U.S. Bitcoin ETFs Face $127 Million in Outflows, Ending Positive Streak

28.08.2024 16:30 1 min. read Alexander Stefanov

U.S. spot Bitcoin exchange traded funds saw net outflows on Tuesday, ending an eight-day streak of positive results, according to Farside.

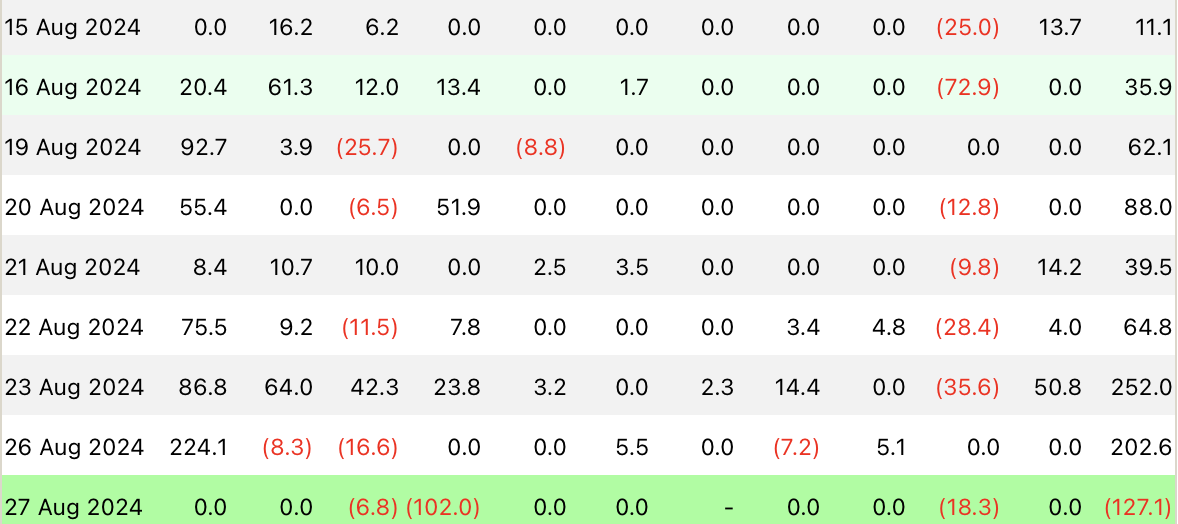

On Tuesday (Aug. 27), those funds recorded net outflows totaling $127.1 million, led by Ark & 21Shares’ ARKB fund, which reported outflows of $102 million.

Grayscale’s GBTC also saw outflows of $18.3 million, while Bitwise’s BITB lost $6.76 million. Valkyrie’s BRRR was not updated and eight funds, including BlackRock’s IBIT, reported zero outflows.

Despite the recent outflows, total trading volume for U.S. spot Bitcoin ETFs, excluding BRRR, was $1.2 billion on Tuesday. Since January, these funds have accumulated net inflows of $17.95 billion.

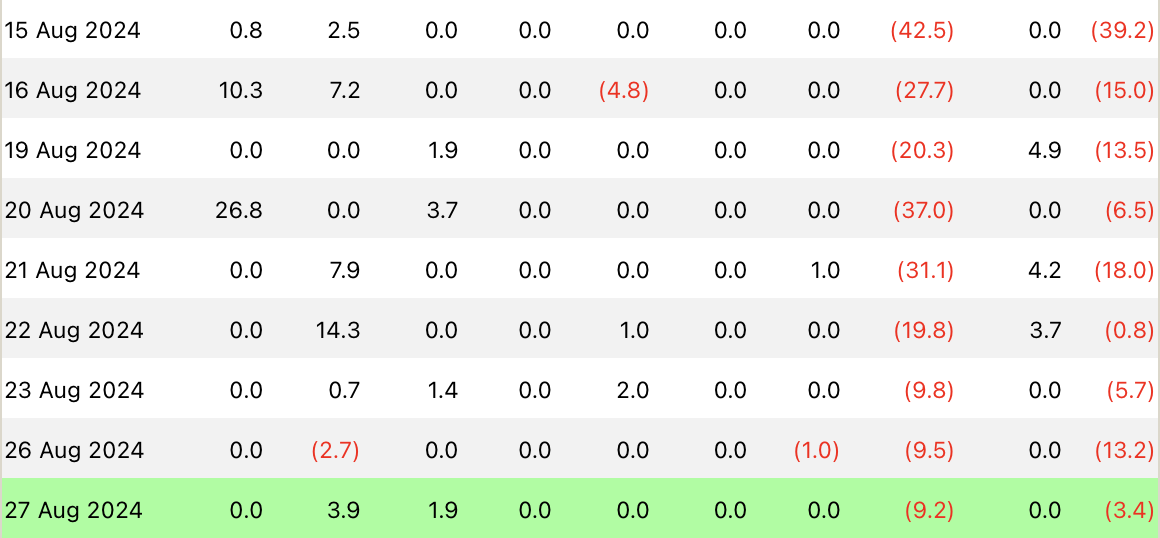

Spot Ethereum ETFs continued the trend of net outflows for the ninth consecutive day, with negative inflows of $3.45 million on Tuesday.

Grayscale’s fund saw significant outflows of $9.18 million, partially offset by inflows of $3.88 million in Fidelity’s FETH and $1.86 million in Bitwise’s ETHW.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read -

5

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read

Tom Lee Reveals What Makek Ethereum His Top Bet

Tom Lee, managing partner and head of research at Fundstrat Global Advisors, recently outlined his bullish stance on Ethereum, linking it directly to the rapid growth of the stablecoin sector.

Ethereum Flashes Golden Cross Against Bitcoin: Will History Repeat?

Ethereum (ETH) has just triggered a golden cross against Bitcoin (BTC)—a technical pattern that has historically preceded massive altcoin rallies.

Crypto Analyst Sees HYPE Cooling After Explosive Run, Eyes New Entry

Crypto analyst Altcoin Sherpa has weighed in on $HYPE’s recent price action, suggesting that the token may have completed the majority of its current bullish leg.

Bitcoin Banana Chart Gains Traction as Peter Brandt Revisits Parabolic Trend

Veteran trader Peter Brandt has reignited discussion around Bitcoin’s long-term parabolic trajectory by sharing an updated version of what he now calls the “Bitcoin Banana.”

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read -

5

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read