USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read Kosta Gushterov

As President Trump accelerates his tariff strategy ahead of the August 1 deadline, new White House letters reveal formal trade warnings sent to multiple nations, including Tunisia, Cambodia, Indonesia, and others.

The administration is demanding action to address trade imbalances—or face escalating duties.

Tariffs hit emerging markets with aggressive rates

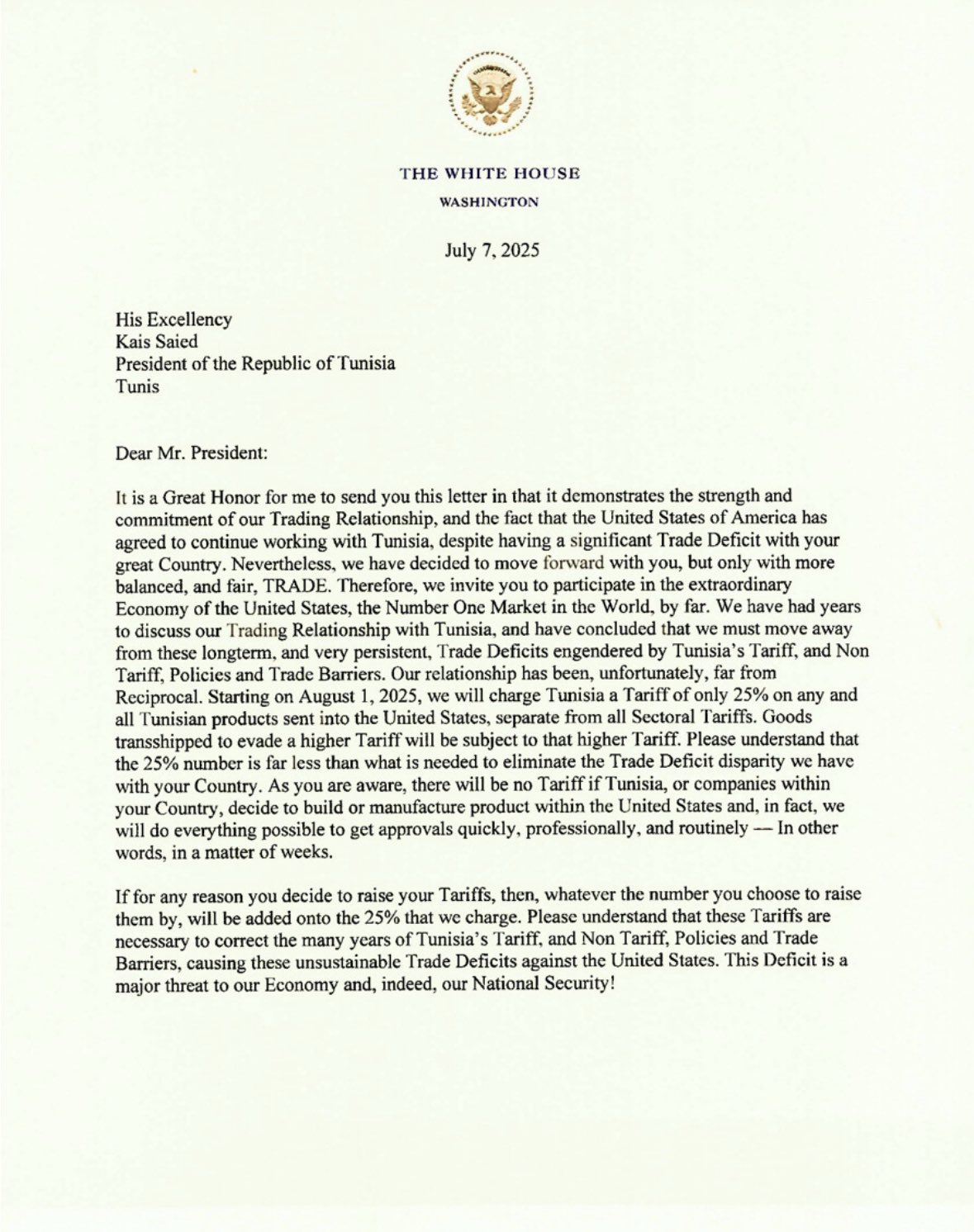

According to a July 7 letter from the White House, the U.S. will impose a 25% tariff on all Tunisian goods entering the country beginning August 1. This base rate may increase if Tunisia retaliates. Similar letters were reportedly sent to Cambodia (36%), Bangladesh (35%), Serbia (35%), Bosnia (30%), and Indonesia (32%). The letters describe these tariffs as a response to years of “non-reciprocal” trade relationships and “unsustainable” deficits with the United States.

