.07.2025 18:00 2 min. read -

3

Chinese Tech Firms Turn to Crypto for Treasury Diversification

26.06.2025 17:00 1 min. read -

4

What Are the Key Trends in European Consumer Payments for 2024?

29.06.2025 8:00 2 min. read -

5

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read