Spot Bitcoin ETFs in the US Record Eighth Day of Positive Inflows

27.08.2024 13:30 1 min. read Alexander Stefanov

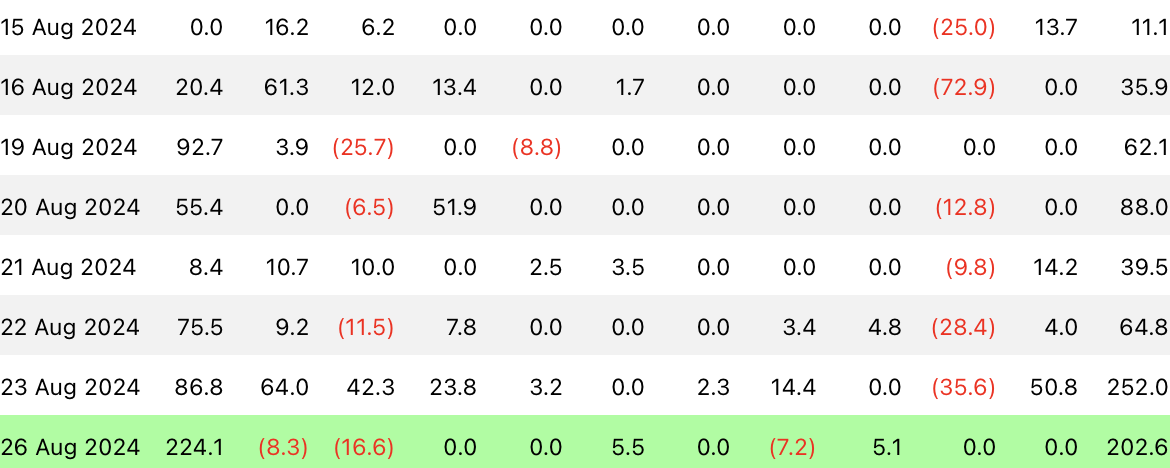

Spot Bitcoin exchange-traded funds in the US recorded an eighth consecutive day of positive net inflows.

On Monday alone, they saw inflows of $202.6 million, signaling continued investor interest in Bitcoin despite recent market volatility.

BlackRock’s IBIT made the most significant impact, attracting $224.1 million – the largest single-day inflow for the fund since July 22.

However, other spot Bitcoin ETFs showed relatively weak activity compared to BlackRock’s.

Franklin Templeton’s EZBC and WisdomTree’s BTCW saw minor positive inflows of $5.5 million and $5.1 million, respectively.

However, not all funds posted gains.

Bitwise’s BITB led the outflows, losing $16.61 million, followed by Fidelity’s FBTC, which saw $8.33 million withdrawn. VanEck’s HODL also saw an outflow of $7.18 million.

Meanwhile, other funds, including Grayscale’s GBTC, showed no significant movements.

-

1

Japan’s Metaplanet Aims for 1% of All Bitcoin with Bold Market Move

06.06.2025 19:00 1 min. read -

2

Here’s Why Bitcoin Could Be Gearing Up for Its Next Move Despite the Pullback

09.06.2025 8:00 2 min. read -

3

BlackRock and Fidelity Pour Over $500M Into Bitcoin in One Day

25.06.2025 21:00 1 min. read -

4

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

5

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

Bitcoin’s network hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing power since July 2024.

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

Bitcoin has officially overtaken Alphabet (Google’s parent company) in global asset rankings, becoming the sixth most valuable asset in the world, according to the latest real-time market data.

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

Philippe Laffont, the billionaire behind Coatue Management, is beginning to question his stance on Bitcoin.

Robert Kiyosaki Says Crypto Is Key to Building Wealth in a Failing System

Personal finance author Robert Kiyosaki is urging investors to rethink their approach to money as digital assets reshape the economic landscape.

-

1

Japan’s Metaplanet Aims for 1% of All Bitcoin with Bold Market Move

06.06.2025 19:00 1 min. read -

2

Here’s Why Bitcoin Could Be Gearing Up for Its Next Move Despite the Pullback

09.06.2025 8:00 2 min. read -

3

BlackRock and Fidelity Pour Over $500M Into Bitcoin in One Day

25.06.2025 21:00 1 min. read -

4

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

5

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read