Stablecoins Help Latin Americans Cope With Inflation

10.10.2024 19:30 1 min. read Alexander Zdravkov

Stablecoins like USDT have become vital in Latin America, assisting people in managing ongoing economic difficulties.

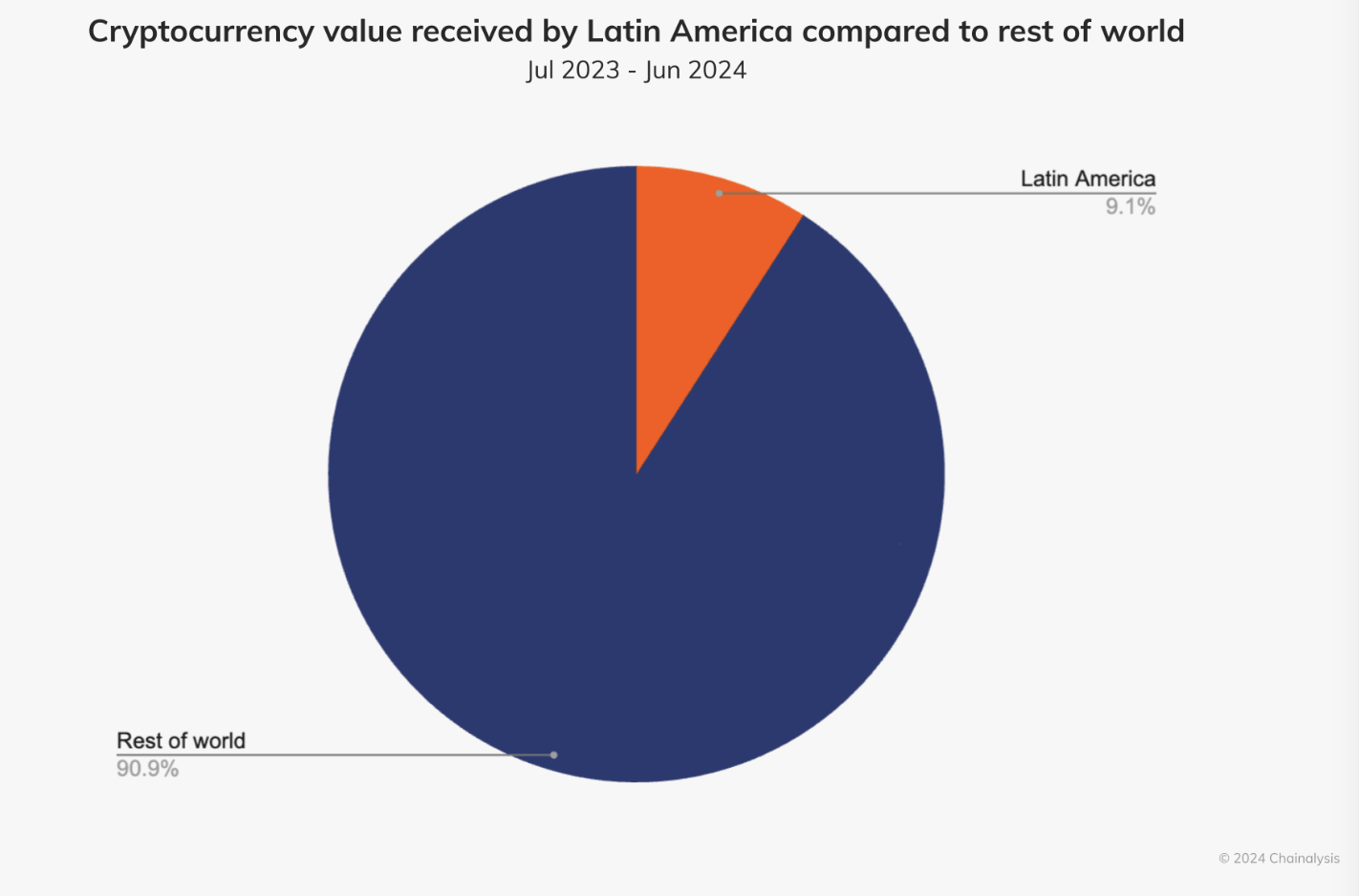

A Chainalysis report reveals that this region accounts for 9.1% of the global cryptocurrency value, with significant growth driven by increased institutional interest and consumer adoption.

From July 2023 to June 2024, Latin America received about $415 billion in crypto, slightly outpacing East Asia despite lower adoption rates.

Argentina led with $91.1 billion, followed by Brazil with $90.3 billion, where institutional activity surged by 48.4% between Q4 2023 and Q1 2024.

In nations like Argentina and Brazil, dollar-pegged stablecoins are crucial for protecting against inflation, especially as local currencies lose value.

Argentina’s inflation hit 143% in 2023, pushing citizens to find ways to secure their savings against the devaluation of the peso. Following President Javier Milei’s new economic policies, stablecoin trading volumes surged past $10 million when the peso fell below $0.002 in December 2023.

Brazil also saw a 29.2% increase in large transactions over $1 million in late 2023, fueled by the SEC’s approval of Bitcoin and Ethereum ETFs.

-

1

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

2

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

3

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read -

4

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

5

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read

Top 10 Biggest Crypto Developments This Week

The latest WuBlockchain Weekly report captures a high-volatility week in crypto. From Bitcoin’s new all-time high to controversy around Pump.fun’s presale and Elon Musk’s political Bitcoin endorsement, markets are witnessing sharp shifts in momentum and policy.

Federal Reserve Chair Jerome Powell Reportedly Weighing Resignation

U.S. financial circles are bracing for a potential shake-up as reports suggest Federal Reserve Chair Jerome Powell is considering stepping down.

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

Gold advocate Peter Schiff issued a stark warning on monetary policy and sparked fresh debate about Bitcoin’s perceived scarcity. In a pair of high-profile posts on July 12, Schiff criticized the current Fed rate stance and challenged the logic behind Bitcoin’s 21 million supply cap.

Report Claims That Binance Played a Foundational Role in the Creation of Trump Related StableCoin

Changpeng Zhao, the former CEO of Binance, reportedly supported crypto projects linked to the Trump family while privately seeking a presidential pardon, according to a July 11 report by Bloomberg News.

-

1

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

2

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

3

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read -

4

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

5

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read