Top 10 DeFi Projects by Development This Month

28.06.2025 20:00 1 min. read Kosta Gushterov

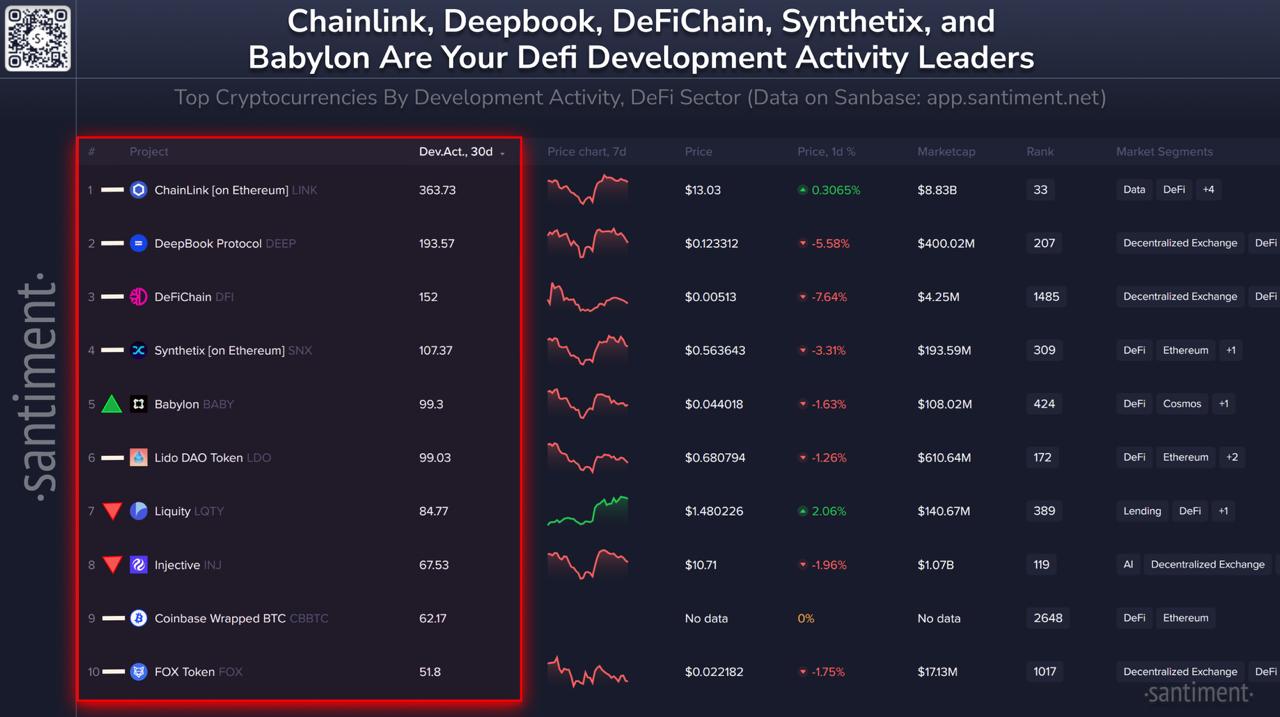

According to a new report by Santiment, Chainlink ($LINK) has maintained its dominant position as the most actively developed DeFi project over the past 30 days.

The list, based on GitHub development metrics, ranks the top 10 decentralized finance projects by developer activity, with directional indicators highlighting monthly rank changes.

Deepbook ($DEEP) climbed into second place, followed by DeFiChain ($DFI) in third. Ethereum-based Synthetix ($SNX) and Babylon ($BABY) round out the top five.

Notably, Babylon and Deepbook saw significant increases in developer engagement compared to last month, signaling growing momentum.

Here’s the full top 10 list by development activity

- Chainlink ($LINK)

- Deepbook ($DEEP)

- DeFiChain ($DFI)

- Synthetix ($SNX)

- Babylon ($BABY)

- Lido DAO ($LDO)

- Liquity ($LQTY)

- Injective ($INJ)

- Coinbase Wrapped BTC ($CBTC)

- Fox Token ($FOX)

Santiment’s data suggests continued developer commitment to oracle and synthetic asset platforms, with Chainlink and Synthetix showing steady contributions. The rise of Cosmos-based Babylon also reflects increasing cross-chain innovation in the DeFi space.

As on-chain and protocol development remains a critical health indicator for crypto ecosystems, these trends highlight which projects may be poised for long-term success amid market fluctuations.

-

1

German State-Owned Development Bank Issues €100 Million Blockchain Bond

11.07.2025 7:00 2 min. read -

2

Tether Ends Support for Five Blockchains in Infrastructure Shift

12.07.2025 11:30 2 min. read -

3

Cardano and Ethereum Lead in Developer Activity as GitHub Commits Surge

14.07.2025 12:00 1 min. read -

4

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

5

Ripple Powers UAE’s First Tokenized Real Estate Project via XRPL

16.07.2025 21:00 2 min. read

Chainlink Partners With Westpac and Imperium to Tokenize Finance in Australia

Chainlink has announced a major institutional partnership with Westpac Institutional Bank and Imperium Markets as part of Project Acacia—a joint initiative involving the Reserve Bank of Australia and the Digital Finance Cooperative Research Centre (DFCRC).

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

Binance continues to refine its ecosystem in 2025, with major updates spanning performance upgrades, token listings and removals, and new token launches—all reinforcing its focus on scalability and innovation.

Ripple Powers UAE’s First Tokenized Real Estate Project via XRPL

Ripple has taken a major step in expanding its institutional digital asset infrastructure in the Middle East by partnering with Ctrl Alt to support Dubai’s first government-backed real estate tokenization initiative.

Cardano and Ethereum Lead in Developer Activity as GitHub Commits Surge

Recent GitHub data reveals which blockchain ecosystems and individual projects attracted the most developer attention last week—a key signal of long-term project strength.

-

1

German State-Owned Development Bank Issues €100 Million Blockchain Bond

11.07.2025 7:00 2 min. read -

2

Tether Ends Support for Five Blockchains in Infrastructure Shift

12.07.2025 11:30 2 min. read -

3

Cardano and Ethereum Lead in Developer Activity as GitHub Commits Surge

14.07.2025 12:00 1 min. read -

4

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

5

Ripple Powers UAE’s First Tokenized Real Estate Project via XRPL

16.07.2025 21:00 2 min. read