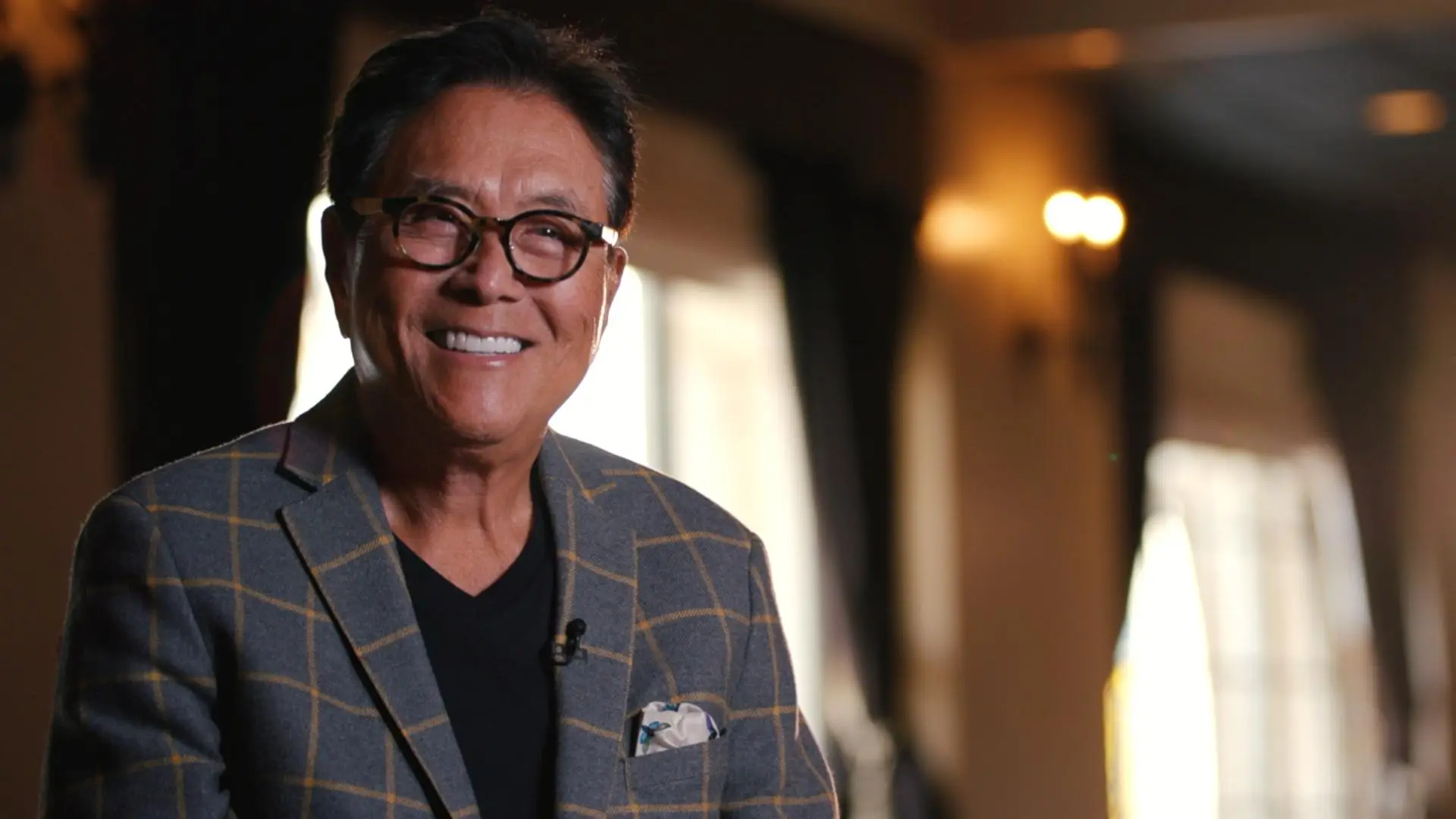

Robert Kiyosaki Predicts When The Price of Silver Will Explode

28.06.2025 16:30 2 min. read Kosta Gushterov

Robert Kiyosaki, author of Rich Dad Poor Dad, has issued a bold prediction on silver, calling it the “best asymmetric buy” currently available.

In a recent post on X, Kiyosaki emphasized that the time to buy is now — not later — warning that the opportunity may soon vanish.

“Your profits are made when you buy, not when you sell,” Kiyosaki reminded followers, repeating one of his core financial principles. He believes silver offers a rare combination of high upside potential with limited downside risk, positioning it as a top investment for those seeking long-term value.

According to the entrepreneur, silver remains widely affordable for the average investor — but not for long. Kiyosaki predicts an explosive surge in silver prices next month, saying “Silver price will explode in July,” and cautioning that “everyone can afford silver today… but not tomorrow.”

While he did not cite specific economic catalysts, Kiyosaki has frequently pointed to inflation concerns, fiat currency devaluation, and global financial instability as long-term drivers of precious metal demand.

His endorsement of silver as an “asymmetric bet” implies a belief that the reward-to-risk ratio is heavily tilted in favor of those entering the market before a major breakout.

Kiyosaki’s view on silver echoes his broader philosophy that fiat currencies are weakening and that real assets — like silver, gold, and Bitcoin — offer better long-term protection and growth. With July approaching, his latest warning may influence retail interest in silver, particularly among followers of his financial strategies.

As usual, the investor closed his message with a concise reminder: “Take care.”

-

1

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

27.06.2025 9:00 2 min. read -

2

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

3

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

4

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

5

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

U.S. inflation accelerated in June, dealing a potential setback to expectations of imminent Federal Reserve rate cuts.

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

In a surprising long-term performance shift, gold has officially outpaced the U.S. stock market over the past 25 years—dividends included.

U.S. Announces Sweeping New Tariffs on 30+ Countries

The United States has rolled out a broad set of new import tariffs this week, targeting over 30 countries and economic blocs in a sharp escalation of its trade protection measures, according to list from WatcherGuru.

Key U.S. Economic Events to Watch Next Week

After a week of record-setting gains in U.S. markets, investors are shifting focus to a quieter yet crucial stretch of macroeconomic developments.

-

1

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

27.06.2025 9:00 2 min. read -

2

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

3

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

4

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

5

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read