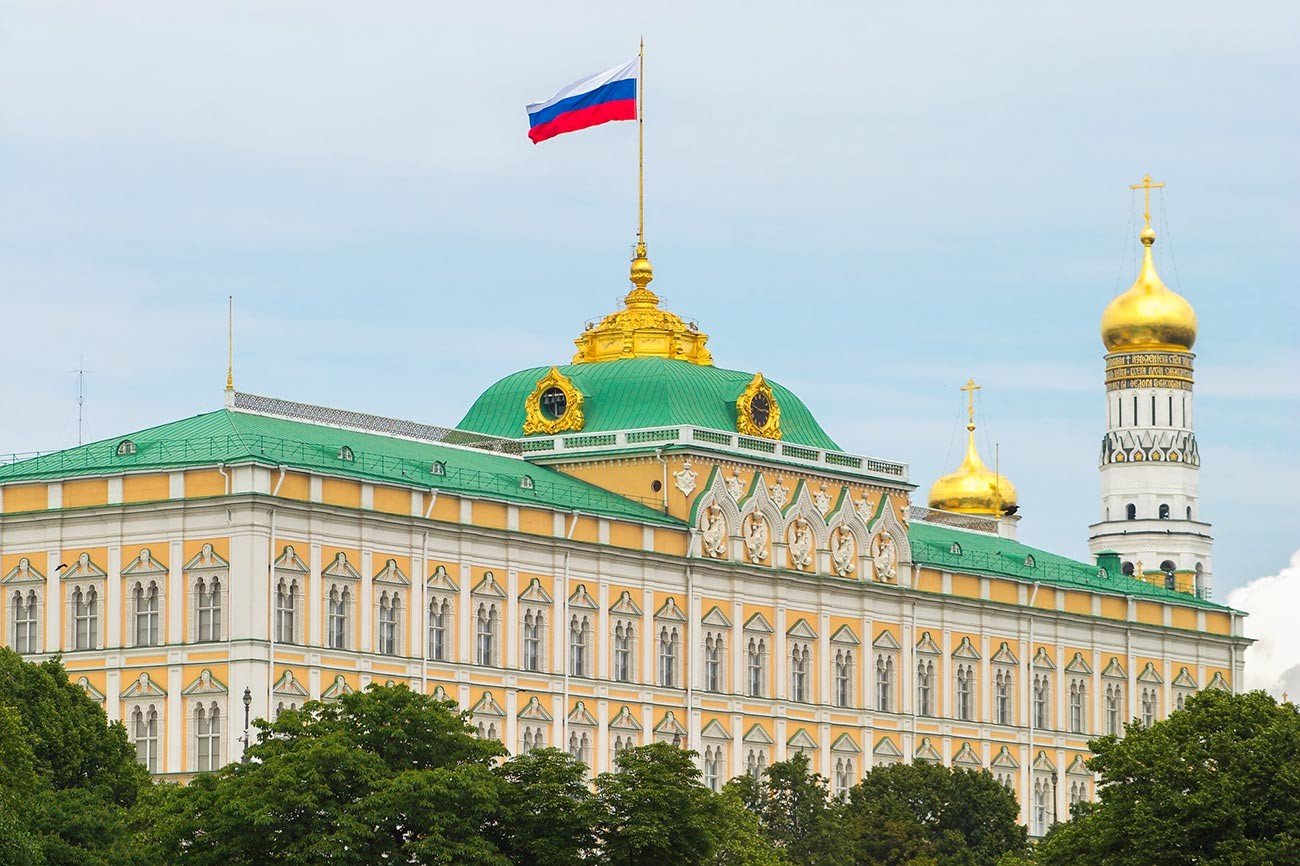

Russia Shifts $2.3 Billion in Cash as Sanctions Bite and Yuan Push Falters

15.08.2024 18:00 1 min. read Alexander Stefanov

Russia is back in the spotlight after recent issues with the Libyan dinar, which Libyan officials attribute to a surge in counterfeit bills reportedly linked to Russia.

Newly analyzed customs data reveals Russia has moved $2.3 billion in cash to Moscow, with Turkey and the UAE facilitating these transfers amidst sanctions. Interestingly, over half of this cash’s origin remains unknown.

Despite the Kremlin’s push to promote the Chinese yuan, many Russians still prefer holding dollars and euros for their reliability. Dmitry Polevoy of Astra Asset Management notes that the dollar continues to be a favored currency among Russians.

This ongoing preference highlights a gap between Russia’s official economic policies and the practical choices of its citizens. The high demand for foreign cash is driven by travel and savings needs.

Additionally, President Putin’s legalization of Bitcoin mining represents a move to overcome financial barriers. Russia’s recent presidency of the UN Security Council has also been used to promote a “multipolar world” and challenge the dominance of the US dollar, aligning with the goals of the BRICS nations.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read -

4

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read -

5

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read

Pump.fun Raises $600M in Record-Breaking PUMP Token Sale

Memecoin launchpad Pump.fun has stunned the crypto market by pulling off one of the fastest initial coin offerings (ICOs) in history.

Binance Founder Says Bloomberg’s USD1 Report is False, Threatens Lawsuit

Binance founder Changpeng Zhao has once again threatened legal action against Bloomberg.

Top 10 Biggest Crypto Developments This Week

The latest WuBlockchain Weekly report captures a high-volatility week in crypto. From Bitcoin’s new all-time high to controversy around Pump.fun’s presale and Elon Musk’s political Bitcoin endorsement, markets are witnessing sharp shifts in momentum and policy.

Federal Reserve Chair Jerome Powell Reportedly Weighing Resignation

U.S. financial circles are bracing for a potential shake-up as reports suggest Federal Reserve Chair Jerome Powell is considering stepping down.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read -

4

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read -

5

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read