Stablecoins’ Market Cap Surged to a New All-Time Hight

26.08.2024 18:00 1 min. read Alexander Stefanov

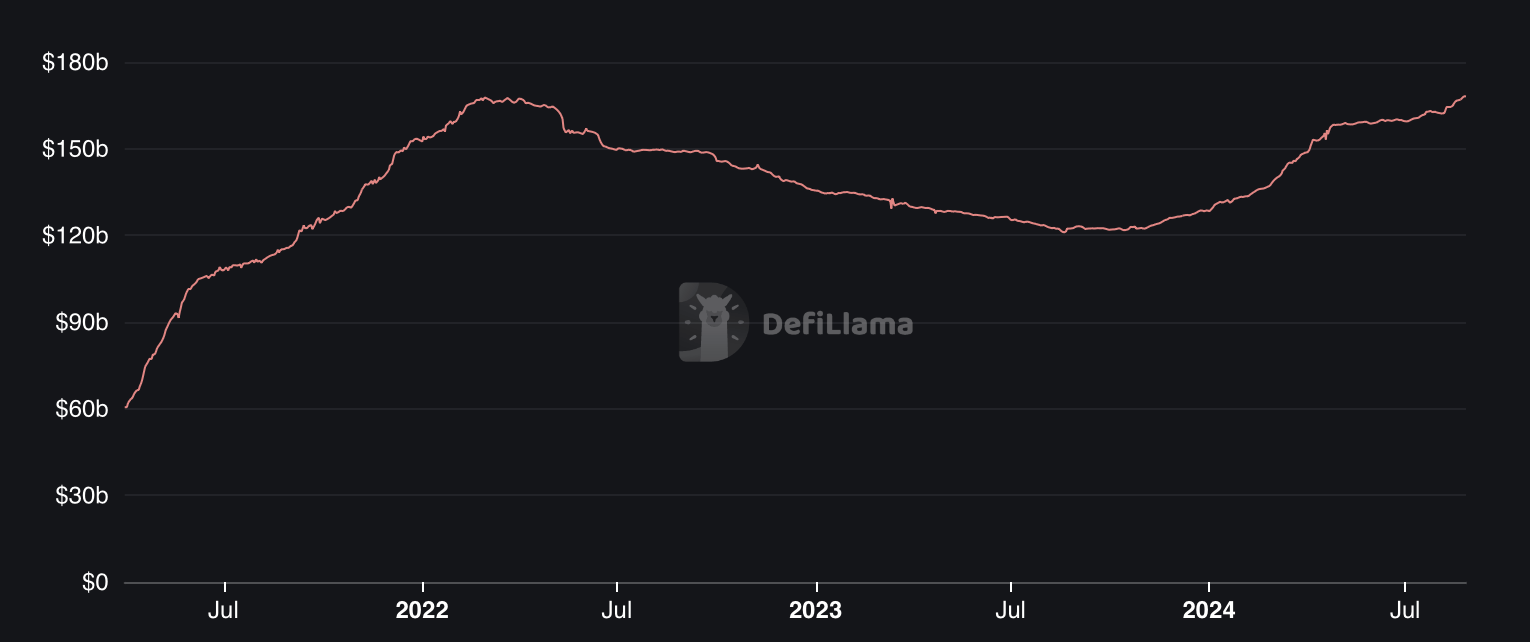

The total market capitalization of stablecoins, excluding algorithmic ones, reached an all-time high of more than $168 billion over the weekend.

Market capitalization had fallen to about $122 billion in October, but has been steadily rising since the start of 2024.

Rachel Lucas, a crypto analyst at BTCMarkets, suggested that the rise in stablecoin market capitalization indicates increased interest from institutional investors who view stablecoins as a safe haven in uncertain market conditions.

She noted that the growing use of stablecoins by institutions underscores the shift toward integrating these digital assets into trading strategies and long-term portfolios.

The market capitalization of USDT, the largest stablecoin, has grown from $91.6 billion in January to $117.889 billion at the time of writing, now accounting for approximately 70% of the segment’s total market cap.

-

1

Ethereum Faces Heavy Sell-Off Amid Rising Geopolitical Tensions

13.06.2025 14:00 1 min. read -

2

Dogecoin Stuck in a Holding Pattern – Can Bulls Force a Break Above $0.21?

15.06.2025 16:00 2 min. read -

3

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read -

4

South Korea’s New President Pushes for Domestic Stablecoins

11.06.2025 16:00 2 min. read -

5

Is a New Altcoin Cycle Brewing in 2025?

13.06.2025 12:00 1 min. read

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

A new milestone in cryptocurrency investment products is set to unfold this Wednesday, as REX Shares prepares to launch the first-ever U.S.-listed staked crypto exchange-traded fund (ETF), according to a company announcement shared on X.

XRP Price Prediction: Can XRP Hit $4 After XRPL EVM Sidechain Launch?

XRP (XRP) has gone up by 1.2% in the past 24 hours but, behind that mild price increase, there has been a significant spike in trading volumes. During this period, $2.4 billion worth of XRP has exchanged hands, representing an 83% increase. Just hours ago, Ripple announced the official launch of its Ethereum-compatible sidechain called […]

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

A community-driven initiative launched Monday is inviting Ethereum users to lock art, memories, and personal messages inside a decentralized “time capsule,” set to be opened on the network’s 11th anniversary next year.

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

A new CryptoQuant report highlights a growing divergence between long-term Ethereum holders and short-term Bitcoin buyers, with significant accumulation behavior unfolding in both markets amid increasing political and economic tension in the U.S.

-

1

Ethereum Faces Heavy Sell-Off Amid Rising Geopolitical Tensions

13.06.2025 14:00 1 min. read -

2

Dogecoin Stuck in a Holding Pattern – Can Bulls Force a Break Above $0.21?

15.06.2025 16:00 2 min. read -

3

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read -

4

South Korea’s New President Pushes for Domestic Stablecoins

11.06.2025 16:00 2 min. read -

5

Is a New Altcoin Cycle Brewing in 2025?

13.06.2025 12:00 1 min. read