Top 20 Cryptos for Q4, According to Grayscale Investments

27.09.2024 21:30 1 min. read Alexander Stefanov

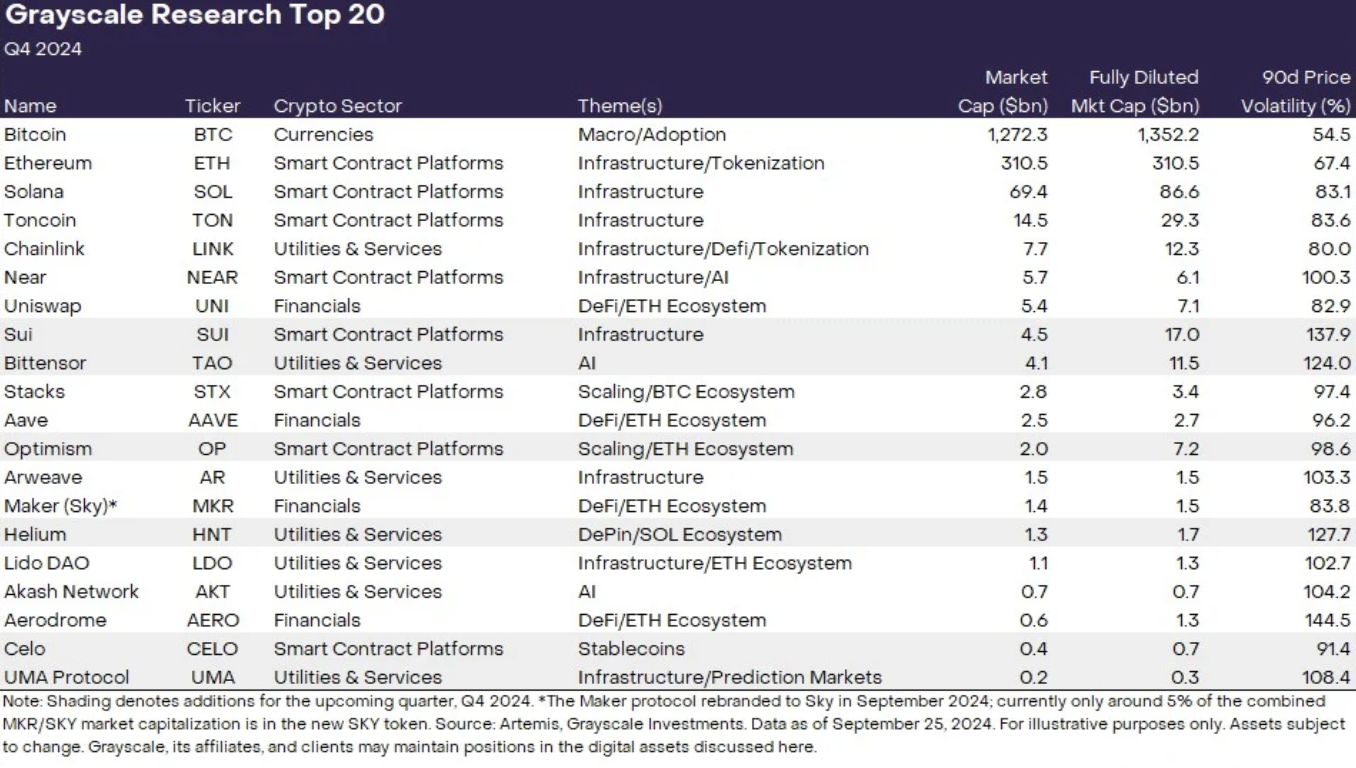

Grayscale revealed its top 20 cryptocurrencies for the fourth quarter of 2024, adding six new altcoins and emphasizing trends such as decentralized artificial intelligence and blockchain scalability.

This update follows the company’s quarterly rebalancing that ended on September 20.

The revised list includes new entrants such as Sui, Bittensor, Optimism, Helium, Celo and UMA Protocol. These assets were selected for their strong fundamentals and growth potential.

Grayscale warned of the risks associated with these cryptocurrencies, highlighting the high volatility and regulatory uncertainty that could make them unsuitable for all investors. Despite the new additions, established favorites like Bitcoin, Ethereum and Solana remain on the list.

This update reflects Grayscale’s intention to diversify its exposure across crypto sectors and capitalize on emerging trends. As the company expands its investment scope, it seeks to balance the growth potential with the inherent risks of the crypto market.

-

1

Ethereum Reclaims $3,000: What’s Driving the Renewed Bullish Momentum?

14.07.2025 10:57 2 min. read -

2

Ondo Price Breakout Confirms Bullish Trend: What’s the Target in Sight

16.07.2025 8:34 2 min. read -

3

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

18.07.2025 16:00 2 min. read -

4

Top 7 Crypto Project Updates This Week

19.07.2025 18:15 3 min. read -

5

These Blockchains are Quietly Heating up—Sonic Leads With 89% Address Growth

14.07.2025 16:00 1 min. read

Bonk Price Prediction: BONK Nears Key Area of Support – Is It Ready for a Big Bounce?

Bonk (BONK) has gone down by 7.6% in the past 24 hours and currently stands at $0.00002800. Although the token has been on a downtrend for a few days, it is approaching a key area of support that could favor a bullish Bonk price prediction. Trading volumes have gone down by 18% during this period, […]

Santiment Highlights 6 Most Discussed Altcoins Amid Crypto Volatility

As Bitcoin and the broader altcoin market continue to swing unpredictably, blockchain analytics firm Santiment has identified six altcoins that have sparked intense interest across social media platforms.

Ethereum Turns 10: Celebrating the Genesis Block That Changed Crypto Forever

On this day ten years ago—July 30, 2015—a revolutionary chapter in blockchain history began.

Standard Chartered: Ethereum Treasury Firms Now Form a Distinct Investment Class

A new report from Standard Chartered highlights that publicly traded companies holding Ethereum (ETH) as a treasury asset have emerged as a unique and fast-evolving asset class, distinct from traditional crypto vehicles such as ETFs or private funds.

-

1

Ethereum Reclaims $3,000: What’s Driving the Renewed Bullish Momentum?

14.07.2025 10:57 2 min. read -

2

Ondo Price Breakout Confirms Bullish Trend: What’s the Target in Sight

16.07.2025 8:34 2 min. read -

3

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

18.07.2025 16:00 2 min. read -

4

Top 7 Crypto Project Updates This Week

19.07.2025 18:15 3 min. read -

5

These Blockchains are Quietly Heating up—Sonic Leads With 89% Address Growth

14.07.2025 16:00 1 min. read