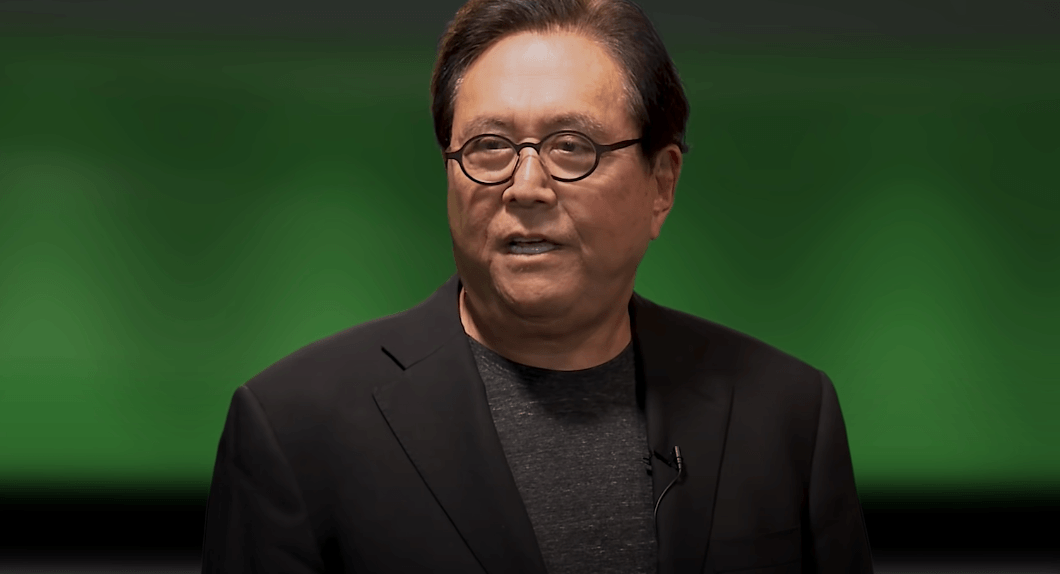

Robert Kiyosaki Issues Another Major Warning on the U.S. Dollar Instability

15.10.2024 8:30 2 min. read Kosta Gushterov

Robert Kiyosaki recently expressed concerns about the U.S. dollar's stability, attributing its current state to decisions made decades ago.

He specifically pointed to President Nixon’s 1971 decision to end the dollar’s gold backing as a key factor.

Kiyosaki argues that since the U.S. dollar was decoupled from gold, it has relied on government bonds and treasuries, which he views as “fake money.” He believes this shift has had significant long-term impacts on the economy. Before 1971, the dollar’s value was tied to gold, providing a stable benchmark, but Nixon’s move transformed it into a fiat currency, leaving its value dependent on market sentiment and government debt.

Kiyosaki has criticized this change, stating that it further eroded the dollar’s value and increased reliance on government-issued debt. He considers this a pivotal moment, noting that the Federal Reserve’s money printing to manage debt has further diminished the dollar’s purchasing power, leading to inflation and rising costs for goods and services.

READ MORE:

How Do Bitcoin’s Gains Compare to S&P500?

He also argues that traditional savings are becoming riskier due to inflation, as the increasing prices reduce the dollar’s purchasing power over time. Kiyosaki suggests that conventional savings accounts are no longer effective for preserving wealth in this economic environment.

To combat this, he advises investors to explore alternative assets like gold, silver, and Bitcoin, which he believes are more resilient against inflation. He noted that gold’s recent record highs demonstrate its ability to maintain value during economic uncertainty, while cryptocurrencies like Bitcoin are also considered protective against inflation. Kiyosaki recommends diversifying investments across precious metals and digital assets to safeguard against economic instability.

-

1

Key U.S. Events to Watch This Week That Could Impact Crypto

30.06.2025 11:00 2 min. read -

2

Here Is How Your Crypto Portfolio Should Look Like According to Investment Manager

30.06.2025 10:00 2 min. read -

3

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

27.06.2025 8:00 1 min. read -

4

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

30.06.2025 9:00 1 min. read -

5

Here is How to Read the Crypto Fear and Greed Index

14.07.2025 15:00 3 min. read

Grayscale Confidentially Files for New SEC-registered Offering Amid Growing Crypto Market demand

Grayscale Investments announced today that it has confidentially submitted a draft registration statement on Form S-1 to the U.S.

Here is How to Read the Crypto Fear and Greed Index

In the volatile world of cryptocurrency, investor psychology is one of the most powerful forces behind price movement.

Bank of England Governor Warns Against Stablecoins, Backs Tokenized Deposits Instead

Bank of England Governor Andrew Bailey has voiced strong concerns about the rising push for stablecoin adoption, calling on banks to steer clear of issuing their own digital currencies.

Czech National Bank Enters Crypto Sector with $18M Coinbase Investment

The Czech National Bank (CNB) has entered the crypto sector with a $18 million investment in Coinbase, purchasing 51,732 shares in Q2 2025, according to a U.S. SEC filing.

-

1

Key U.S. Events to Watch This Week That Could Impact Crypto

30.06.2025 11:00 2 min. read -

2

Here Is How Your Crypto Portfolio Should Look Like According to Investment Manager

30.06.2025 10:00 2 min. read -

3

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

27.06.2025 8:00 1 min. read -

4

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

30.06.2025 9:00 1 min. read -

5

Here is How to Read the Crypto Fear and Greed Index

14.07.2025 15:00 3 min. read