Solana Reaches New All-Time High After FTX Collapse Dropped Its Price to $10

22.11.2024 8:04 1 min. read Kosta Gushterov

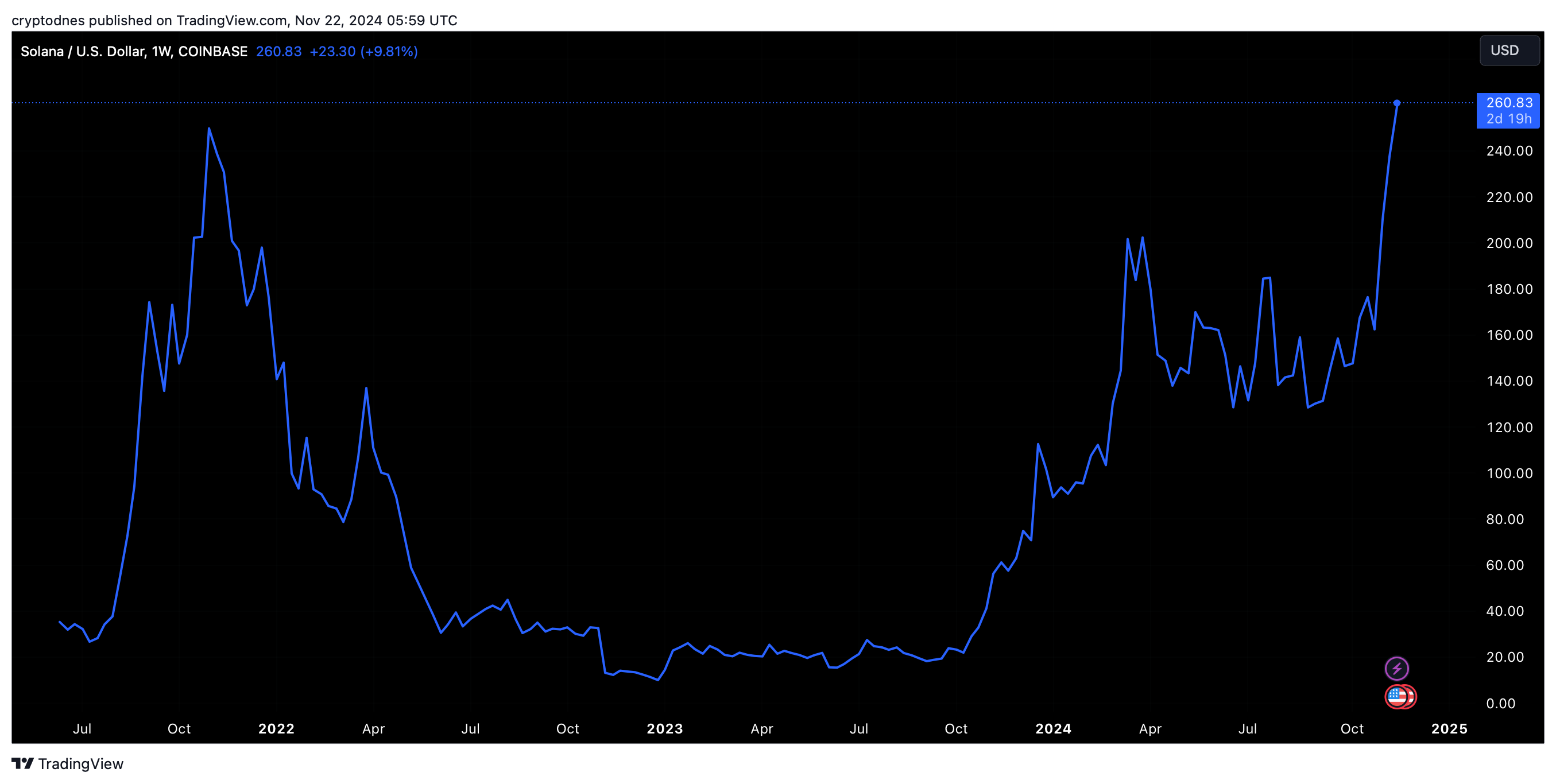

On November 22, Solana (SOL) achieved a new all-time high, marking a significant recovery two years after the collapse of the FTX exchange pushed the token’s price below $10 in December 2022.

The new record of $264.3 reflects an 11% increase in the last 24 hours and a remarkable 160% surge since the start of 2024. However, at the time of writing, the coin has shed a small portion of its gains and is trading at $260.

What’s Driving Solana’s Momentum?

The recent surge in SOL’s value has been bolstered by applications from firms such as Bitwise, VanEck, 21Shares, and Canary Capital to launch spot exchange-traded funds (ETFs) for Solana. Analysts are now predicting a target price of $400, provided market strength continues.

The demand for Solana in this cycle is also fueled by its favorable infrastructure for meme coins, which makes mining cheap and efficient. Additionally, Solana’s decentralized finance (DeFi) sector has seen explosive growth, with its total value locked (TVL) increasing by over 500% this year, reaching $8.8 billion.

-

1

Pi Price Prediction: Top Community Member Believes PI Will Drop to $0.40

20.06.2025 23:05 3 min. read -

2

Ethereum ETFs See First Outflows After Record Inflow Streak

14.06.2025 15:00 1 min. read -

3

This Solana Memecoin Poised for Breakout, Says Analyst

20.06.2025 8:00 1 min. read -

4

Solana ETF Push Gains Momentum After Flurry of S-1 Updates

14.06.2025 21:00 1 min. read -

5

Altcoin Market Poised for Turbulence as Key Support Levels Flash Signals

16.06.2025 21:00 2 min. read

June’s Top-Performing Crypto Projects Across Key Metrics

A new report from on-chain analytics platform Santiment has identified standout crypto projects that posted the largest gains across various performance metrics during June 2025.

Binance to Delist Five Tokens on July 4

The move follows the exchange’s routine asset evaluations, which are aimed at maintaining quality standards and user protection.

Sui Price Prediction: SUI Surpasses BNB and HYPE Trading Volumes in June – $10 by July?

Sui (SUI) has gone up by nearly 4% in the past 24 hours and its performance is diverging from that of other altcoins after some interesting technical news. Popular trading accounts on X pointed out that Sui’s trading volumes in June surpassed those of well-established tokens like BNB Coin (BNB) and Hyperliquid (HYPER) by $7 […]

SEC Approves Grayscale ETF Tracking Top Five Cryptocurrencies

The U.S. Securities and Exchange Commission (SEC) has officially approved the conversion of the Grayscale Digital Large Cap Fund into an exchange-traded fund (ETF), finalizing its transition from an over-the-counter product into a fully regulated ETF structure.

-

1

Pi Price Prediction: Top Community Member Believes PI Will Drop to $0.40

20.06.2025 23:05 3 min. read -

2

Ethereum ETFs See First Outflows After Record Inflow Streak

14.06.2025 15:00 1 min. read -

3

This Solana Memecoin Poised for Breakout, Says Analyst

20.06.2025 8:00 1 min. read -

4

Solana ETF Push Gains Momentum After Flurry of S-1 Updates

14.06.2025 21:00 1 min. read -

5

Altcoin Market Poised for Turbulence as Key Support Levels Flash Signals

16.06.2025 21:00 2 min. read