Sui Price Prediction: Is SUI About to Drop to $2? Elliott Waves Suggest So

29.05.2025 23:41 3 min. read Alejandro Ar

Sui (SUI) has dropped by 8% recently and currently sits at $3.5 after the token experienced significant selling pressure upon reaching the $4 mark.

This latest setback has pushed the token to the red zone in terms of year-to-date returns even though it has recovered strongly off its 2025 lows.

Just a week ago, a decentralized DEX aggregator built on Sui, Cetus, suffered a $220 million exploit.

📢 New Progress Update – A Path Forward Together!

Since the incident, we have reflected deeply on the incident and its impact on our users, partners, and the broader ecosystem. We are deeply sorry and take this responsibility seriously. Today, we want to share a meaningful step…

— Cetus🐳 (@CetusProtocol) May 27, 2025

The Sui Foundation asked the community to vote if they should make the affected parties whole for their losses. The voting ended today with an overwhelming total of 90.9% ‘Yes’ votes.

One of the hacker’s crypto wallets containing $160 million worth of digital assets was frozen. These funds will be returned to those affected by the theft while the Sui Foundation will put down the difference.

Most Sui-based tokens suffered significant price declines after news of the exploit came out. It also affected Sui’s reputation as some community members and industry observers have said that making users whole sets a bad precedent as it bails out dApps for their security weaknesses.

The incident may have also affected the price of SUI as the token experienced an 8% drop after reports of the hack started to circulate.

Cetus Hack Favors Bearish Sui Price Prediction

Looking at the daily chart, Sui may have already entered a phase of exhaustion as its rally exhibits signs of decelerating momentum.

An Elliott Wave analysis shows that the last push from $3.25 to $4.27 could have been the last leg up for SUI.

This means that the asset could now be due for a strong correction as early buyers could read the signs of an impending decline as well and cash out frantically.

Sui is already in a descending price channel and the Relative Strength Index (RSI) has been trending lower for days. A break below the $3 level would confirm a bearish outlook and favor a bearish Sui price prediction of $2 in the next few weeks.

Investors are now looking for better opportunities among the best crypto presales of the year as well-established tokens such as Sui may have exhausted their upside potential for now.

