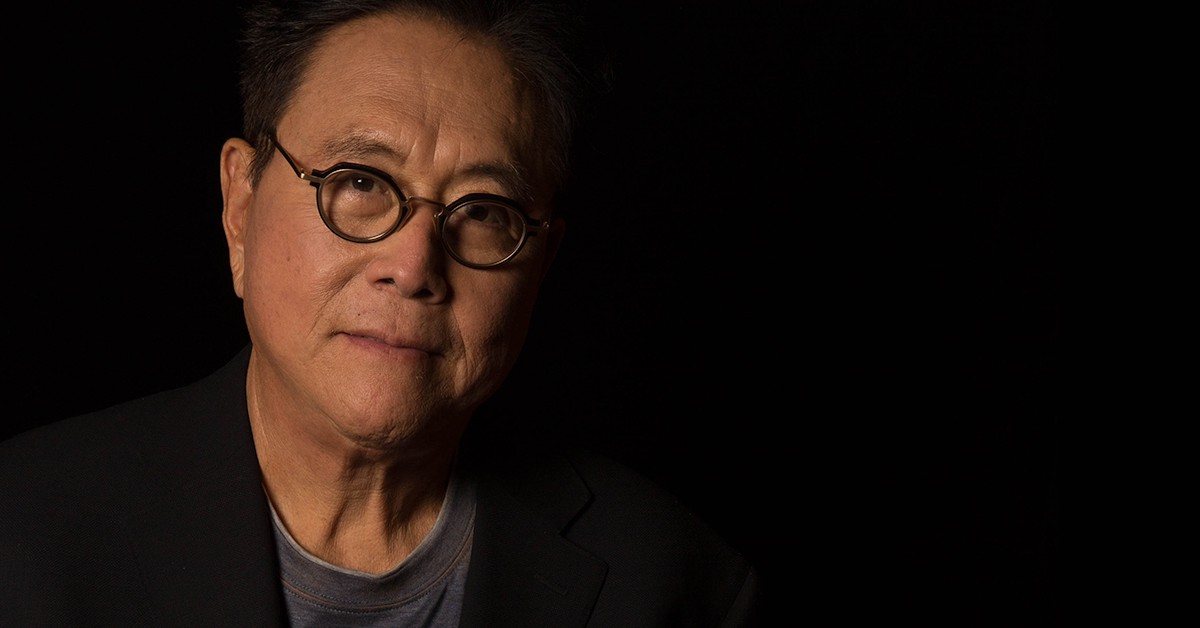

Robert Kiyosaki Sees Market Crash as Opportunity for Wealth Growth

03.08.2024 18:00 1 min. read Alexander Stefanov

Financial expert Robert Kiyosaki, author of "Rich Dad Poor Dad," recently addressed his followers on the X platform about the current market conditions.

Despite the market downturn, Kiyosaki sees opportunities for wealth creation. He pointed out the recent declines: the Dow Jones fell by 600 points, the Nasdaq dropped 2.4%, and the S&P 500 decreased by 6% from its recent high.

Kiyosaki reminded his 2.1 million followers that he had been predicting this market drop for years and now advises taking advantage of lower asset prices.

He emphasized a principle from his book, suggesting that economic downturns are prime times for the wealthy to acquire assets cheaply and increase their wealth.

In June, Kiyosaki made a notable prediction in the cryptocurrency sector, forecasting that Bitcoin could soar to $350,000.

He described this as his goal rather than a prediction and mentioned his investments in Bitcoin, Ethereum, and Solana.

Kiyosaki has consistently critiqued U.S. economic policies since 2020 and cites the growing national debt, now at $35 trillion, as a key reason for his optimistic cryptocurrency outlook.

-

1

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

2

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

3

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

4

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read

U.S. Public Pension Giant Boosts Palantir and Strategy Holdings in Q2

According to a report by Barron’s, the Ohio Public Employees Retirement System (OPERS) made notable adjustments to its portfolio in Q2 2025, significantly increasing exposure to Palantir and Strategy while cutting back on Lyft.

Key Crypto Events to Watch in the Next Months

As crypto markets gain momentum heading into the second half of 2025, a series of pivotal regulatory and macroeconomic events are poised to shape sentiment, liquidity, and price action across the space.

Here is Why Stablecoins Are Booming, According to Tether CEO

In a recent interview with Bankless, Tether CEO Paolo Ardoino shed light on the growing adoption of stablecoins like USDT, linking their rise to global economic instability and shifting generational dynamics.

U.S. Dollar Comes Onchain as GENIUS Act Ushers in Digital Era

In a statement that marks a major policy shift, U.S. Treasury Secretary Scott Bessent confirmed that blockchain technologies will play a central role in the future of American payments, with the U.S. dollar officially moving “onchain.”

-

1

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

2

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

3

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

4

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read