Token Price Plunges 15% After Hack – User Loses $8 Million

03.07.2024 11:00 1 min. read Alexander Stefanov

On July 3, the Bittensor (TAO) blockchain was temporarily suspended due to an attack on several user wallets, resulting in at least one of them losing $8 million.

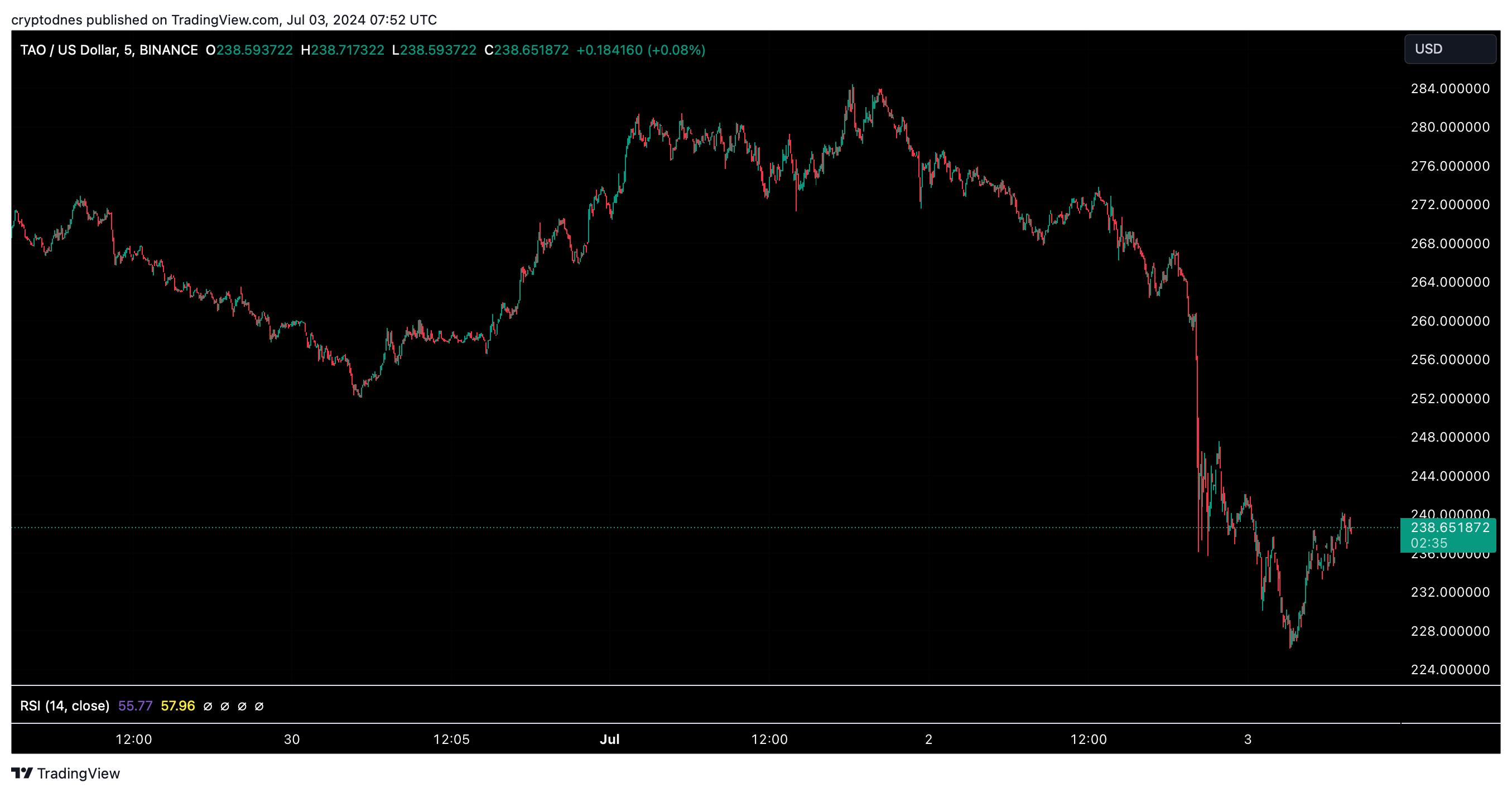

Following the attack, TAO ‘s price dropped by as much as 15% to $227, but has recovered slightly to $238 at the time of writing, and the platform has assured that measures are in place to prevent further incidents.

“We are conducting an investigation and out of an abundance of caution have completely halted transactions on the chain until we receive more information about the attack,” a member of Bittensor’s core team wrote on the project’s Discord channel.

