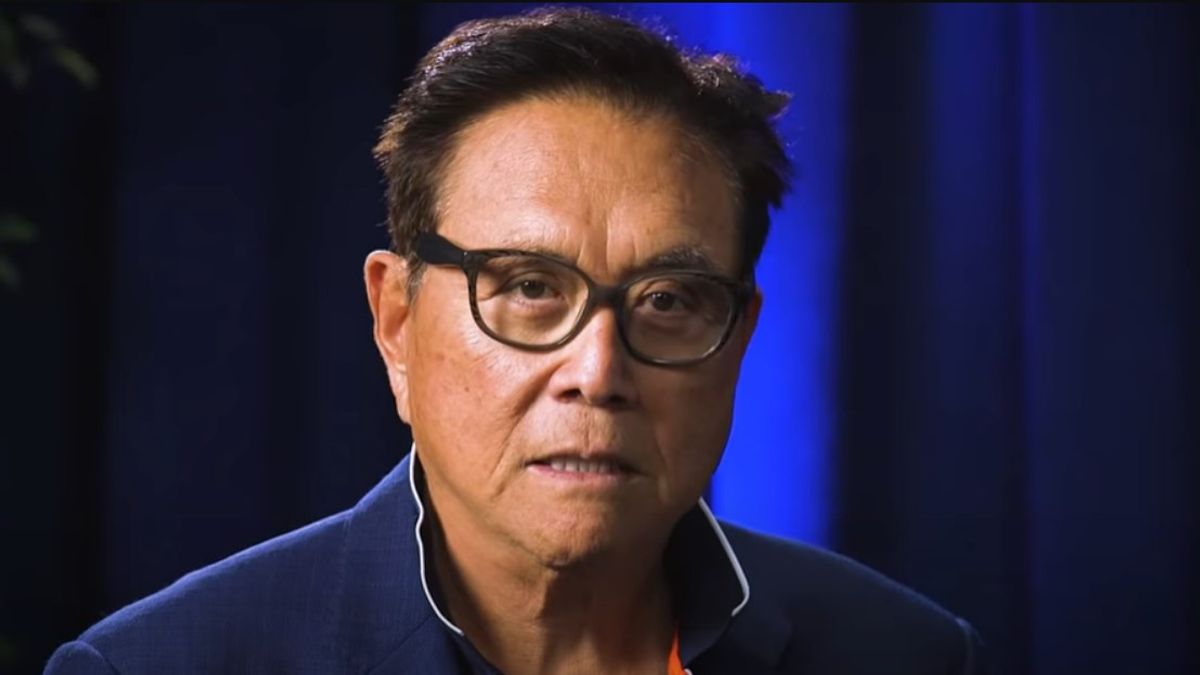

Trillions in U.S. Debt Pile Up, It’s Time to Buy Bitcoin – Robert Kiyosaki

22.08.2024 12:08 1 min. read Alexander Stefanov

Robert Kiyosaki, the best-selling author of Rich Dad Poor Dad, recently took to X to express concerns over the United States' rapidly growing national debt.

In a striking comparison, Kiyosaki pointed out that a trillion seconds equals roughly 31,688 years. He emphasized that the U.S. now accumulates this much debt every 100 days.

Kiyosaki’s message is clear: the relentless increase in national debt is unsustainable. His tweet underscores his long-held belief in alternative assets like gold, silver, and Bitcoin as protective measures against economic instability.

For years, Kiyosaki has been vocal about his skepticism toward traditional financial systems, advocating for investments in tangible assets and cryptocurrencies. As the U.S. continues to face mounting fiscal challenges, his call for action resonates with those concerned about inflation, currency devaluation, and financial security.

The trillion-dollar debt figure Kiyosaki references is a stark reminder of the scale of the problem. His advice to invest in gold, silver, and Bitcoin reflects a growing sentiment among investors seeking safe havens amid economic uncertainty. Whether or not one agrees with his perspective, his commentary adds to the ongoing debate about the future of the global financial system.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read