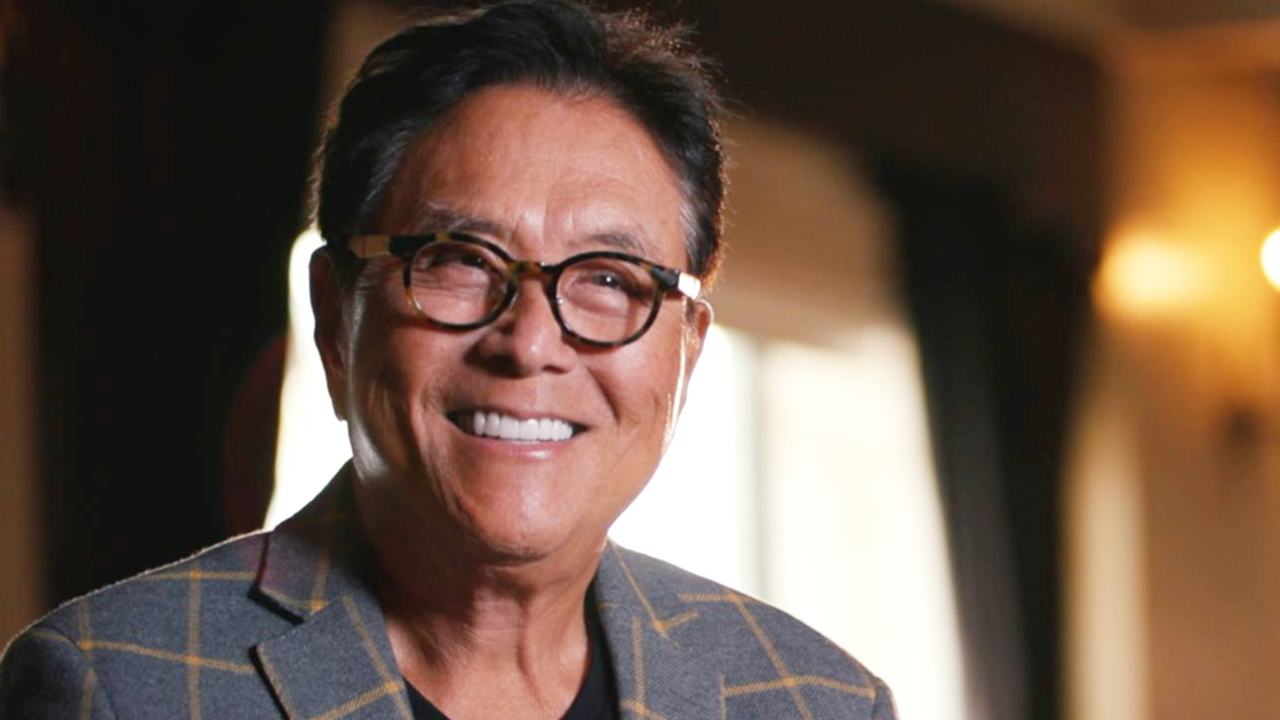

Robert Kiyosaki Predicts Big Gains for Bitcoin – Here’s Why

11.07.2024 8:30 2 min. read Alexander Stefanov

Renowned investor Robert Kiyosaki has voiced strong support for Bitcoin (BTC) and gold amidst recent market gains.

In a recent tweet, Kiyosaki emphasized the importance of these assets as stores of value, urging investors not to miss out amid current market conditions. He highlighted Bitcoin’s role in institutional investment, likening market dynamics to a challenging card game where strategic moves can lead to success.

Kiyosaki’s endorsement underscores Bitcoin’s resilience and appeal as a hedge against economic uncertainty. He noted the asset’s recent price uptick and its potential to maintain momentum, buoyed by institutional interest and the approval of Bitcoin ETFs earlier this year. Despite fluctuations like the recent German Bitcoin sale, optimism prevails in mid-week trading with cryptocurrencies showing renewed strength.

Bitcoin’s allure as a digital gold has been increasingly recognized, particularly with the rise of institutional adoption and investment vehicles like ETFs. This validation has bolstered confidence among investors seeking alternative assets amidst traditional market volatility.

Kiyosaki’s call to also consider gold and silver aligns with historical perceptions of precious metals as stable investments during economic uncertainty, complementing Bitcoin’s digital store-of-value narrative.

As the market continues to evolve, Kiyosaki’s stance resonates with those looking to diversify portfolios with assets that offer resilience and potential long-term growth, despite short-term market fluctuations. His advocacy for Bitcoin and precious metals reflects broader sentiment among investors aiming to safeguard wealth in a changing financial landscape.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read