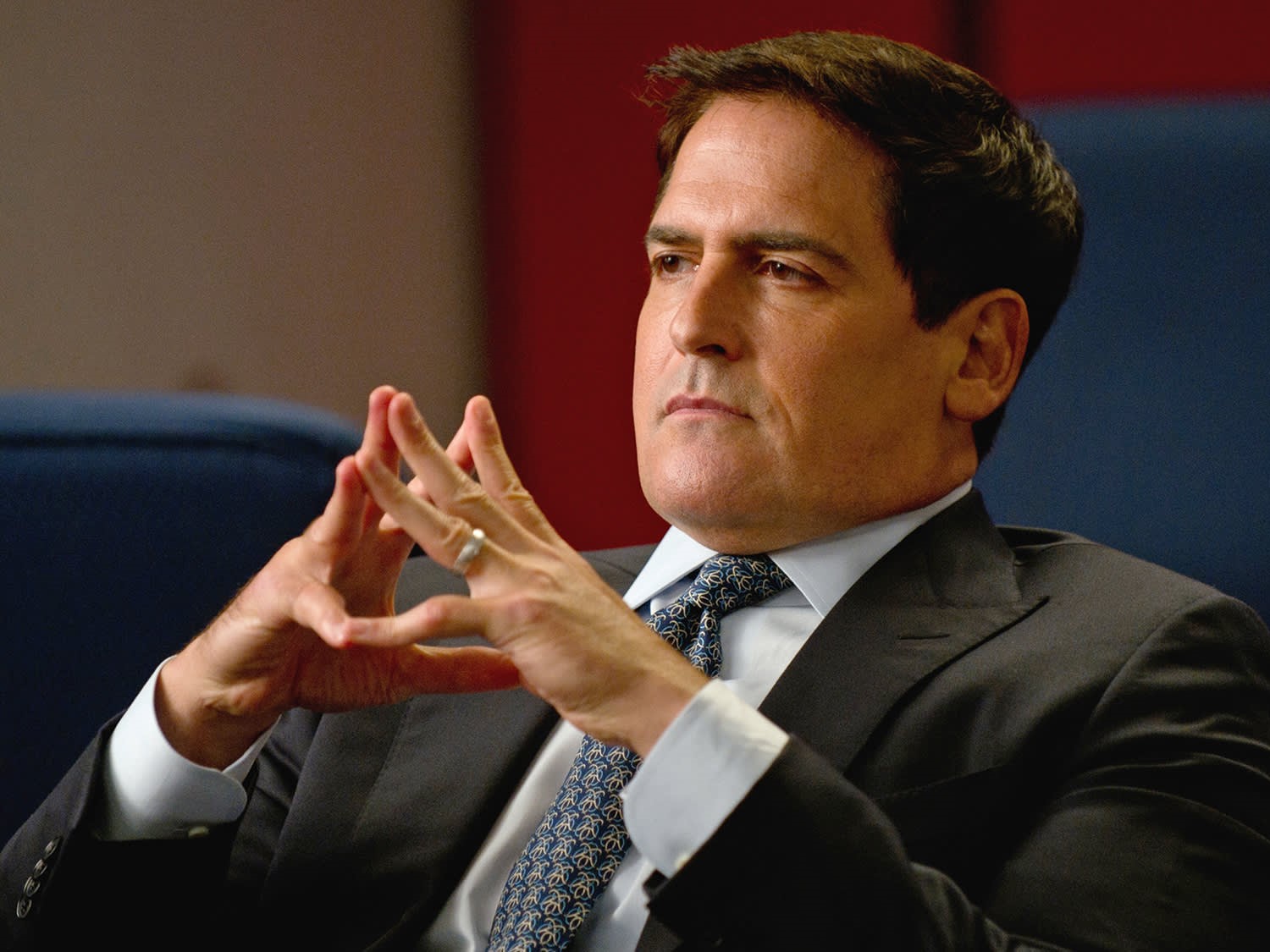

Trump’s Memecoin is a Threat to Crypto’s Future, Warns Mark Cuban

21.01.2025 9:30 2 min. read Kosta Gushterov

Mark Cuban has sharply criticized the TRUMP memecoin, which was launched around the time of Donald Trump’s presidential inauguration.

The coin has stirred significant controversy, with Cuban condemning it as a speculative and self-serving project that lacks real value. He expressed his belief that such tokens only contribute to the growing skepticism surrounding the crypto space, labeling the coin as “the biggest bunch of self-serving nonsense I have ever heard.”

While the TRUMP memecoin has attracted attention due to its volatility and the hype surrounding its release, Cuban argues that it promotes a dangerous mindset of investing in something without substance. He emphasized that this kind of token goes against the principles of ownership and legitimate investment.

On a deeper level, Cuban also raised concerns about the potential regulatory implications of the project. He pointed out the conflict of interest when the president is both the issuer and investor of a coin, creating confusion for both regulators and investors. This could complicate efforts to introduce proper regulations for cryptocurrency, especially as the U.S. Securities and Exchange Commission (SEC) increases its scrutiny on the sector.

Crypto analyst Michaël van de Poppe also weighed in on the TRUMP token, noting its price fluctuations and suggesting that a price correction is needed before it could see long-term gains. However, Cuban’s main concern remains the damage this kind of project could do to the credibility of the cryptocurrency market, as it risks reinforcing the notion that the industry is unserious.

In the face of growing regulation in the crypto space, Cuban fears that the TRUMP memecoin could undermine the push for clearer, more structured legislation, making it harder for legitimate crypto projects to thrive.

-

1

SPX6900 Price Prediction: SPX Holders Jump and Trading Volumes Explode – Is $2 In Sight?

09.07.2025 17:44 3 min. read -

2

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read -

3

Whales Quietly Accumulate Four Altcoins: Early Signals of Potential Rally

08.07.2025 17:30 2 min. read -

4

What’s Ahead for Ethereum, According to Former Core Developer

05.07.2025 19:00 2 min. read -

5

SEC Accelerates Spot Solana ETF Timeline as July Deadline Looms

07.07.2025 19:40 2 min. read

Top trending tokens today: WEMIX, Drift and TRUMP Coin

CoinMarketCap’s momentum algorithm is flashing strong upside signals for several fast-moving tokens. WEMIX, Drift, and OFFICIAL TRUMP Coin top today’s trending list, each driven by unique catalysts—from GameFi upgrades and DeFi volume surges to political tailwinds.

Crypto Greed Index Stays Elevated for 9 Days — What it Signals Next?

The crypto market continues to flash bullish signals, with the CMC Fear & Greed Index holding at 67 despite a minor pullback from yesterday.

Altcoin Season Signals Strengthen as Institutional Flows Accelerate

According to QCP Capital’s latest report, altcoin season may have finally arrived.

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

Solana (SOL) has gone up by 35% in the past 30 days as multiple tailwinds have lifted the price of this top altcoin above the $190 level. A breakout above this level favors a bullish Solana price prediction as it could anticipate a big move ahead, especially at a point when market conditions are favorable. […]

-

1

SPX6900 Price Prediction: SPX Holders Jump and Trading Volumes Explode – Is $2 In Sight?

09.07.2025 17:44 3 min. read -

2

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read -

3

Whales Quietly Accumulate Four Altcoins: Early Signals of Potential Rally

08.07.2025 17:30 2 min. read -

4

What’s Ahead for Ethereum, According to Former Core Developer

05.07.2025 19:00 2 min. read -

5

SEC Accelerates Spot Solana ETF Timeline as July Deadline Looms

07.07.2025 19:40 2 min. read