USDC Gains Popularity as Demand for Regulated Stablecoins Rises

10.07.2024 19:00 1 min. read Alexander Stefanov

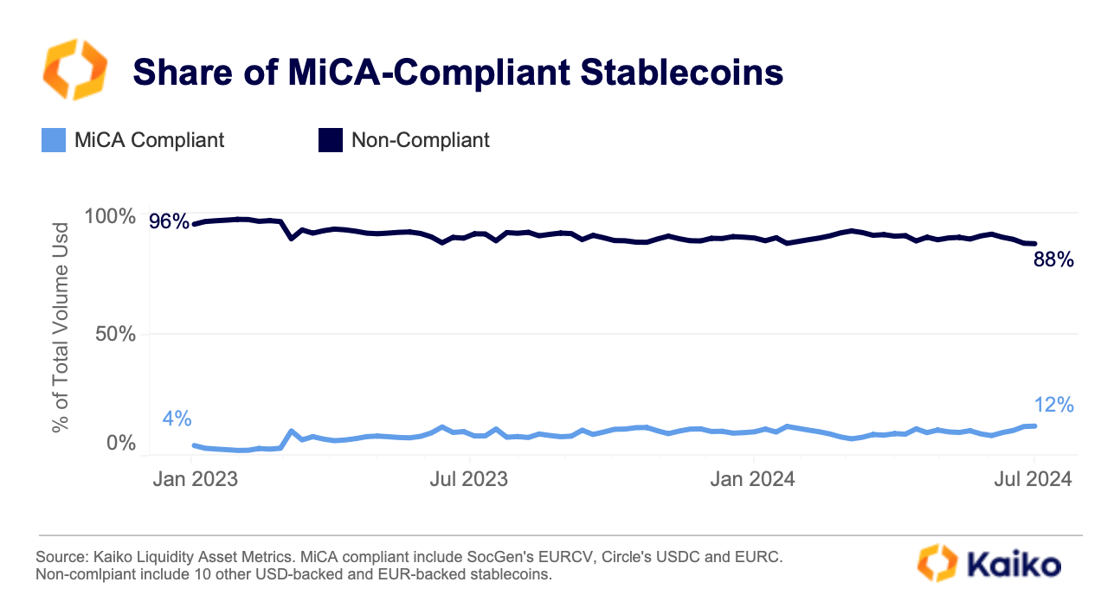

Circle’s USDC stablecoin is currently experiencing the highest demand among regulated stablecoins, according to data from Kaiko.

Kaiko’s recent report highlights that after Circle announced that its USDC and EURC stablecoins would comply with European Markets in Crypto-assets Regulation (MiCA), both have seen significant volume increases.

While non-compliant stablecoins still dominate the market, comprising 88% of the total stablecoin volume, there is a noticeable shift towards regulated products.

This shift could be driven by a growing preference for transparency in the market. Exchanges and market makers may begin favoring compliant stablecoins, especially as major crypto exchanges like Binance, Bitstamp, Kraken, and OKX have started restricting or delisting non-compliant stablecoins for their European users.

In the past year, the volume share of compliant stablecoins has risen, reflecting this increased demand for regulated alternatives. So far, this trend has mainly benefited USDC.

Another contributing factor to USDC’s growth is its rising use in perpetual futures settlement, even though its market share is still much smaller compared to Tether’s USDT.

-

1

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read -

2

Is a New Altcoin Cycle Brewing in 2025?

13.06.2025 12:00 1 min. read -

3

Ethereum Faces Heavy Sell-Off Amid Rising Geopolitical Tensions

13.06.2025 14:00 1 min. read -

4

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read -

5

South Korea’s New President Pushes for Domestic Stablecoins

11.06.2025 16:00 2 min. read

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

A new milestone in cryptocurrency investment products is set to unfold this Wednesday, as REX Shares prepares to launch the first-ever U.S.-listed staked crypto exchange-traded fund (ETF), according to a company announcement shared on X.

XRP Price Prediction: Can XRP Hit $4 After XRPL EVM Sidechain Launch?

XRP (XRP) has gone up by 1.2% in the past 24 hours but, behind that mild price increase, there has been a significant spike in trading volumes. During this period, $2.4 billion worth of XRP has exchanged hands, representing an 83% increase. Just hours ago, Ripple announced the official launch of its Ethereum-compatible sidechain called […]

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

A community-driven initiative launched Monday is inviting Ethereum users to lock art, memories, and personal messages inside a decentralized “time capsule,” set to be opened on the network’s 11th anniversary next year.

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

A new CryptoQuant report highlights a growing divergence between long-term Ethereum holders and short-term Bitcoin buyers, with significant accumulation behavior unfolding in both markets amid increasing political and economic tension in the U.S.

-

1

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read -

2

Is a New Altcoin Cycle Brewing in 2025?

13.06.2025 12:00 1 min. read -

3

Ethereum Faces Heavy Sell-Off Amid Rising Geopolitical Tensions

13.06.2025 14:00 1 min. read -

4

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read -

5

South Korea’s New President Pushes for Domestic Stablecoins

11.06.2025 16:00 2 min. read