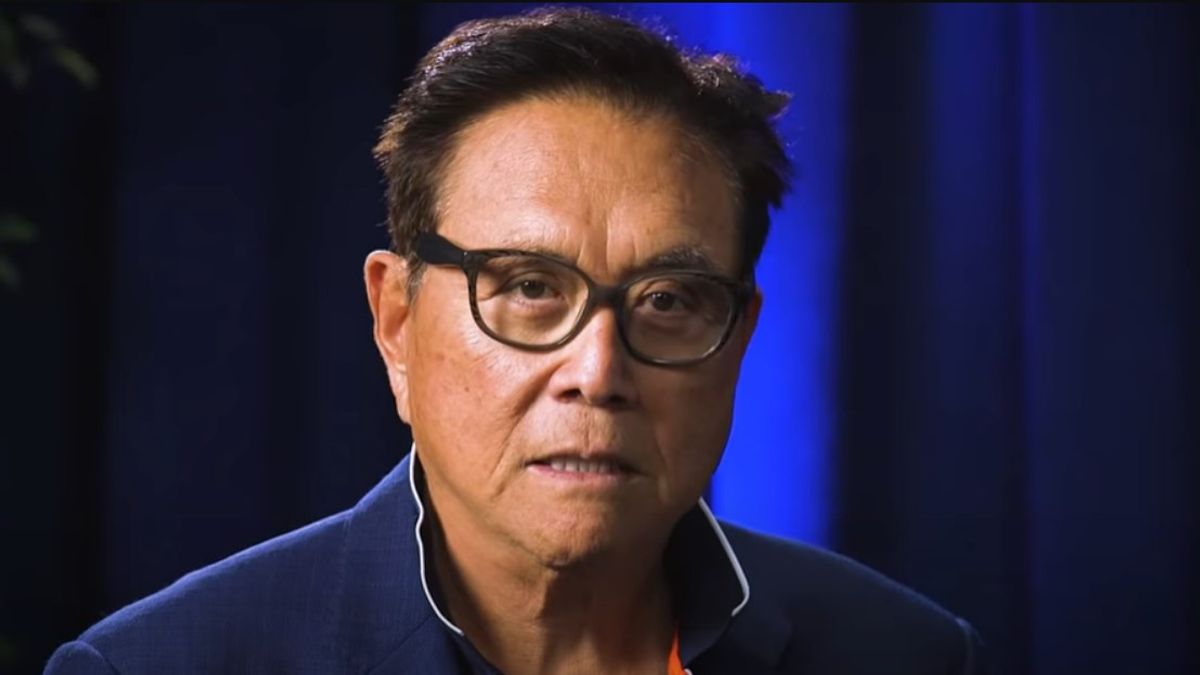

Robert Kiyosaki Ditches Gold and Silver, Goes All-In on Bitcoin

31.01.2025 12:30 1 min. read Alexander Zdravkov

Robert Kiyosaki, best known for Rich Dad Poor Dad, is making a major shift in his investment approach, swapping gold and silver for Bitcoin (BTC).

After decades of favoring precious metals, he now believes Bitcoin holds the most potential for future gains.

Kiyosaki explained that he is rapidly offloading his gold and silver holdings to accumulate Bitcoin, predicting that BTC could soar to $250,000 by 2025. As of now, Bitcoin is valued at $102,011, reinforcing his confidence in its trajectory.

Pointing to America’s ballooning debt, which now exceeds $36.2 trillion, Kiyosaki sees Bitcoin as a hedge against reckless monetary policies. He warned that the U.S. government is printing $1 trillion every 90 days, devaluing traditional currencies.

“For years, I trusted gold and silver to preserve wealth. But now, I’m going all-in on Bitcoin because fiat money is crumbling, and no one in power is addressing it,” he emphasized.

Kiyosaki sees the financial landscape undergoing a historic transformation, calling it the biggest shift in economic history—from paper money to digital assets. He remains committed to embracing Bitcoin, convinced that it will play a central role in the future of finance.

-

1

Bitcoin Whales Accumulate as Long-Term Holders Hit All-Time High

03.07.2025 21:00 2 min. read -

2

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

3

Arizona Governor Vetoes Bill, Related to State Crypto Reserve Fund: Here Is Why

02.07.2025 16:00 2 min. read -

4

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

5

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

Traders are rapidly shifting their focus to Ethereum and altcoins after Bitcoin’s recent all-time high triggered widespread retail FOMO.

BSTR to Launch With 30,021 BTC, Becomes 4th Largest Public Bitcoin Holder

BSTR Holdings Inc. is set to become the fourth-largest public holder of Bitcoin, announcing it will launch with 30,021 BTC on its balance sheet as part of its public debut.

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

The cryptocurrency market is experiencing a notable shift in capital flows as Bitcoin’s market dominance has dropped to 61.6%, marking a 2.36% decrease.

France Eyes Bitcoin Mining to Solve Surplus Energy Challenges

French lawmakers have introduced a groundbreaking proposal that would turn excess electricity from energy producers into a valuable digital asset—Bitcoin.

-

1

Bitcoin Whales Accumulate as Long-Term Holders Hit All-Time High

03.07.2025 21:00 2 min. read -

2

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

3

Arizona Governor Vetoes Bill, Related to State Crypto Reserve Fund: Here Is Why

02.07.2025 16:00 2 min. read -

4

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

5

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read