Tron Hits New All-Time High, Doubling Price Within Hours

04.12.2024 12:18 1 min. read Alexander Stefanov

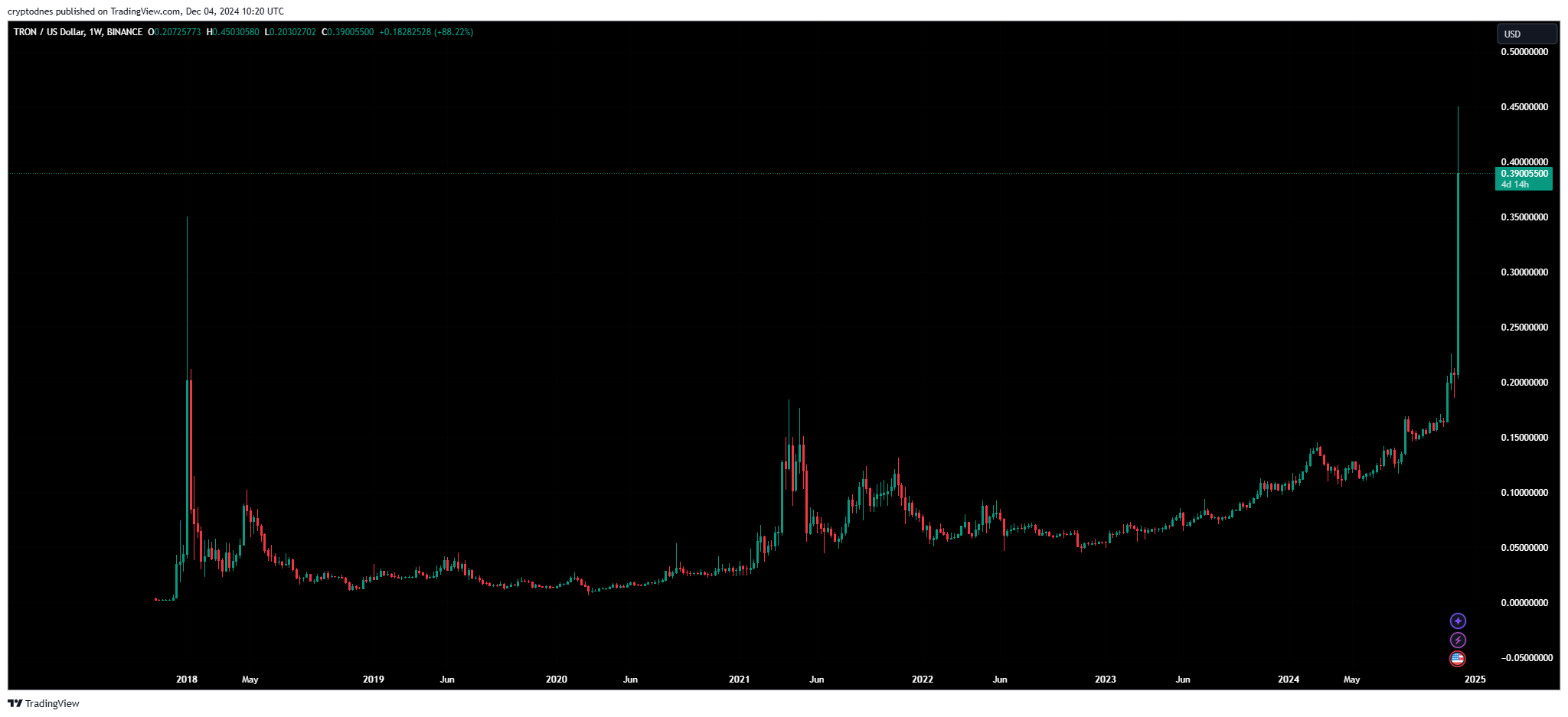

The price of Tron experienced a remarkable rally, more than doubling within hours and reaching a peak of $0.44, a new all-time high.

This dramatic rise was fueled by an influx of liquidity, driven by increased Tether issuance on both Ethereum and Tron networks.

This spike in activity caused Tron’s trading volume to soar by over 500%, ranking it as the fourth most traded asset of the day behind USDT, Bitcoin, Ethereum, and XRP.

While the bulls currently dominate the market, there are signs of a potential pullback. Tron’s price is approaching the upper boundary of a rising wedge pattern.

READ MORE:

Top 4 AI Altcoins Leading Developer Interest

Should it break out, projections suggest a climb to $0.70, followed by a correction to $0.50 before potentially rebounding to $1.

However, with the monthly RSI exceeding 91, there are indications that a cooling-off period might be imminent.

During this phase, the price may consolidate within the wedge until it reaches its apex, setting the stage for a breakout that could surpass $1.

At the time of writing, TRX has retraced back to $0.39 with 538.95% surge in trading volume.

-

1

Pepe Price Prediction: One-Month Trend Line Resistance Breakout Could Push PEPE to $0.000015

04.07.2025 18:41 3 min. read -

2

Bonk Price Prediction: Binance.US Mention Triggers 9% Jump – Can BONK Reach $1?

07.07.2025 16:29 3 min. read -

3

Top 10 Trending Cryptocurrencies Today, According to CoinGecko

04.07.2025 15:31 3 min. read -

4

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

07.07.2025 15:30 2 min. read -

5

How Much Profit Would you Make if you Invested $3,000 in Shiba Inu One Year Ago?

09.07.2025 22:00 2 min. read

Here is What New Crypto Traders Should Focus on, According to Top Analyst

Entering any fast-paced financial market can be overwhelming for newcomers. The promise of high returns often tempts beginners to jump into risky opportunities without fully understanding the dynamics at play.

Is the Crypto Market Topping Out? Key Signals to Watch

The crypto market is heating up as bullish momentum sweeps across altcoins, raising a critical question: is this rally sustainable, or is a correction looming?

Altcoin Season Nears as Bitcoin Dominance Slips

Altcoins are steadily gaining ground against Bitcoin, with signs pointing to the early stages of a broader market rotation.

Ethereum Surges 3.5% to Break Above $3,700

Ethereum posted a 3.48% 24-hour gain, climbing past $3,500 as a wave of regulatory clarity and institutional appetite accelerated inflows into ETH.

-

1

Pepe Price Prediction: One-Month Trend Line Resistance Breakout Could Push PEPE to $0.000015

04.07.2025 18:41 3 min. read -

2

Bonk Price Prediction: Binance.US Mention Triggers 9% Jump – Can BONK Reach $1?

07.07.2025 16:29 3 min. read -

3

Top 10 Trending Cryptocurrencies Today, According to CoinGecko

04.07.2025 15:31 3 min. read -

4

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

07.07.2025 15:30 2 min. read -

5

How Much Profit Would you Make if you Invested $3,000 in Shiba Inu One Year Ago?

09.07.2025 22:00 2 min. read