Top 10 blockchains by transaction volume in June 2025

06.07.2025 16:00 2 min. read Kosta Gushterov

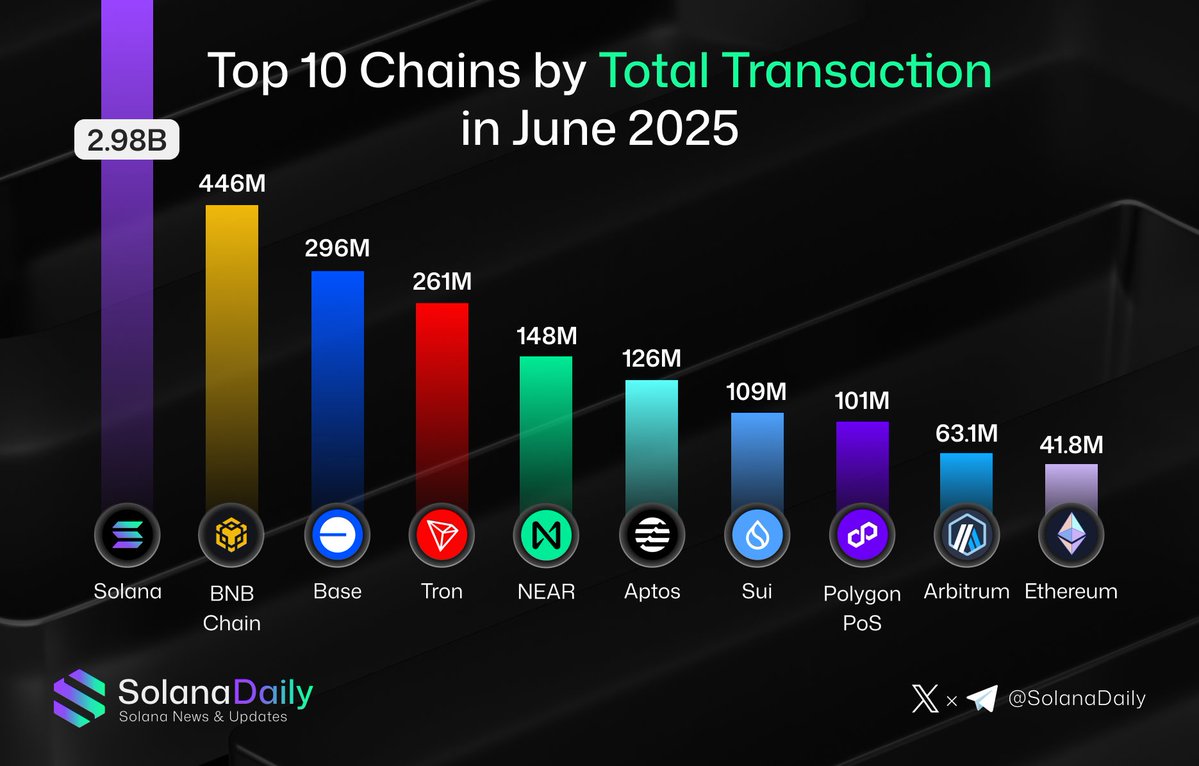

New data highlights a dramatic lead for Solana in blockchain activity for June 2025. According to the figures, Solana processed a staggering 2.98 billion transactions, far outpacing all other chains in the ecosystem.

The report, which lists the top 10 chains by total transactions, shows that BNB Chain came in second with 446 million transactions, followed by Base with 296 million and Tron with 261 million. While these numbers are strong, none come close to Solana’s near-3 billion mark—underscoring its current dominance in on-chain activity.

Full June 2025 transaction ranking

- Solana – 2.98B

- BNB Chain – 446M

- Base – 296M

- Tron – 261M

- NEAR Protocol – 148M

- Aptos – 126M

- Sui Network – 109M

- Polygon (PoS) – 101M

- Arbitrum – 63.1M

- Ethereum – 41.8M

The results reinforce Solana’s reputation for high throughput and low transaction costs—key features that have attracted developers and users to its ecosystem. With over six times more transactions than BNB Chain and more than 70 times that of Ethereum, Solana continues to benefit from its scalability-first architecture.

Ethereum’s lagging transaction count raises questions

Ethereum, despite being the second-largest blockchain by market cap, came in last with just 41.8 million transactions in June. This comparatively low number reflects Ethereum’s ongoing transition toward Layer 2 scaling solutions, as well as its higher transaction costs and slower speeds relative to newer chains.

While Ethereum remains dominant in DeFi and institutional trust, its mainnet’s lower raw transaction count signals a shifting user base toward more cost-efficient platforms.

Conclusion

Solana’s explosive growth in on-chain activity continues to position it as a leader in real-world blockchain usage. As newer chains like Base, Sui, and Aptos also gain momentum, the transaction volume leaderboard offers a clear snapshot of where user adoption is heading—and what networks are winning in day-to-day utility.

-

1

Cardano and Ethereum Lead in Developer Activity as GitHub Commits Surge

14.07.2025 12:00 1 min. read -

2

Ripple Powers UAE’s First Tokenized Real Estate Project via XRPL

16.07.2025 21:00 2 min. read -

3

German State-Owned Development Bank Issues €100 Million Blockchain Bond

11.07.2025 7:00 2 min. read -

4

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

5

Tether Ends Support for Five Blockchains in Infrastructure Shift

12.07.2025 11:30 2 min. read

Wall Street Moves Onchain: Tokenized Finance Enters its Breakout Era

The tokenization of real-world assets (RWAs) has entered a new phase in 2025—no longer a concept, but a confirmed trajectory.

Vietnam Launches National Blockchain to Digitize Government and Citizen Services

Vietnam has officially launched NDAChain, a national blockchain infrastructure designed to underpin its digital transformation strategy.

Solana Plans 66% Block Upgrade to Boost Network Capacity

Solana developers have introduced a new proposal aimed at pushing the network’s performance even further.

Chainlink Partners With Westpac and Imperium to Tokenize Finance in Australia

Chainlink has announced a major institutional partnership with Westpac Institutional Bank and Imperium Markets as part of Project Acacia—a joint initiative involving the Reserve Bank of Australia and the Digital Finance Cooperative Research Centre (DFCRC).

-

1

Cardano and Ethereum Lead in Developer Activity as GitHub Commits Surge

14.07.2025 12:00 1 min. read -

2

Ripple Powers UAE’s First Tokenized Real Estate Project via XRPL

16.07.2025 21:00 2 min. read -

3

German State-Owned Development Bank Issues €100 Million Blockchain Bond

11.07.2025 7:00 2 min. read -

4

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

5

Tether Ends Support for Five Blockchains in Infrastructure Shift

12.07.2025 11:30 2 min. read