VanEck Moves Forward with Avalanche ETF Filing

11.03.2025 15:00 2 min. read Alexander Stefanov

VanEck, a global investment firm managing $113.8 billion in assets, is moving forward with plans to launch an Avalanche (AVAX) exchange-traded fund (ETF) after registering a trust in Delaware.

This marks a crucial step in the firm’s strategy to tap into the growing interest in digital assets, particularly in blockchain technologies like Avalanche, which is known for its high-speed transaction processing and support for decentralized applications.

The registration of this trust, filed on March 10, positions VanEck to potentially file for a spot AVAX ETF with the U.S. Securities and Exchange Commission (SEC) in the near future.

This will allow the company to formally outline the fund’s structure, strategy, and risks before moving forward with an official launch, pending SEC approval. If successful, the ETF could provide institutional investors with a regulated avenue to gain exposure to Avalanche.

The filing comes at a time when cryptocurrency ETFs are gaining traction in the financial world. Firms like Canary Capital and Bitwise are also pursuing similar initiatives with assets such as Sui (SUI) and Aptos (APT), reflecting an expanding appetite for cryptocurrencies beyond the mainstream offerings of Bitcoin and Ethereum.

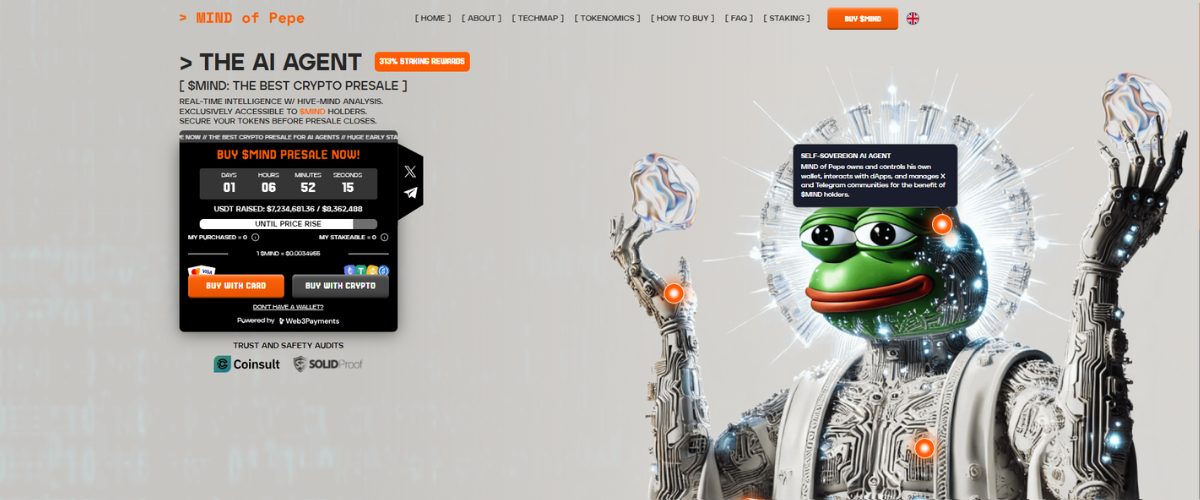

Lookin for New Altcoins? MIND of Pepe Might Be What You Are Looking for

Looing at alternative cryptocurrencies, the AI agent MIND of Pepe ($MIND) is gaining traction as it promises investors exclusive access to a self-sovereign AI agent that could transform the crypto market and provide deep trading insights.

MIND of Pepe can not only analyze community sentiment around the crypto market—it can jump into the discussion and actively change investors’ mindset and help them with their strategy.

$MIND is a relatively new project, that took the spotlight and raised millions in no time, aiming to be the next game changer

in the meme coin space.

-

1

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

2

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

3

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read -

4

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read -

5

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read

Ethereum Spot ETFs Dwarf Bitcoin with $1.85B Inflows: Utility Season in Full Swing

Ethereum is rapidly emerging as the institutional favorite, with new ETF inflow data suggesting a seismic shift in investor focus away from Bitcoin.

Ethereum 2025 Mirrors 2017 Breakout—But With Wall Street Fueling the Surge

Ethereum (ETH) appears to be entering a breakout phase eerily reminiscent of its historic 2017 rally—but this time, the move is backed by deep institutional support and ETF inflows.

SUI Price Breaks Key Resistance as BTCFi Vision Gains Traction

SUI, the native token of the Sui blockchain, is drawing attention following a major breakout on the charts—driven by surging total value locked (TVL) and growing anticipation around Bitcoin-native decentralized finance (BTCFi) infrastructure.

Tom Lee Reveals What Makek Ethereum His Top Bet

Tom Lee, managing partner and head of research at Fundstrat Global Advisors, recently outlined his bullish stance on Ethereum, linking it directly to the rapid growth of the stablecoin sector.

-

1

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

2

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

3

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read -

4

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read -

5

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read