This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read Kosta Gushterov

According to the latest Santiment report, the crypto market is entering a critical phase, with a mix of bullish on-chain signals and cautionary sentiment indicators.

While Bitcoin remains near $109,000, Santiment notes that Ethereum, Solana, and XRP are showing signs of renewed strength amid whale accumulation and shifting investor behavior.

The report, presented during Santiment’s weekly livestream with Tony Edward (Thinking Crypto), breaks down the state of the market using key metrics such as MVRV ratios, whale holdings, social sentiment, and funding rates.

Santiment: Stable Start to July, But Divergence Underneath

Santiment highlights that July began with modest gains for Bitcoin (+2.5%), while altcoins like Ethereum (+6%), Uniswap, Pepe, and Arbitrum posted stronger returns. The firm suggests this reflects continued capital rotation into risk assets as global liquidity conditions improve.

Santiment advises monitoring traditional markets like the S&P 500 and gold for signals that may spill over into crypto, especially when those markets are also rallying.

Bitcoin’s MVRV Ratio Suggests Profit-Taking Risk

Santiment’s MVRV data shows that Bitcoin traders are, on average, in profit, placing the asset in what the firm calls “slight danger territory.” Long-term holders are up 18%, and short-term holders are up 2.8%. Although not yet extreme, Santiment warns that if the ratio moves toward the +30% range, risk of a pullback increases.

The report recommends aligning trade horizons with MVRV levels—short-term traders still have room to operate, while long-term investors may want to wait for better entry points.

Whales Accumulate Despite ETF Outflows

One of Santiment’s most bullish findings is the continued accumulation by Bitcoin whales. Over the past week, wallets holding 10 to 10,000 BTC added more than 25,000 BTC, and over the last three months, that figure rises to 160,000 BTC.

This accumulation has occurred even as spot Bitcoin ETFs recorded their first net outflow in 14 days, totaling $342.2 million. Despite the streak break, Santiment emphasizes that 85% of trading days since mid-April still saw net inflows, underscoring sustained institutional demand.

Ethereum vs. Bitcoin: Signs of a Long-Awaited Breakout?

Santiment highlights a notable move on the ETH/BTC trading pair, where Ethereum gained 3.5% in just a few hours. This strength, rarely seen in recent years, could mark the beginning of a capital rotation toward ETH.

Their MVRV data also suggests Ethereum is less overheated than Bitcoin. Short-term ETH holders are barely in profit (+1.2%), and long-term holders remain underwater. This gives Ethereum more upside potential before entering speculative risk zones.

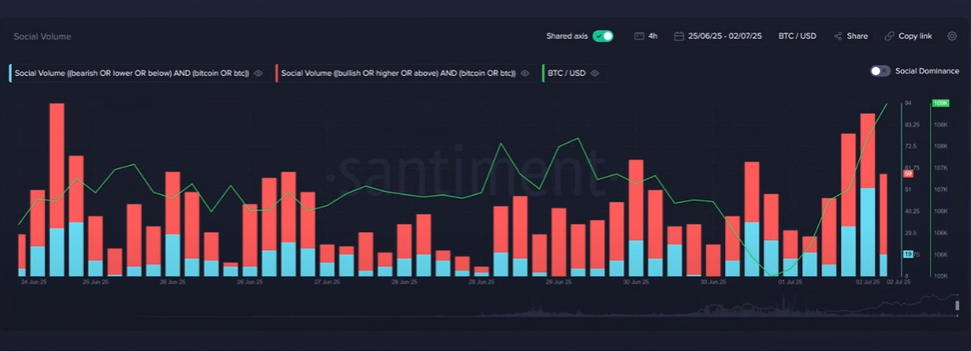

Sentiment Watch: Bitcoin and XRP Near Euphoria

Santiment flags rising social sentiment for Bitcoin and XRP as a potential red flag. These assets are currently experiencing the highest levels of crowd excitement in weeks, which historically precedes short-term corrections. By contrast, Ethereum and Solana remain in neutral sentiment territory, signaling more balanced risk-reward dynamics.

Santiment encourages using sentiment divergence to adjust portfolio exposure—trimming overly euphoric assets while rotating into undervalued ones with quieter narratives.

Solana, Development Trends, and Short-Squeeze Setups

The report names Solana as a “sneaky pick” due to its solid fundamentals and relatively muted social buzz, which could prime it for a low-expectation rally.

Additionally, Santiment lists Ethereum, Chainlink, Cardano, and Internet Computer among the most actively developed projects, based on GitHub activity. High development signals continued technical progress and long-term viability.

On derivatives markets, negative Bitcoin funding rates suggest traders are heavily shorting BTC. Santiment views this as a bullish contrarian signal, as prolonged bearish positioning often sets the stage for short squeezes.

Conclusion: Santiment Sees Room for Rotation

Santiment concludes that while Bitcoin shows strength, its rising MVRV and euphoric sentiment pose near-term risks. Meanwhile, Ethereum and Solana offer healthier on-chain setups, whale support, and lower social hype—conditions that often precede outperformance.

The firm recommends a data-first approach: monitoring MVRV, sentiment scores, ETF flows, and whale behavior to guide decisions in a market full of noise.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Top 10 Trending Altcoins Right Now, According to CoinGecko Data

13.07.2025 17:30 3 min. read -

3

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

16.07.2025 17:26 3 min. read -

4

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

5

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

Ethereum: What The Last Move Tells us About the Next One

Ethereum is showing strength in the face of broader market weakness, holding firm even as Bitcoin and other major assets trend downward.

Massive Bitcoin Move Sparks Panic, Price Tests Range Low

Bitcoin has dropped sharply to test its local range low near $115,000, with analysts pointing to renewed whale activity and long-dormant supply movements as key contributors to the decline.

PENGU Price Eyes Bounce From Key Support Level – What’s Next?

Pudgy Penguins’ native token $PENGU is attracting renewed attention from traders after showing consistent support at a key technical level.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Top 10 Trending Altcoins Right Now, According to CoinGecko Data

13.07.2025 17:30 3 min. read -

3

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

16.07.2025 17:26 3 min. read -

4

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

5

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read