Senate Republicans Unveil Crypto Market Bill to Expand CLARITY Act

22.07.2025 18:00 1 min. read Kosta Gushterov

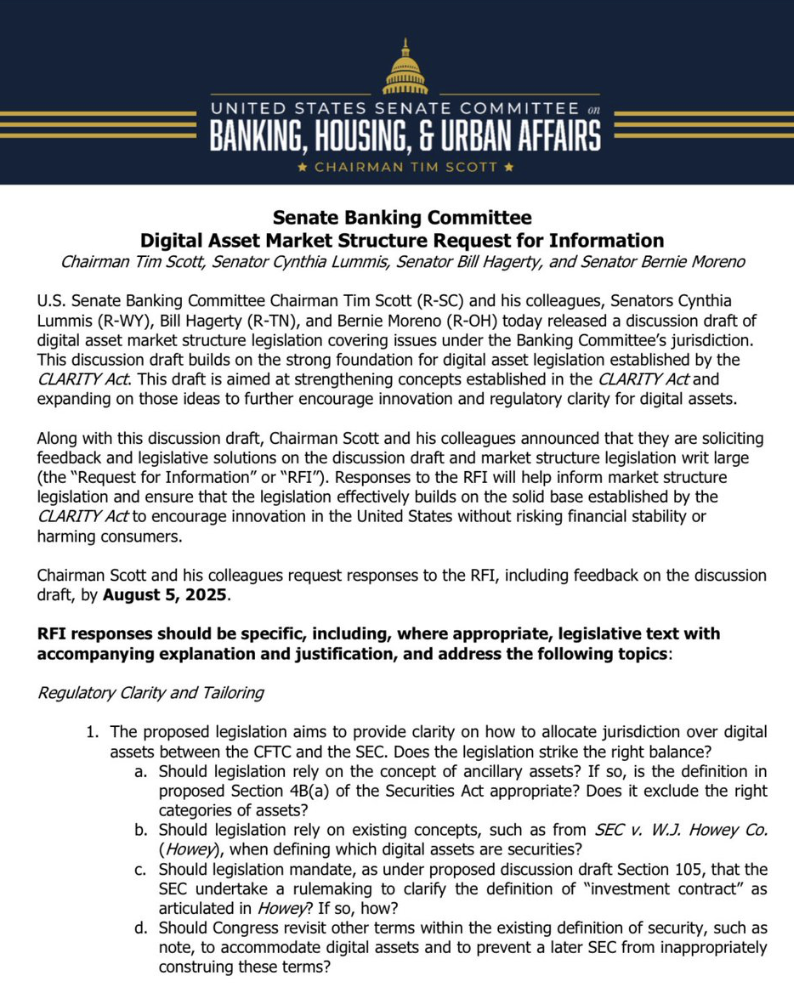

Senators Tim Scott, Cynthia Lummis, Bill Hagerty, and Bernie Moreno (R-OH) have released a discussion draft of a new digital asset market structure bill—framed as the Senate counterpart to the CLARITY Act.

The proposal aims to further define the regulatory boundaries between the SEC and CFTC, and improve clarity for digital asset innovation in the United States.

The draft, published by the Senate Banking Committee under Chairman Scott, builds on the principles laid out in the original CLARITY Act and is designed to encourage innovation without compromising financial stability or consumer protections.

Lawmakers are now requesting public feedback through a Request for Information (RFI) process. They’re asking industry participants and the public to submit comments by August 5, 2025, including detailed input on topics such as:

- Whether legislation should rely on the concept of “ancillary assets”

- The appropriate use of the Howey test in classifying digital assets as securities

- Mandating SEC rulemaking to redefine the term “investment contract”

This effort comes amid growing bipartisan momentum for establishing a clear regulatory framework in the wake of rising institutional crypto adoption and stablecoin innovation following the GENIUS Act.

-

1

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

2

Crypto Week Begins: U.S. Congress Advances Key Bills as Trump Pushes for Regulatory Clarity

15.07.2025 7:00 2 min. read -

3

Crypto Tax Policy in Spotlight as House Plans July 16 Hearing

10.07.2025 9:00 2 min. read -

4

Thailand Launches National Crypto Sandbox

17.07.2025 9:03 2 min. read -

5

House Clears Path for Landmark Crypto Bills: Vote Set for Thursday

17.07.2025 9:15 2 min. read

Banking Trade Groups Urge OCC to Halt Digital Trust Bank Approvals

Five major banking associations are urging the Office of the Comptroller of the Currency (OCC) to delay approval of new national trust bank charters for digital asset firms, including Ripple, Fidelity Digital Assets, National Digital TR CO, and First National Digital Currency Bank.

Key Crypto Events to Watch in the Next Months

As crypto markets gain momentum heading into the second half of 2025, a series of pivotal regulatory and macroeconomic events are poised to shape sentiment, liquidity, and price action across the space.

What the GENIUS Act Means for Stablecoins, According to SEC Commissioner Hester Peirce

The signing of the GENIUS Act into law, represents a landmark step in U.S. crypto regulation, according to SEC Commissioner Hester M. Peirce.

Trump Set to Sign GENIUS Act, Ushering in Landmark U.S. Stablecoin Regulation

The United States is poised to introduce its most sweeping cryptocurrency legislation to date, as President Donald Trump prepares to sign the GENIUS Act—a groundbreaking bill aimed at regulating the rapidly expanding stablecoin market.

-

1

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

2

Crypto Week Begins: U.S. Congress Advances Key Bills as Trump Pushes for Regulatory Clarity

15.07.2025 7:00 2 min. read -

3

Crypto Tax Policy in Spotlight as House Plans July 16 Hearing

10.07.2025 9:00 2 min. read -

4

Thailand Launches National Crypto Sandbox

17.07.2025 9:03 2 min. read -

5

House Clears Path for Landmark Crypto Bills: Vote Set for Thursday

17.07.2025 9:15 2 min. read