TRON Inc Files $1 Billion Mixed Shelf Offering With SEC

28.07.2025 17:47 2 min. read Kosta Gushterov

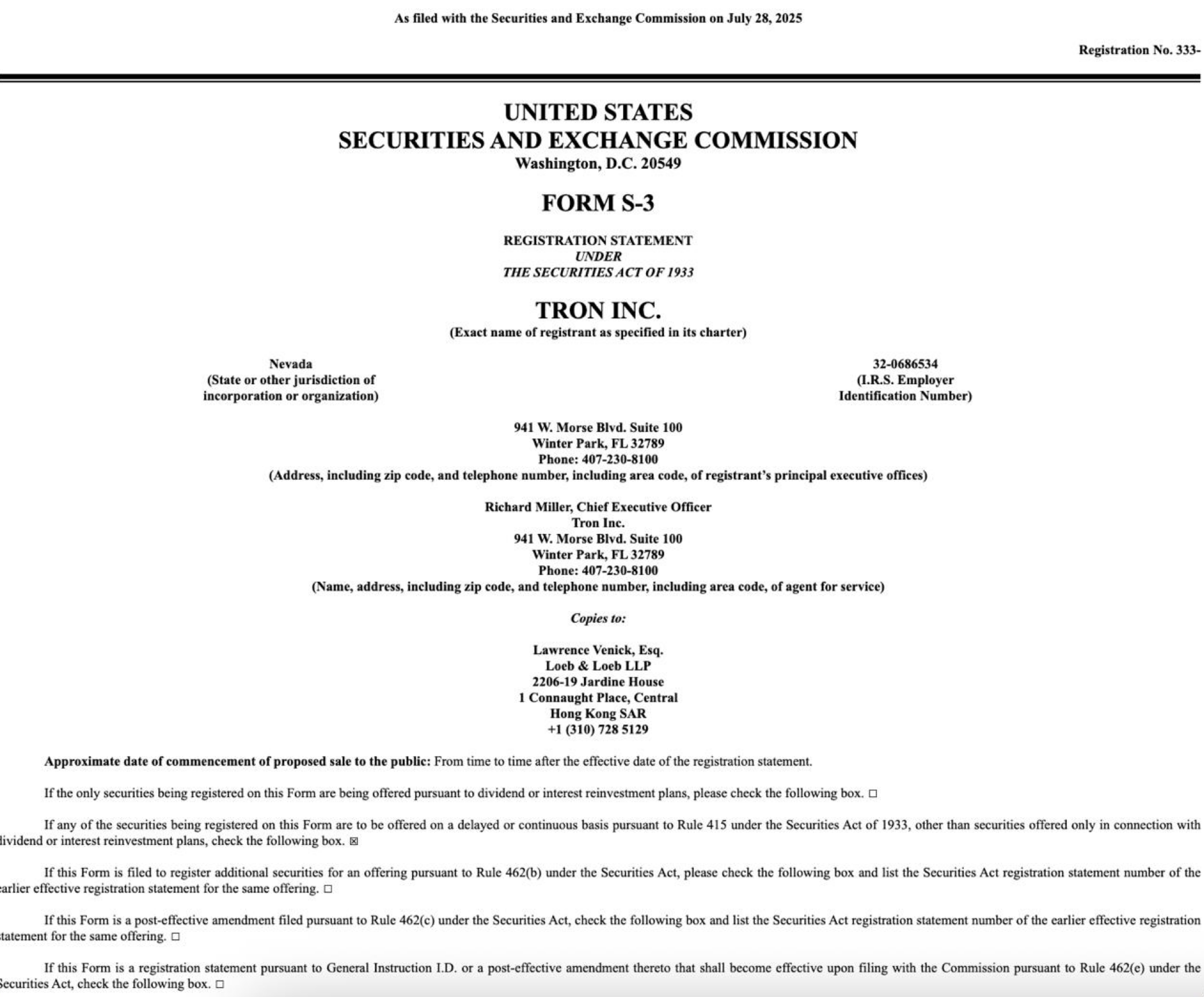

TRON Inc., a blockchain-based technology firm incorporated in Nevada, has officially filed a Form S-3 with the U.S. Securities and Exchange Commission (SEC) to initiate a mixed shelf offering of up to $1 billion.

The filing, submitted on July 28, 2025, opens the door for TRON Inc. to offer a variety of securities—including common stock, preferred stock, debt securities, and warrants—on a delayed or continuous basis.

The company, headquartered at 941 W. Morse Blvd, Winter Park, Florida, listed Richard Miller, its Chief Executive Officer, as the primary contact. Legal representation for the filing is provided by Lawrence Venick of Loeb & Loeb LLP, based in Hong Kong.

A shelf registration like this allows the company flexibility to raise capital over time rather than all at once, which is commonly used by companies planning multiple rounds of fundraising or wishing to respond swiftly to changing market conditions.

The filing does not immediately issue any securities but enables TRON Inc. to do so in the future without submitting additional registration statements each time. The proceeds from such offerings could be used for various purposes, including product development, strategic acquisitions, expansion, or balance sheet restructuring.

This move comes amid heightened interest in crypto-aligned corporate issuances, as regulatory clarity improves and blockchain infrastructure continues to attract institutional investors.

While no specific timeline for issuance was disclosed, the filing notes the company’s intent to commence offerings “from time to time after the effective date.”

With this filing, TRON Inc. joins the ranks of blockchain-native companies leveraging traditional capital markets for strategic financial flexibility. Investors will now be watching closely for further details on the nature and timing of any securities to be offered under this registration.

-

1

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

2

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read -

3

Majority of U.S. Crypto Investors Back Trump’s Crypto Policy, Survey Finds

05.07.2025 18:09 2 min. read -

4

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

5

Here is How to Read the Crypto Fear and Greed Index

14.07.2025 15:00 3 min. read

Robert Kiyosaki Warns of 1929-Style Crash, Urges Bitcoin Hedge

Financial author Robert Kiyosaki is once again sounding the alarm on America’s economic health.

China and U.S. Plan Trade Truce Extension Before Talks: How It Can Affect Bitcoin

The United States and China are expected to extend their trade truce by 90 days. The extension would delay new tariffs and create space for fresh negotiations in Stockholm.

Michael Saylor’s STRC IPO Tops U.S. Charts with $2.5B Raise

Michael Saylor, the high-profile Bitcoin advocate and executive chairman of MicroStrategy, has made headlines again—this time with the largest initial public offering (IPO) of 2025.

Ripple CTO Addresses Early XRP Ledger Block Loss: ‘Not Intentional’

Ripple’s chief technology officer, David Schwartz, has addressed renewed controversy in the XRP community over the loss of approximately 32,000 blocks from the early days of the XRP Ledger.

-

1

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

2

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read -

3

Majority of U.S. Crypto Investors Back Trump’s Crypto Policy, Survey Finds

05.07.2025 18:09 2 min. read -

4

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

5

Here is How to Read the Crypto Fear and Greed Index

14.07.2025 15:00 3 min. read