Sui Price Prediction: Ecosystem Growth in First Quarter Supports Push to $5

03.06.2025 1:14 3 min. read Alejandro Ar

Sui (SUI) has dropped in the past week as the crypto market rally that started in late April has cooled off a bit but has still managed to leave the token in a much better place to eye a retest of its all-time high.

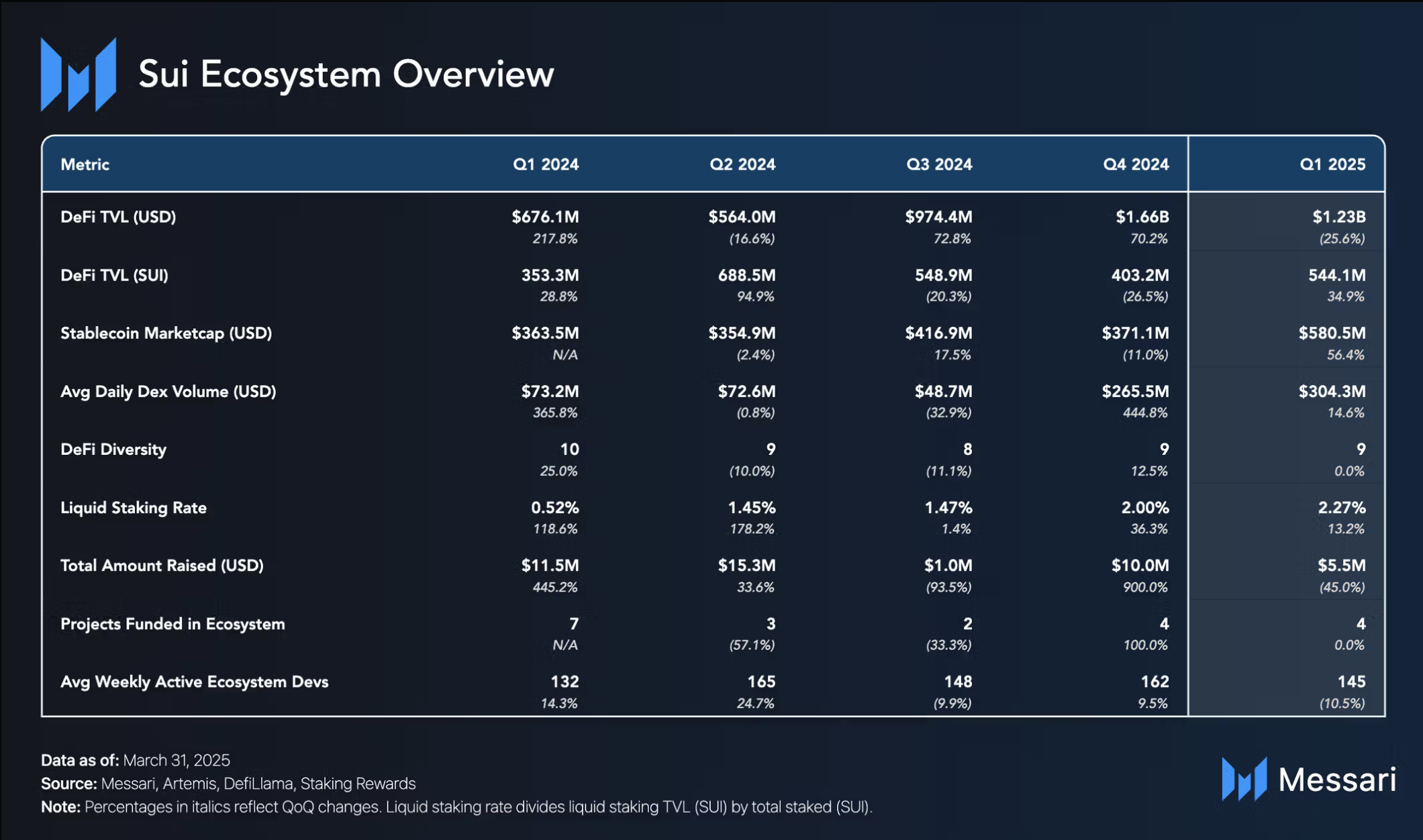

This layer-1 blockchain had a great first quarter. A report from Messari highlighted that average daily DEX volumes on Sui reached a record of $304.3 million. This represented a 315.7% increase compared to the same period a year ago.

Meanwhile, the total value locked (TVL) in its DeFi ecosystem grew by 35% compared to the previous quarter and currently stands at 544.1 million SUI.

Expressing TVL values in SUI rather than USD helps offset the negative or positive impact that price appreciation or depreciation of the SUI token can cause in this metric.

Meanwhile, the network’s stablecoin market cap increased by nearly 57% compared to the previous quarter and currently sits at $580.50 million.

Despite the Cetus incident, these metrics indicate rapid ecosystem growth and favor a bullish Sui price prediction.

Sui Price Prediction: SUI Could Retest Its All-Time High If This Key Support Holds

The daily chart shows that Sui recently broke its bullish structure as it dropped below its second-best higher high of around $3.6.

However, the token has found strong support at the $3 level. This is a key psychological threshold as well that late buyers could have picked as an ideal entry after a much-needed pullback from SUI’s latest rally.

The Relative Strength Index (RSI) currently sits at 43, meaning that bears are in control of the price action and negative momentum has accelerated.

After its bounce from the $3 level, Sui has been performing positively for three days in a row, counting this session’s strong recovery from daily lows.

If the price breaks out of its descending price channel, this would confirm a bullish outlook. The market may retest the $3 level again to raise the necessary liquidity and then prepare for the next leg up, which could take SUI from $3 to $5.

This jump would resemble the late April rally, which pushed SUI from less than $2 to $4 in just a month.

