Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Solana Price Prediction for February 15: Can SOL Break Through Key Resistance?

15.02.2025 13:20 4 min. read Alexander StefanovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

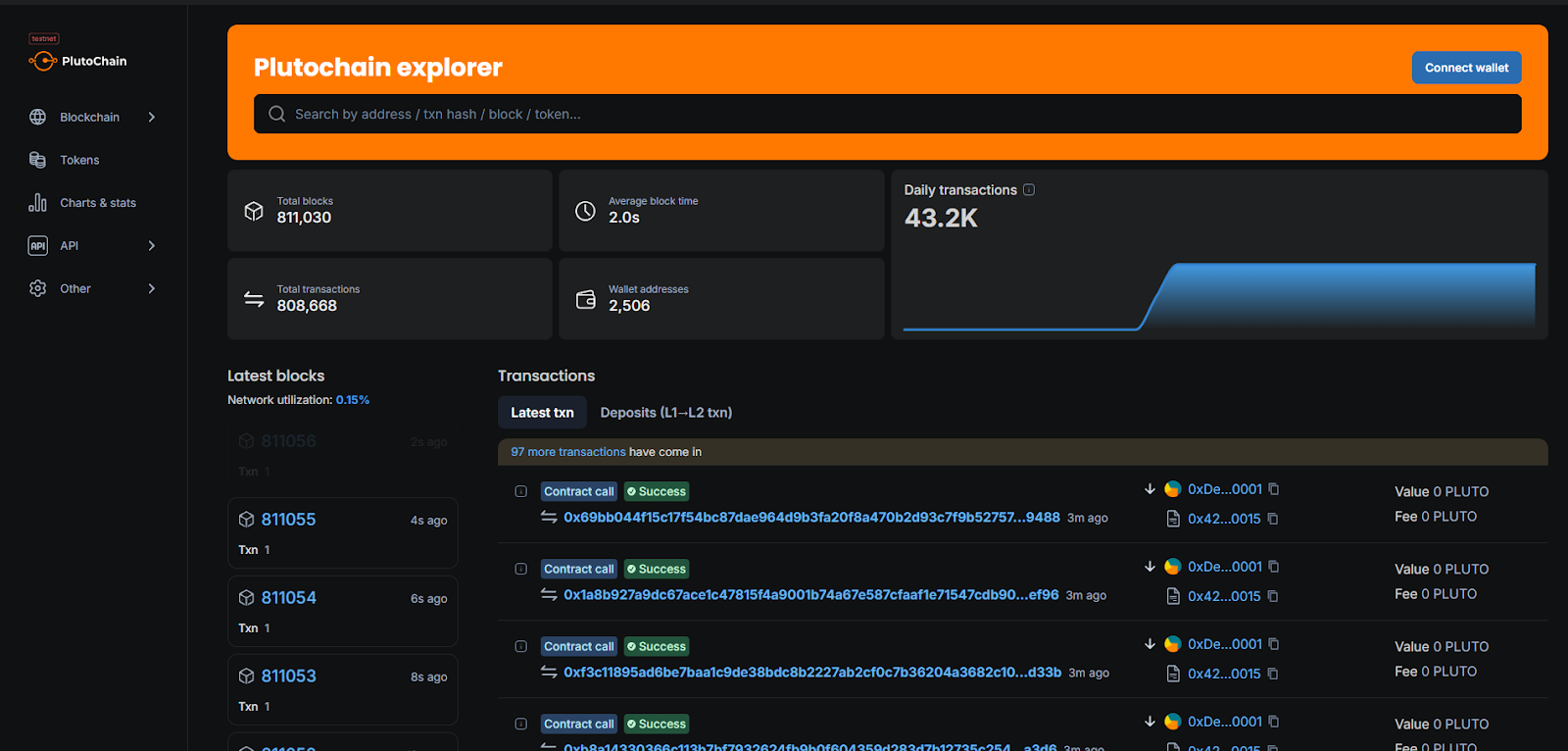

Bitcoin, on the other hand, continues to struggle with slow transactions and high fees, which is something PlutoChain ($PLUTO) could address. This Layer-2 solution could speed up Bitcoin with 2-second block times and lower fees.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Here’s what you need to know.

Can Solana (SOL) Rally Past Resistance? Key Levels to Watch on February 15

Solana (SOL) is gaining momentum, currently trading around $196.98 after a solid 24-hour increase. But now, it’s approaching a key resistance zone between $200 and $210, a level that has historically led to selling pressure.

Traders are keeping a close eye to see if SOL can break through this barrier. If it does, especially with strong trading volume, the next target could be $220.

However, with the Relative Strength Index (RSI) currently at 49, SOL remains in a neutral zone, which indicates a balance between buying and selling pressure. While not yet overbought, it suggests that traders should watch for potential shifts in momentum.

If SOL struggles to push past $210, it might drop back to its immediate support at $185. A further dip below that could see prices fall toward $170.

The next few days will be key in determining where SOL heads next. A strong breakout above $210 could set the stage for more gains, while a rejection at this level might trigger a correction.

Coin Signals believes Solana has bounced off the 200-day EMA and key support and is set up for a major breakout with a price target of $260 to $320. Sheldon The Sniper, a crypto analyst on X, believes Solana is gearing up for an all-time high breakout, with potential targets between $500 and $600 — or even higher — during the next run.