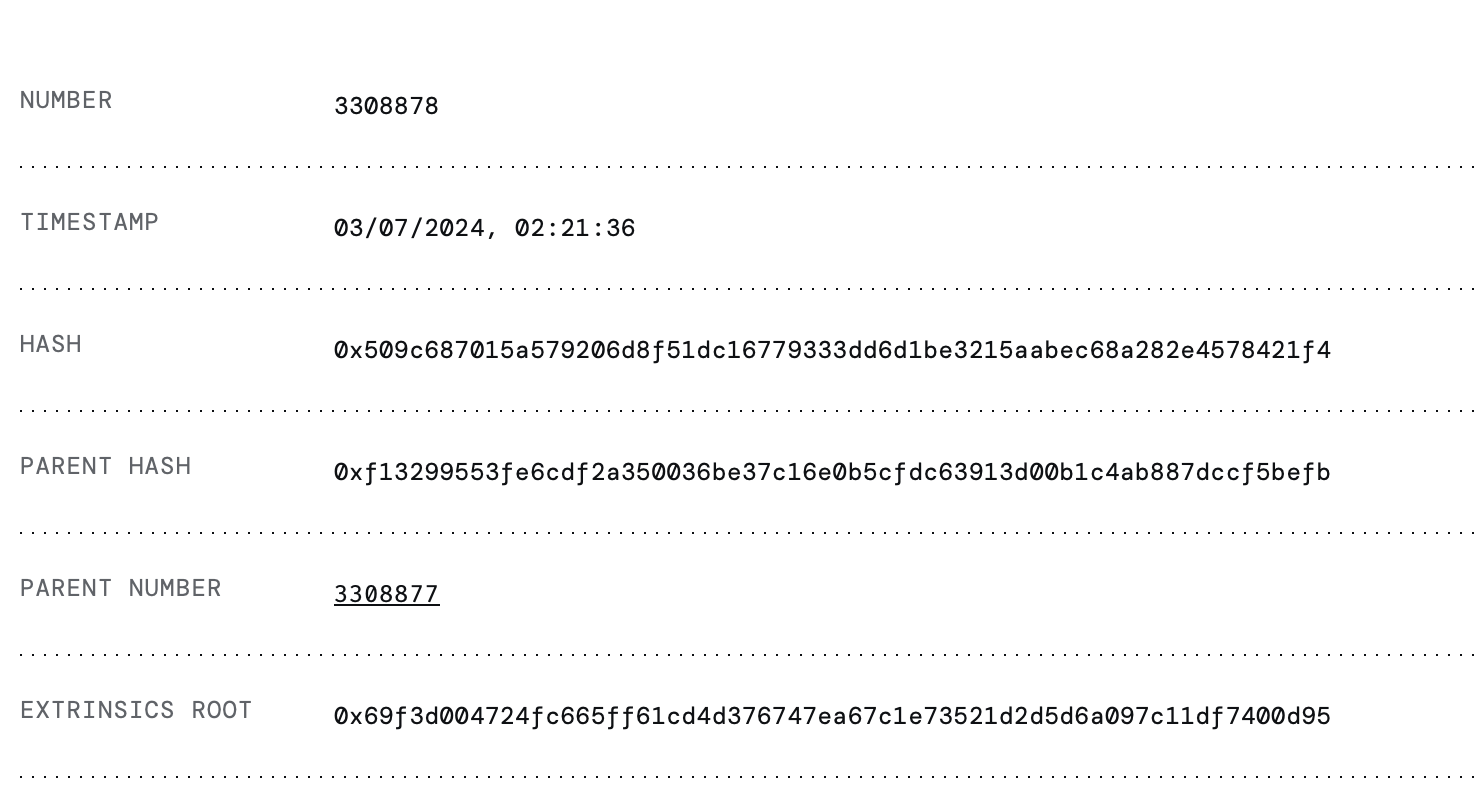

Later, co-founder Ala Shaabana confirmed on X that the chain had been put into “safe mode,” meaning that while blocks were still being produced, no transactions were being processed.

Blockchain trackers for the Bittensor network indicated that the last transactions and blocks were processed around 2:20 a.m. EDT on June 3.

Independent security analyst ZachXBT reported on his Telegram channel that one user lost 32,000 TAOs, valued at $8 million at the time, and suggested that a private key leak may have caused the attack.

-

1

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read

XRP Eyes Next Target as Bullish Crossover Sparks 560% Surge

XRP is back in the spotlight after crypto analyst EGRAG CRYPTO highlighted a powerful historical pattern on the weekly timeframe—the bullish crossover of the 21 EMA and 55 SMA.

Top 5 Most Trending Cryptocurrencies Today: Zora, Pudgy Penguins, SUI and More

Crypto markets are buzzing with momentum as several altcoins post double-digit gains and surging volumes.

Sui Price Jumps 14% to $4.26 amid ETF Hopes

Sui (SUI) surged 14% in the past 24 hours, reaching $4.26 as bullish technical patterns, Bitcoin’s rebound, and renewed ETF speculation pushed the altcoin higher.

HBAR Mirrors 2021 Cycle as Key Breakout Test Approaches

Hedera Hashgraph (HBAR) is closely tracking its 2021 price behavior, according to crypto analyst Rekt Capital.

-

1

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read