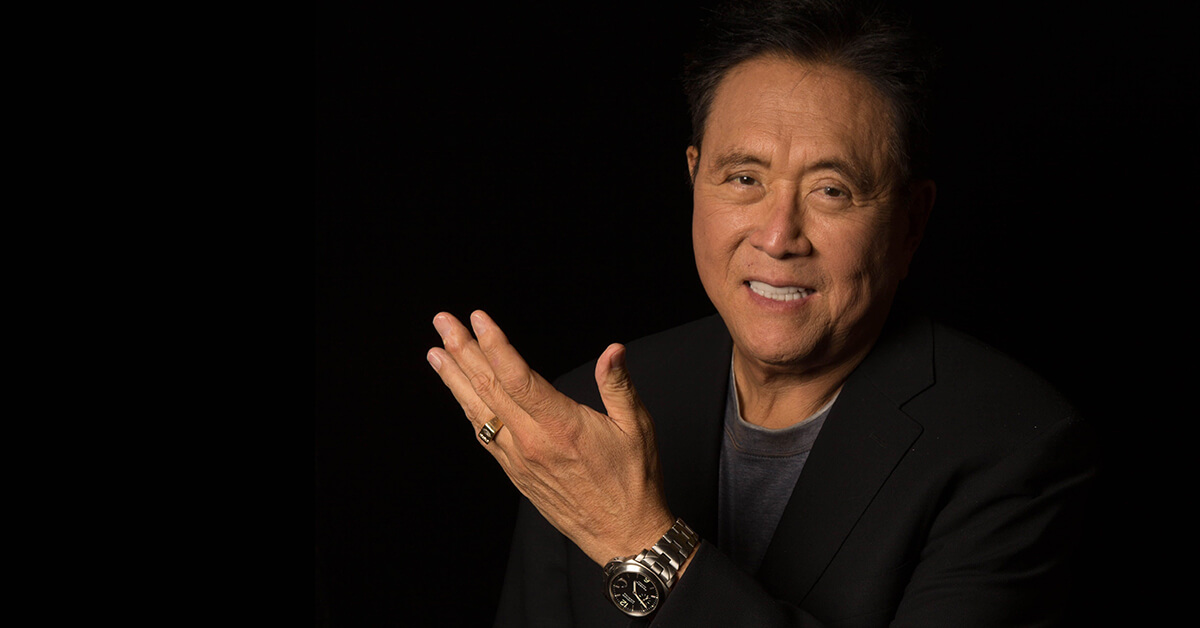

Robert Kiyosaki Reveals the Best Asset Today Besides Bitcoin and Gold

22.10.2024 21:30 1 min. read Kosta Gushterov

Bestselling author and renowned financial motivator Robert Kiyosaki, famous for his book "Rich Dad, Poor Dad" , has released a new statement.

According to Kiyosaki, “the best asset today” is silver, which he says is on track to reach $50 an ounce. Although he has touted silver alongside gold and Bitcoin before, it has typically received less attention than the other two assets.

Several factors are contributing to silver’s current strong performance. From a technical standpoint, the formation of a large “cup and handle” pattern suggests bullish momentum, which often signals the potential for significant price increases.

In addition, gold is reaching record highs and fear of missing out (FOMO) is prompting investors to seek alternative assets for profits.

More fundamentally, demand for silver is rising due to its wide range of industrial applications, including use in medical technology, engineering, electronics, photography and the defense sector.With 95% of the world’s silver supply related to industrial applications and limited quantities available for circulation, conditions are right for a potential price spike.

For bitcoin and gold, this appreciation in silver could lead to reduced attention and lower volatility, though time will tell how it will affect these assets.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read -

4

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read -

5

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read

Binance Founder Says Bloomberg’s USD1 Report is False, Threatens Lawsuit

Binance founder Changpeng Zhao has once again threatened legal action against Bloomberg.

Top 10 Biggest Crypto Developments This Week

The latest WuBlockchain Weekly report captures a high-volatility week in crypto. From Bitcoin’s new all-time high to controversy around Pump.fun’s presale and Elon Musk’s political Bitcoin endorsement, markets are witnessing sharp shifts in momentum and policy.

Federal Reserve Chair Jerome Powell Reportedly Weighing Resignation

U.S. financial circles are bracing for a potential shake-up as reports suggest Federal Reserve Chair Jerome Powell is considering stepping down.

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

Gold advocate Peter Schiff issued a stark warning on monetary policy and sparked fresh debate about Bitcoin’s perceived scarcity. In a pair of high-profile posts on July 12, Schiff criticized the current Fed rate stance and challenged the logic behind Bitcoin’s 21 million supply cap.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read -

4

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read -

5

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read