PlutoChain ($PLUTO): The Hybrid Layer-2 Innovation That Could Solve Bitcoin’s Scalability Problem and Unlock Mass Adoption

Bitcoin, despite being the first and most well-known cryptocurrency, struggles with slow transactions and high fees, which makes it less practical for everyday use.

It processes only 3 to 7 transactions per second, with confirmation times averaging 10 minutes. Fees can also be unpredictable, sometimes surging as high as $60 during peak activity.

These limitations reduce Bitcoin’s usability as a real-world payment option. PlutoChain ($PLUTO) might be able to fix these issues by introducing a Layer-2 solution designed to improve Bitcoin’s speed and affordability.

By implementing 2-second block times, PlutoChain could enable near-instant transactions and make microtransactions and cross-border payments much smoother.

A significant advantage of PlutoChain is its potential to reduce transaction fees. High fees have often made small Bitcoin transactions impractical, but PlutoChain’s approach could lower these costs and make Bitcoin more accessible for daily use by both individuals and businesses.

Beyond improving transaction speed and cost, PlutoChain offers Ethereum Virtual Machine (EVM) compatibility. This feature could allow Bitcoin to integrate with decentralized finance (DeFi) applications, NFT marketplaces, and AI-driven blockchain tools, thereby expanding its functionality.

The platform has undergone audits by SolidProof, QuillAudits, and Assure DeFi, and continues to conduct rigorous testing to ensure network reliability.

In terms of scalability, PlutoChain has demonstrated its capacity by processing over 43,200 transactions in a single day during testing.

Unlike Bitcoin’s miner-controlled network, PlutoChain employs a more decentralized governance model and encourages users to propose and vote on upgrades. This approach enhances adaptability and user involvement in the platform’s evolution.

Closing Thoughts

As Solana nears the $200-$210 resistance zone, analysts are hopeful for a breakout, with targets ranging from $260-$320 and even $500-$600 in the long run.

And PlutoChain might do something about Bitcoin’s biggest problems — slow transactions and high fees. With lower costs and EVM compatibility, it could make Bitcoin faster and more usable for everyday use.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy for Q3? BTC Bull Token Enters Final Week of Presale

24.06.2025 17:53 5 min. read -

2

Is BTC Bull Token the Best Crypto Presale? Bitcoin Airdrops, Token Burns, and BTCBULL Rewards

25.06.2025 10:40 4 min. read -

3

Best Crypto Presales to Buy for Q3: 4 Promising ICOs

24.06.2025 17:55 5 min. read -

4

Best Altcoins to Buy Now: 5 Low-Cap Cryptos That Could Explode in Q3

25.06.2025 23:39 5 min. read -

5

Best Crypto to Buy Now As $1B Sell-Off Crashes the Market – Buy The Dip Coins

24.06.2025 12:21 8 min. read

Best Crypto to Buy Now as Trump’s Vietnam Deal Ignites Bitcoin and Stocks

When U.S. President Donald Trump made a historic trade deal with Vietnam, cutting tariffs on Vietnamese goods from 46% to 20%, world markets stirred into action. Bitcoin surged more than 3% as institutional investors welcomed lowered friction in international trade, and the Nasdaq and S&P 500 rose in tandem. BREAKING: Trump announced a trade deal with […]

Best Crypto to Buy Now as BlackRock Bitcoin ETF Outvalues S&P 500 Fund

BlackRock’s iShares Bitcoin Trust (IBIT) has quietly surged past the asset manager’s flagship S&P 500 ETF (IVV) in annual fee revenue, upending long‑standing expectations in the traditional fund world. #BlackRock’s Bitcoin ETF now generates more revenue than its S&P 500 ETF. pic.twitter.com/UhvEIbC1jM — Christiaan (@ChristiaanDefi) July 2, 2025 This shift matters because it signals institutional money […]

Best Crypto Presale to Buy in July: Why BTC Bull Token is Set for Massive Gains

The BTC Bull Token presale is almost over. With less than five days left, this is the last chance for buyers to secure a lower price before the token goes live. The project’s raised amount will breach the $8 million mark any minute now, showing a notable uptick in investor support in the final presale […]

Best Crypto to Buy Now After Trump’s $220 Million Bitcoin Power Play

When Eric Trump’s American Bitcoin secured a $220 million injection from private backers to snap up Bitcoin and state‑of‑the‑art mining rigs, it marked more than just a hefty capital raise. This move highlights the widening gap between traditional finance and crypto’s institutional frontier, where major investors are racing to legitimize digital gold. 🔺 Eric Trump-Backed Mining […]

-

1

Best Crypto to Buy for Q3? BTC Bull Token Enters Final Week of Presale

24.06.2025 17:53 5 min. read -

2

Is BTC Bull Token the Best Crypto Presale? Bitcoin Airdrops, Token Burns, and BTCBULL Rewards

25.06.2025 10:40 4 min. read -

3

Best Crypto Presales to Buy for Q3: 4 Promising ICOs

24.06.2025 17:55 5 min. read -

4

Best Altcoins to Buy Now: 5 Low-Cap Cryptos That Could Explode in Q3

25.06.2025 23:39 5 min. read -

5

Best Crypto to Buy Now As $1B Sell-Off Crashes the Market – Buy The Dip Coins

24.06.2025 12:21 8 min. read