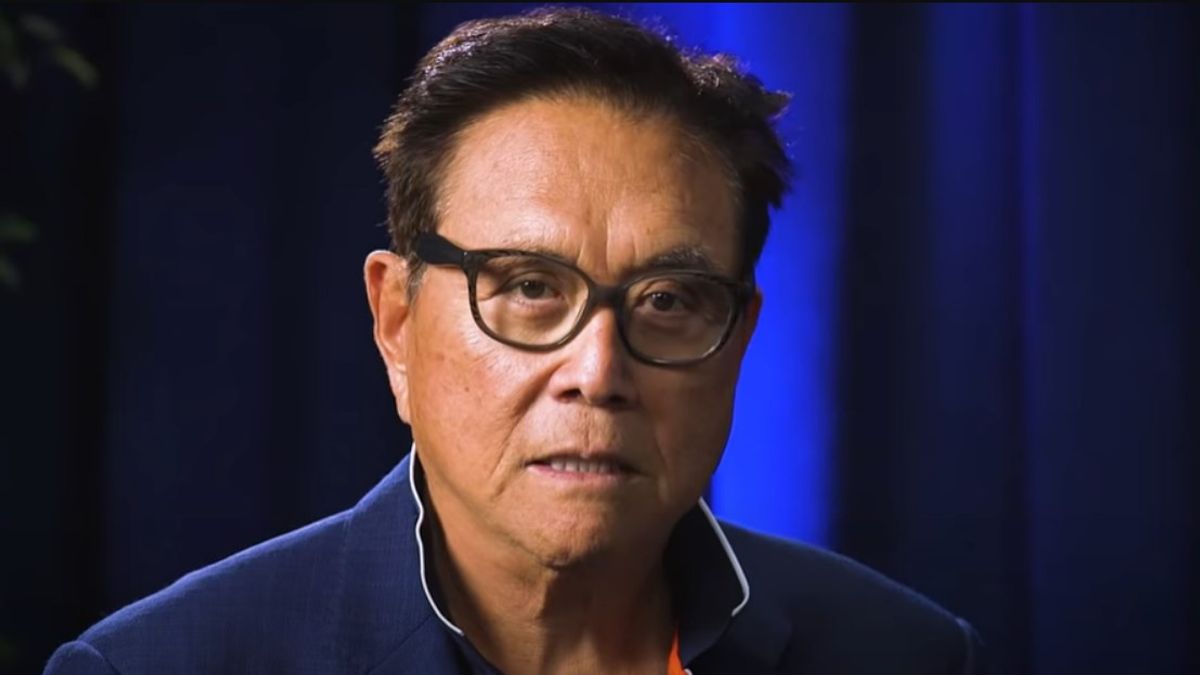

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read Alexander Stefanov

Personal-finance author Robert Kiyosaki is sounding the alarm that next year could bring an economic breakdown unlike anything modern markets have seen.

In a recent X thread, the Rich Dad Poor Dad writer blames surging prices and rapid job disruption from artificial intelligence for what he calls an inevitable “biggest crash in history.”

Why 2025?

- Runaway inflation: Kiyosaki argues soaring living costs are eroding retirees’ savings faster than they can respond.

- AI-driven layoffs: He forecasts “millions” will lose work as automation spreads across white- and blue-collar roles.

- False security: Traditional advice—earn a degree, land a steady job—no longer protects households, he says.

The “hard-money” playbook

Kiyosaki’s solution remains unchanged: accumulate scarce, non-government assets.

- Gold & silver: Ignore daily spot moves and focus on how many ounces you hold.

- Bitcoin: He started buying around $6 k and still adds on dips, predicting BTC could top $1 million by 2030.

“Poor people obsess over price; the wealthy count units,” he wrote, stressing that ownership volume, not headline quotes, will decide who weathers the storm.

Dismiss “false prophets”

The author warns against YouTube influencers and conventional educators promising job security. Instead, he urges followers to vet information sources carefully and build positions in what he terms “real money.”

With 2025 framed as a potential financial reset, Kiyosaki’s message is blunt: stockpile gold, silver, and Bitcoin now—or risk being caught on the wrong side of history’s next major market wipeout.

-

1

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

30.06.2025 15:23 2 min. read -

2

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read -

3

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

4

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read -

5

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

27.06.2025 12:00 1 min. read

Bitcoin Blasts Past $121,000 [Live blog schema]

Bitcoin has officially broken through the $121,000 level, rising 2.84% in the past 24 hours to hit $121,400, according to CoinMarketCap data.

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

Bitcoin has officially broken through the $121,000 level, rising 2.84% in the past 24 hours to hit $121,400, according to CoinMarketCap data.

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

Bitcoin soared to a new all-time high above $119,000 on July 13, extending its bullish momentum on the back of institutional accumulation, shrinking exchange reserves, and technical breakout patterns.

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

A major shift in the crypto cycle may be approaching as Bitcoin dominance (BTC.D) once again reaches critical long-term resistance.

-

1

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

30.06.2025 15:23 2 min. read -

2

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read -

3

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

4

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read -

5

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

27.06.2025 12:00 1 min. read