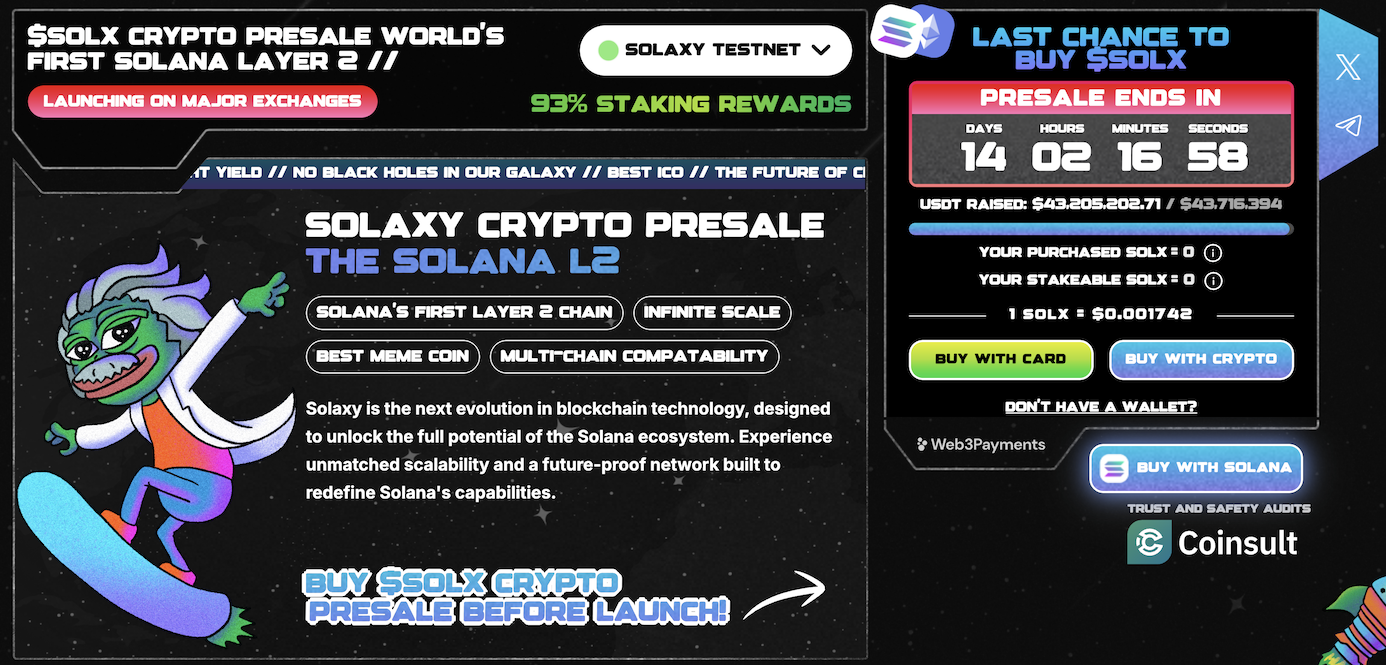

The war between smart contracts platform continue and one crypto presale stands to gain from Solana’s dominance of the meme coin market. Solaxy (SOLX), a layer-two scaling solution, has raised more than $40 million since its ICO kicked off in December 2024.

Solaxy (SOLX) Gives the Community 14 More Days to Invest

Solaxy (SOLX) is a promising layer-2 project for the Solana network that solves the congestion issues that this blockchain has experienced during peak usage periods.

The developing team has made significant progress in launching the L2 including the release of a block explorer for the Solaxy testnet that allows investors to check the blockchain’s performance in real time.

Once Solaxy starts to be adopted by wallets and exchanges, the demand for its utility token, $SOLX, will skyrocket. On top of its upside potential, the project offers staking rewards of 93% to investors who lock up their tokens to secure the L2.

To buy $SOLX at its discounted price before the presale ends, head to the Solaxy website and connect your wallet (e.g. Best Wallet). You can either swap USDT or SOL for this token or use a bank card to make your investment.

-

1

Binance to Delist Five Tokens on July 4

02.07.2025 20:00 2 min. read -

2

What Are the Most Talked-About Words in Crypto Today?

28.06.2025 7:30 2 min. read -

3

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

30.06.2025 18:00 2 min. read -

4

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

30.06.2025 19:00 1 min. read -

5

Solana Staking ETF Ranks in Top 1% of ETF Launches on Day One

03.07.2025 16:00 2 min. read

Solana Price Prediction: SOL Could Jump to $200 After This ‘Buy’ Signal

Solana (SOL) has gone up by 7% in the past 7 days after the approval of the first exchange-traded fund (ETF) linked to this token in the United States. The REX-Osprey SOL + Staking ETF (SSK) is already nearing the $100 million mark in assets under management (AUM), which favors a bullish Solana price prediction. […]

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

A major development in the world of crypto ETFs has just been confirmed, as NYSE Arca has officially certified the approval for listing the ProShares Ultra XRP ETF (UXRP).

Top Crypto Trends Dominating Discussions This Week

As Bitcoin smashes through all-time highs, crypto-related conversation is surging across social media.

6 Altcoins Gaining Attention After Market Rally, Says Analyst

Crypto markets are buzzing once again, and according to analyst Miles Deutscher, a fresh wave of altcoins is drawing investor interest.

-

1

Binance to Delist Five Tokens on July 4

02.07.2025 20:00 2 min. read -

2

What Are the Most Talked-About Words in Crypto Today?

28.06.2025 7:30 2 min. read -

3

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

30.06.2025 18:00 2 min. read -

4

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

30.06.2025 19:00 1 min. read -

5

Solana Staking ETF Ranks in Top 1% of ETF Launches on Day One

03.07.2025 16:00 2 min. read