In the letter to Tunisian President Kais Saied, President Trump wrote: “Our relationship has been, unfortunately, far from reciprocal,” and emphasized that the 25% figure is “far less than what is needed” to balance the trade gap. The message to global leaders is clear—comply, negotiate, or face steep economic consequences.

Schiff criticizes strategy as economically flawed

However, not everyone is convinced the strategy will work. Economist Peter Schiff issued a strong rebuttal, stating that tariffs have little to do with trade deficits. “Trump’s letters to Japan and South Korea demonstrate a complete lack of understanding of trade,” Schiff wrote. He emphasized that low foreign tariffs—Japan at under 2%, Korea under 1%—aren’t the cause of U.S. trade gaps.

Instead, Schiff argues that America’s deficits stem from its reliance on foreign-made goods that Americans prefer. He warned that Trump’s tariffs may raise import prices while doing little to reduce deficits: “As the dollar falls, our trade deficits will likely rise in dollar terms, as we pay more to import less.”

Possible implications for the crypto market

Trump’s aggressive trade moves could indirectly boost crypto markets if global economic tensions rise. Investors often turn to Bitcoin and stablecoins as hedges against currency volatility and trade-related uncertainty. If these tariffs trigger inflationary pressures or strain emerging market currencies—especially in countries hit hardest like Tunisia or Indonesia—demand for decentralized assets may spike. Furthermore, any retaliation or disruption in cross-border payments could reinforce narratives around permissionless crypto use, particularly in regions where dollar access becomes unstable or restricted.

-

1

Majority of U.S. Crypto Investors Back Trump’s Crypto Policy, Survey Finds

05.07.2025 18:09 2 min. read -

2

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

3

Here is How to Read the Crypto Fear and Greed Index

14.07.2025 15:00 3 min. read -

4

Binance Founder Says Bloomberg’s USD1 Report is False, Threatens Lawsuit

13.07.2025 8:30 2 min. read -

5

Binance CEO Issues Urgent Crypto Security Reminder

09.07.2025 17:30 2 min. read

TRON Inc Files $1 Billion Mixed Shelf Offering With SEC

TRON Inc., a blockchain-based technology firm incorporated in Nevada, has officially filed a Form S-3 with the U.S. Securities and Exchange Commission (SEC) to initiate a mixed shelf offering of up to $1 billion.

Robert Kiyosaki Warns of 1929-Style Crash, Urges Bitcoin Hedge

Financial author Robert Kiyosaki is once again sounding the alarm on America’s economic health.

China and U.S. Plan Trade Truce Extension Before Talks: How It Can Affect Bitcoin

The United States and China are expected to extend their trade truce by 90 days. The extension would delay new tariffs and create space for fresh negotiations in Stockholm.

Michael Saylor’s STRC IPO Tops U.S. Charts with $2.5B Raise

Michael Saylor, the high-profile Bitcoin advocate and executive chairman of MicroStrategy, has made headlines again—this time with the largest initial public offering (IPO) of 2025.

-

1

Majority of U.S. Crypto Investors Back Trump’s Crypto Policy, Survey Finds

05.07.2025 18:09 2 min. read -

2

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

3

Here is How to Read the Crypto Fear and Greed Index

14.07.2025 15:00 3 min. read -

4

Binance Founder Says Bloomberg’s USD1 Report is False, Threatens Lawsuit

13.07.2025 8:30 2 min. read -

5

Binance CEO Issues Urgent Crypto Security Reminder

09.07.2025 17:30 2 min. read