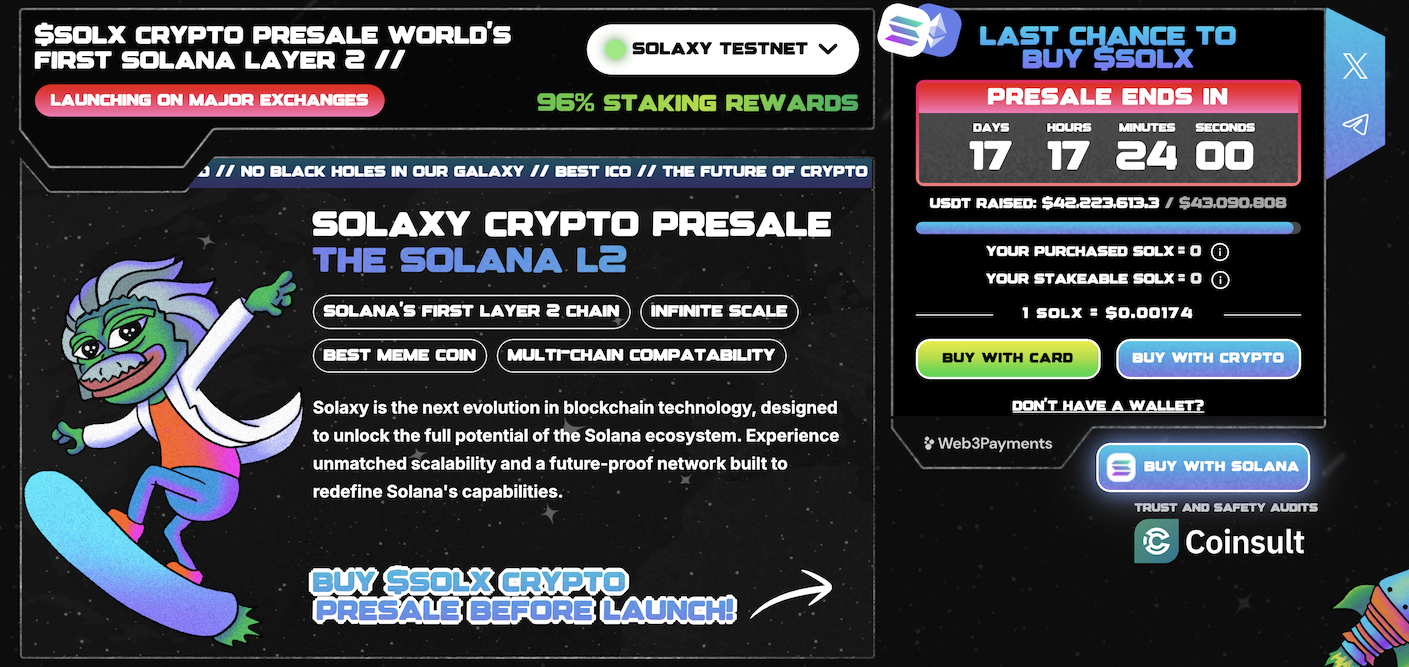

Solaxy (SOLX), a layer-two scaling protocol for Solana, has emerged as one of the favorite candidates as reflected by the nearly $42 million the project has raised in just a few months.

Solaxy (SOLX) Presale Ends in 17 Days – Don’t Miss Out

Solaxy (SOLX) was born to strengthen Solana’s infrastructure and ecosystem by introducing a side chain that increases the blockchain’s scalability and efficiency.

Since the presale was launched in December, it has raised $42.2 million. Thus far, the developing team has launched a testnet, a token bridge, and a block explorer that investors can use to keep track of the solution’s performance in real time.

As the L2’s utility token, $SOLX will experience increased demand once it is embraced by top wallets and exchanges.

To buy $SOLX and reap the highest returns once the token is listed on exchanges, head to the Solaxy website and connect your wallet (e.g. Best Wallet). You can either swap SOL or USDT or use a bank card to make your investment.

-

1

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

2

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read -

3

BNB Chain Boosts Transaction Speed and Stability with New Upgrade

30.06.2025 8:00 1 min. read -

4

Altcoin Market: In Which Stage are we Now, According to Top Crypto Expert

06.07.2025 18:00 2 min. read -

5

Nasdaq-Listed Firm Targets HYPE, Solana, and Sui for Reserve Strategy

27.06.2025 19:00 2 min. read

These Blockchains are Quietly Heating up—Sonic Leads With 89% Address Growth

According to on-chain analytics firm Nansen, several blockchain networks are witnessing a sharp rise in user activity, led by Sonic, which recorded an impressive 89% growth in active addresses over the past 7 days.

These Are the Most Trending Altcoins Right Now, According to CoinGecko

Crypto analysis platform CoinGecko has revealed the most talked-about altcoins in recent hours, highlighting a surge in investor interest across a range of sectors—from meme coins to DeFi and gaming tokens.

How Can You Tell When it’s Altcoin Season?

As the cryptocurrency market heats up, one recurring question dominates traders’ minds: are we in an Altcoin Season?

Ethereum Reclaims $3,000: What’s Driving the Renewed Bullish Momentum?

Ethereum is once again trading above the key $3,000 level after a 2.4% price jump brought it to $3,044 on July 14.

-

1

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

2

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read -

3

BNB Chain Boosts Transaction Speed and Stability with New Upgrade

30.06.2025 8:00 1 min. read -

4

Altcoin Market: In Which Stage are we Now, According to Top Crypto Expert

06.07.2025 18:00 2 min. read -

5

Nasdaq-Listed Firm Targets HYPE, Solana, and Sui for Reserve Strategy

27.06.2025 19:00 2 min. read