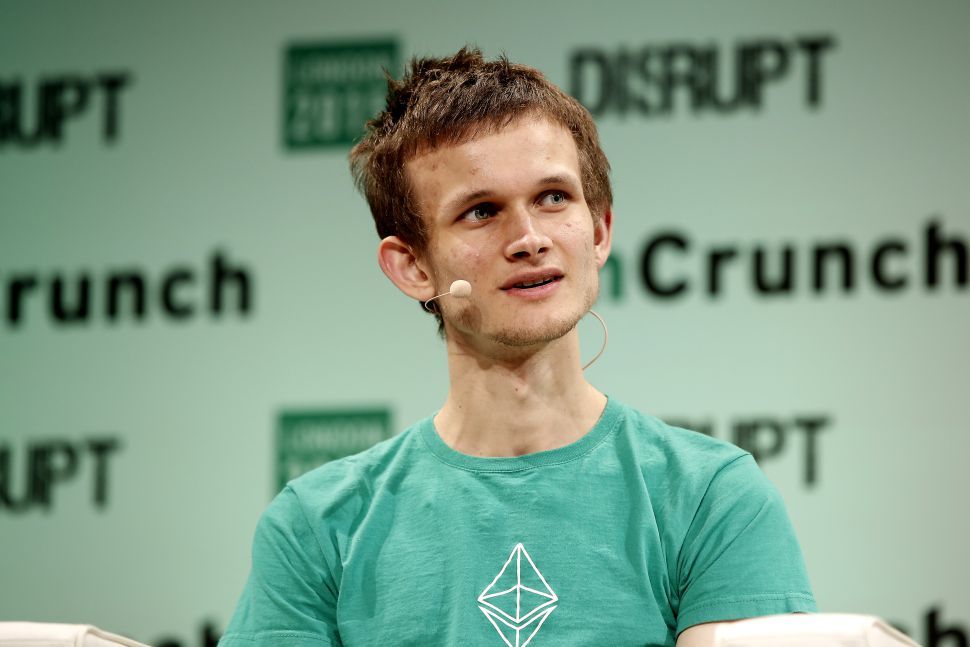

Vitalik Buterin: Ethereum Must Be Ready to Replace Cash

27.05.2025 14:00 1 min. read Alexander Stefanov

Ethereum co-founder Vitalik Buterin has renewed calls for the network to embrace a more cash-like function, pointing to Sweden’s unexpected return to promoting physical currency as a cautionary tale.

Reacting to a Guardian report highlighting Sweden’s reconsideration of its cashless push, Buterin noted on X that even highly digital societies are recognizing the need for physical money in times of uncertainty.

Geopolitical instability and war in Eastern Europe have prompted Swedish officials to advise citizens to keep physical krona on hand, despite years of advancing digital payments and a now-abandoned e-krona pilot.

Buterin argued that centralized systems can prove fragile in crisis scenarios. “Cash turns out necessary as a backup,” he said, emphasizing the need for Ethereum to evolve into a truly robust and private alternative. For the network to serve as a digital fallback, it must meet high standards of resilience and privacy, he added.

His comments reflect a broader vision of Ethereum not just as programmable money, but as a decentralized financial layer capable of serving real-world needs during uncertain times.

With central banks hesitating on digital currencies and public trust in institutions fluctuating, Ethereum’s ability to function as a private, censorship-resistant form of money could become increasingly vital.

-

1

What Are the Most Talked-About Words in Crypto Today?

28.06.2025 7:30 2 min. read -

2

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

30.06.2025 18:00 2 min. read -

3

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

30.06.2025 19:00 1 min. read -

4

Top Trending Cryptocurrencies Today

01.07.2025 15:17 3 min. read -

5

XRP Price Prediction: Can XRP Hit $4 After XRPL EVM Sidechain Launch?

30.06.2025 22:06 3 min. read

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

Pepe (PEPE) has been outpacing the top two cryptos in the meme coin category in the past 7 days. This favors a bullish Pepe price prediction as it could push it to flip Shiba Inu (SHIB) as the second most valuable meme coin in the world. During this period, PEPE delivered gains of 27.5%. As […]

XRP Surges Toward $3: Main Factors Driving the Rally

XRP is trading near the $3 mark after gaining 2.98% in the past 24 hours, supported by a surge of bullish momentum across regulatory, institutional, and real-world utility fronts.

Ondo Price Breakout Confirms Bullish Trend: What’s the Target in Sight

Ondo (ONDO) has captured trader attention with a confirmed breakout above $0.87, signaling a possible shift in trend after months of consolidation.

Hedera (HBAR) Faces Sharp Pullback After 49% Monthly Rally

Hedera’s native token HBAR is facing selling pressure after an explosive 49% monthly surge, dropping over 5% in the past 24 hours at time of writing.

-

1

What Are the Most Talked-About Words in Crypto Today?

28.06.2025 7:30 2 min. read -

2

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

30.06.2025 18:00 2 min. read -

3

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

30.06.2025 19:00 1 min. read -

4

Top Trending Cryptocurrencies Today

01.07.2025 15:17 3 min. read -

5

XRP Price Prediction: Can XRP Hit $4 After XRPL EVM Sidechain Launch?

30.06.2025 22:06 3 min. read