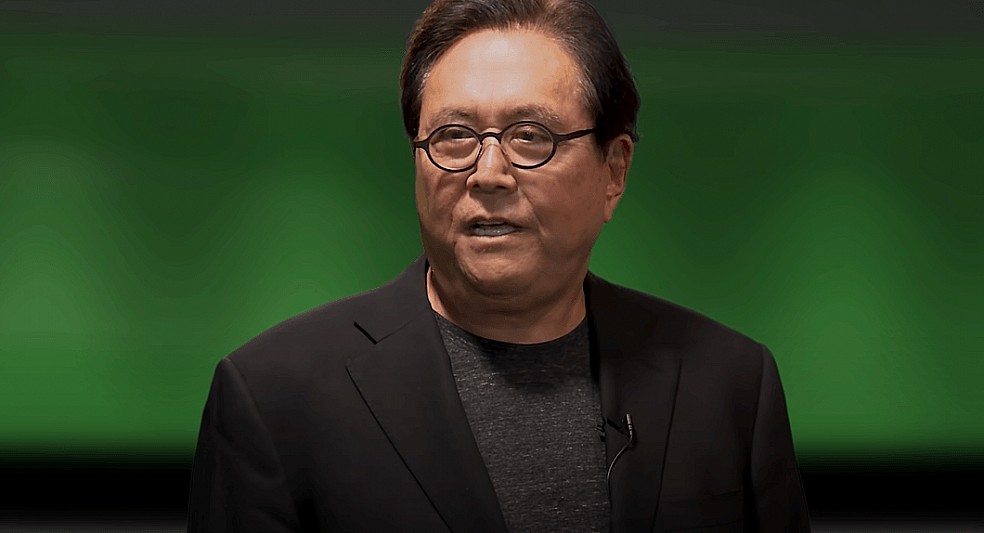

Robert Kiyosaki Warns: Move Your Money Out of Banks

19.08.2024 8:30 1 min. read Alexander Stefanov

Robert Kiyosaki, author of ‘Rich Dad Poor Dad,’ has recently turned his attention to the banking system, issuing a stark warning on August 18 through his social media platform.

He advised his followers to reconsider keeping their money in traditional banks, which he described as “corrupt” and vulnerable during financial crises.

Kiyosaki highlighted that the Federal Deposit Insurance Corporation (FDIC) insures deposits up to $250,000 but questioned the reliability of this system, suggesting it is inherently flawed. Instead, he urged people to protect their wealth by investing in precious metals and cryptocurrencies, which he referred to as “real money.”

He emphasized that bank failures are often unnoticed by the general public, making it risky to rely on traditional banking. “Why risk it? Move your savings into gold, silver, and Bitcoin,” Kiyosaki advised.

This stance is consistent with Kiyosaki’s long-held views against conventional banking and fiat currency. He believes an economic crash is imminent and that relying on the Federal Reserve is futile. Instead, he recommends alternative investments to safeguard wealth.

Kiyosaki’s warnings about a significant market downturn, including a potential 70% drop in the S&P 500, reflect his ongoing concern about economic instability and his advice for financial self-reliance.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read -

4

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read -

5

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read

Coinbase Strengthens DeFi Push With Opyn Leadership Acquisition

Coinbase has taken a major step toward expanding its decentralized finance (DeFi) presence by bringing onboard the leadership team behind Opyn Markets, a prominent name in the DeFi derivatives space.

Grayscale Urges SEC to Allow Multi-Crypto ETF to Proceed

Grayscale Investments has called on the U.S. Securities and Exchange Commission (SEC) to allow the launch of its multi-crypto ETF—the Grayscale Digital Large Cap Fund—arguing that further delays violate statutory deadlines and harm investors.

Robinhood Launches Ethereum and Solana Staking for U.S. Users

Robinhood has officially introduced Ethereum (ETH) and Solana (SOL) staking services for its U.S. customers, offering a new way for users to earn rewards on their crypto holdings.

Binance CEO Reveals What’s Fueling the Next Global Crypto Boom

Binance CEO Richard Teng shared an optimistic outlook on the future of cryptocurrencies during an appearance on Mornings with Maria, highlighting growing global acceptance, regulatory progress, and strategic reserve integration.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read -

4

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read -

5

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read