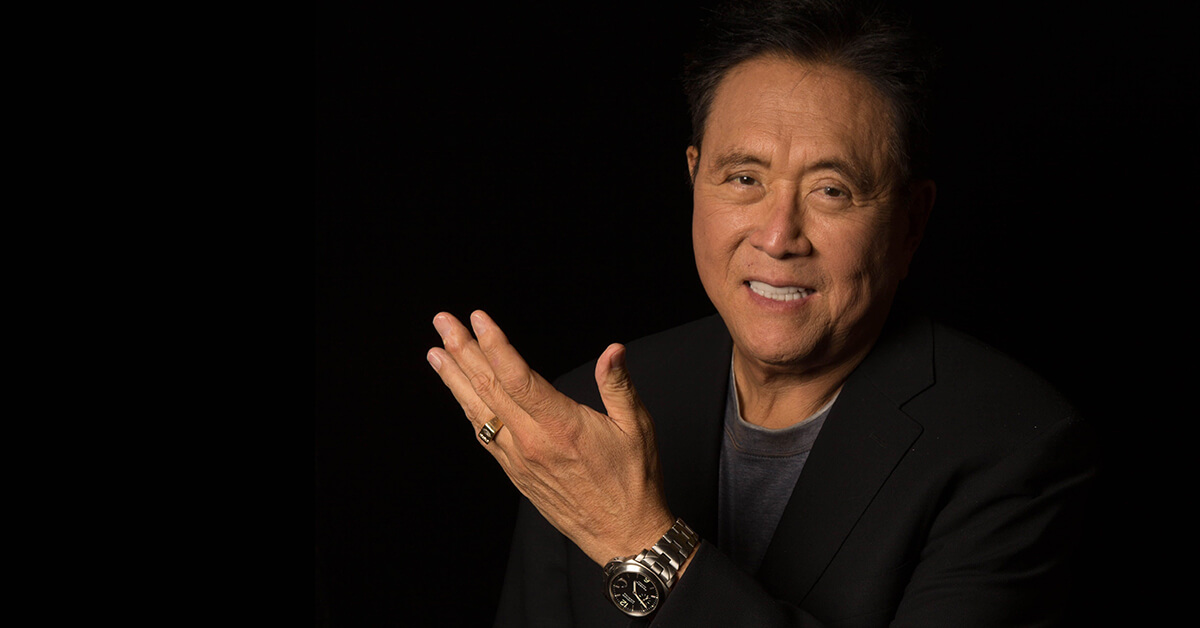

Robert Kiyosaki Warns of Deepening Financial Crisis, Urges Shift to Bitcoin and Precious Metals

03.06.2025 17:00 1 min. read Alexander Stefanov

Robert Kiyosaki, author of Rich Dad Poor Dad, has raised alarm bells once again—this time warning that the financial system may already be in the early stages of a historic downturn.

In a recent post on social media platform X, Kiyosaki shared a stark forecast: the economic turmoil he predicted years ago could now be unfolding in real time.

Referencing insights from his 2013 book Rich Dad’s Prophecy, he claimed the current instability marks the beginning of what he believes could be the most severe market collapse in modern history.

According to him, the damage will hit hardest in traditional investment vehicles like stocks, bonds, and real estate—assets widely held by the aging baby boomer generation.

READ MORE:

Ripple’s RLUSD Stablecoin Gains Approval in Dubai, Set to Support Real Estate Tokenization

While the outlook may appear grim, Kiyosaki pointed to alternative assets as potential lifelines. He expects massive capital flight into Bitcoin, gold, and silver as investors search for safer ground amid worsening volatility.

He also left followers with a motivating message: those who act early and decisively could emerge from the downturn with considerable wealth.

With summer approaching, Kiyosaki anticipates a turbulent season for global markets—and a pivotal moment for those ready to rethink where they store their value.

-

1

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

2

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

07.07.2025 17:00 2 min. read -

3

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

4

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

5

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read

Bitcoin Open Interest Hits $42B as Funding Rates Signal Bullish Overextension

Bitcoin’s derivatives market is heating up, with open interest climbing back to $42 billion while funding rates continue to surge.

Tim Draper Predicts Bitcoin Will Replace U.S. Dollar

Tim Draper isn’t just betting on Bitcoin—he’s forecasting the death of the U.S. dollar.

UK to Sell Almost $7B in Seized Bitcoin as Treasury Eyes Crypto Boost

The United Kingdom’s Home Office is preparing to liquidate a massive cache of seized cryptocurrency—at least $7 billion worth of Bitcoin—according to a new report by The Telegraph.

Crypto’s Top Narratives in Focus, According to AI

A fresh breakdown from CoinMarketCap’s AI-powered narrative tracker reveals the four most influential crypto trends currently shaping the market: BTCFi & DePIN, U.S. regulatory breakthroughs, AI agent economies, and real-world asset (RWA) tokenization.

-

1

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

2

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

07.07.2025 17:00 2 min. read -

3

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

4

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

5

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read