US Crypto ETFs Saw Combined Outflows of Over $105 Million

10.08.2024 14:00 1 min. read Kosta Gushterov

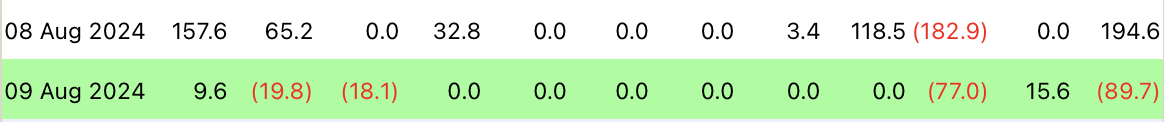

Spot Bitcoin exchange-traded funds (ETFs) in the U.S. recorded net outflows of $89.7 million on August 9, after attracting just over $194 million the day before.

According to Farside, Grayscale’s GBTC converted fund led the outflows with $77 million, followed by Fidelity’s FBTC with $19.8 million and Bitwise’s BITB with $18.1 million.

BlackRock’s Bitcoin fund (IBIT) was one of two funds to see inflows, adding $9.6 million. Hashdex’s DEFI was the best performer for the day, adding $15.6 million.

Interestingly, BlackRock’s IBIT, the largest spot Bitcoin ETF by net asset value, reported zero flows on Tuesday, along with seven other funds.

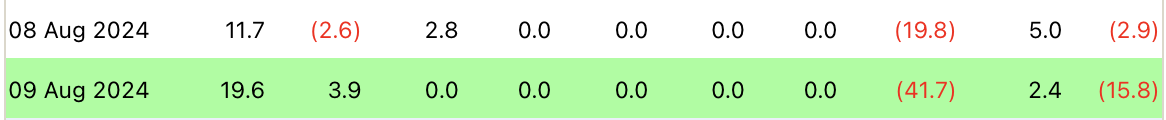

On the other hand, spot Ether ETFs also saw net outflows on Friday, with total outflows amounting to $15.8 million.

The largest inflow was recorded by BlackRock’s ETHA, which saw $19.6 million. Fidelity’s FETH received inflows of $3.9 million, Grayscale’s mini fund (ETH) attracted $2.4 million, while the rest remained neutral.

Grayscale’s ETHE, on the other hand, experienced the largest outflow of the day, seeing outflows of $41.7 million.

-

1

Top 10 Trending Cryptocurrencies Today, According to CoinGecko

04.07.2025 15:31 3 min. read -

2

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

07.07.2025 15:30 2 min. read -

3

How Much Profit Would you Make if you Invested $3,000 in Shiba Inu One Year Ago?

09.07.2025 22:00 2 min. read -

4

SPX6900 Price Prediction: SPX Holders Jump and Trading Volumes Explode – Is $2 In Sight?

09.07.2025 17:44 3 min. read -

5

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read

Tim Draper Predicts Bitcoin Will Replace U.S. Dollar

Tim Draper isn’t just betting on Bitcoin—he’s forecasting the death of the U.S. dollar.

Top Trending Cryptocurrencies Today: Qubic, Conflux, and Tezos

The crypto market is seeing a burst of activity, with several altcoins outperforming the broader market.

Altcoins Drain Bitcoin Liquidity as Correlation Breakdown Sparks Caution

According to a new market update from Alphractal, altcoins have been outperforming Bitcoin in recent days—drawing liquidity away from the leading cryptocurrency and triggering key warning signals.

Here is What New Crypto Traders Should Focus on, According to Top Analyst

Entering any fast-paced financial market can be overwhelming for newcomers. The promise of high returns often tempts beginners to jump into risky opportunities without fully understanding the dynamics at play.

-

1

Top 10 Trending Cryptocurrencies Today, According to CoinGecko

04.07.2025 15:31 3 min. read -

2

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

07.07.2025 15:30 2 min. read -

3

How Much Profit Would you Make if you Invested $3,000 in Shiba Inu One Year Ago?

09.07.2025 22:00 2 min. read -

4

SPX6900 Price Prediction: SPX Holders Jump and Trading Volumes Explode – Is $2 In Sight?

09.07.2025 17:44 3 min. read -

5

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read