Solana Soars Above $150 – Here’s What Could Extend Gains

15.07.2024 13:14 2 min. read Alexander Stefanov

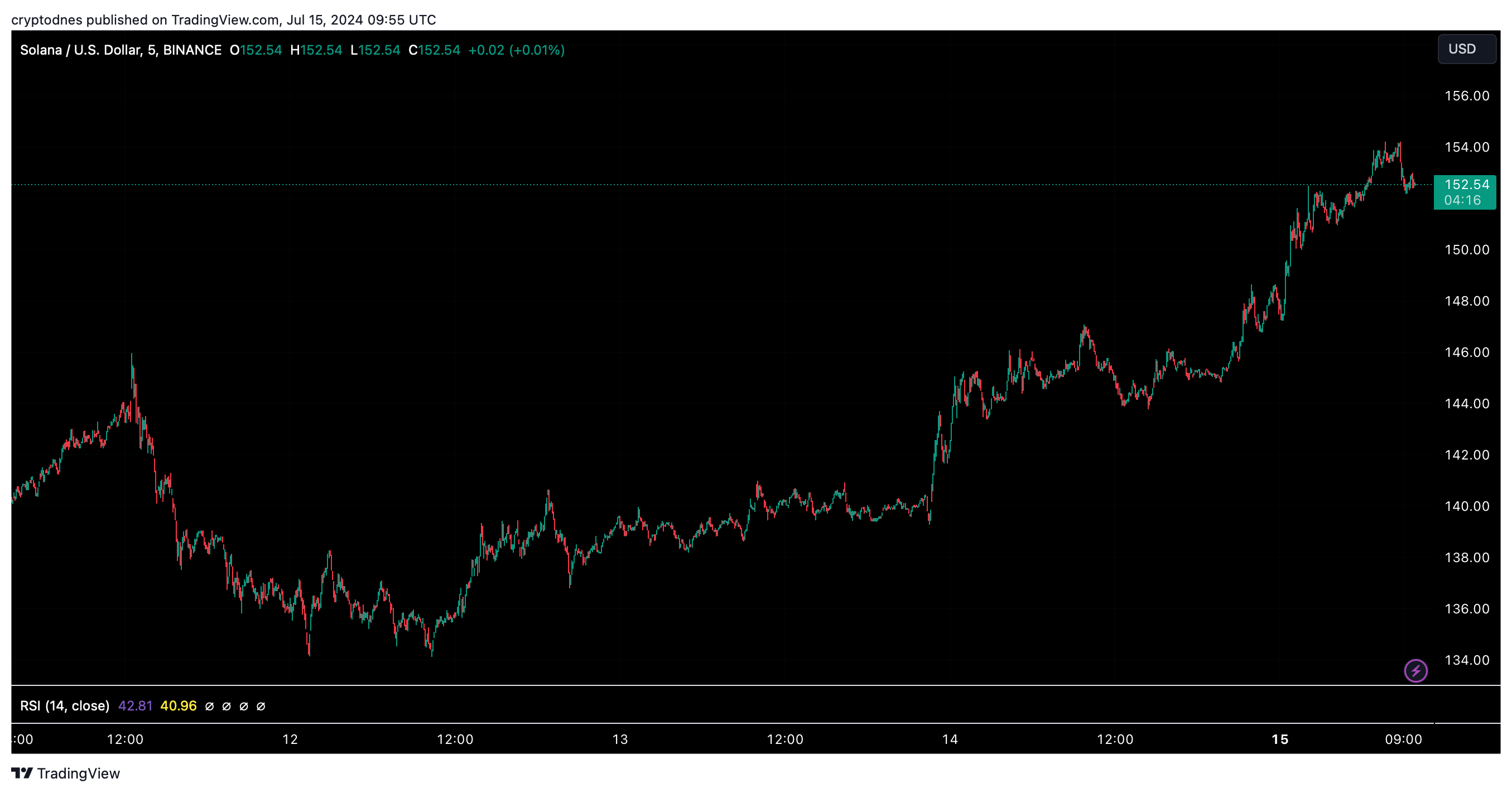

Solana's price started this week quite strong, even breaking the $145 resistance and surpassing the $150 barrier, reaching a high of $154, according to CoinMarketCap.

At the time of writing, SOL is trading at around $152, representing about a 4.3% gain over the past 24 hours and 9% over the past week.

The next significant resistance is believed to be near $155. A successful close above this level could pave the way for another steady advance, with the next key resistance near $165. Further gains could potentially push price above $170.

If the cryptocurrency fails to hold above $152, it could lead to a downward correction. Initial downside support is near the $150 level and the next support is near the $147 level.

FTX’s bankruptcy could have unintended consequences for the crypto market. As the shuttered exchange prepares to redistribute $16 billion to its affected customers, experts predict significant buying pressure on Bitcoin and Solana.

The potential approval of the Solana ETF could also incite price moves. However, Gracie Chen, CEO of Bitget, remains cautious. He thinks it is unlikely that the U.S. will launch any other crypto ETFs besides the one for Ethereum in 2024.

Moreover, Solana’s technical features, such as high transaction speed and low fees, continue to make it a popular choice for both consumers and investors.

Solana’s circuit metrics also highlight a thriving and well-utilized network. With daily transactions consistently exceeding 100,000, there is a clear sign of strong demand for the platform. This robust activity reflects continued user confidence and a solid foundation for the network’s growth.

-

1

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

2

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

3

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

Bitcoin’s breakout to a new all-time high above $118,000 has reignited momentum across the crypto market. While BTC itself saw nice gains several altcoins are riding the wave of renewed investor interest.

Ethereum Jumps 8% to Reclaim $3,000

Ethereum surged 8.4% in the past 24 hours, reaching $3,010 as renewed interest in altcoins follows Bitcoin’s explosive rally.

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

Grayscale, one of the leading cryptocurrency asset managers, has unveiled its latest benchmark update structured around its Crypto Sectors framework.

Trump’s Truth Social to Launch Utility Token for Subscribers

Truth Social, the platform founded by Donald Trump, is moving deeper into the crypto space with plans for a utility token tied to its premium services.

-

1

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

2

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

3

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read