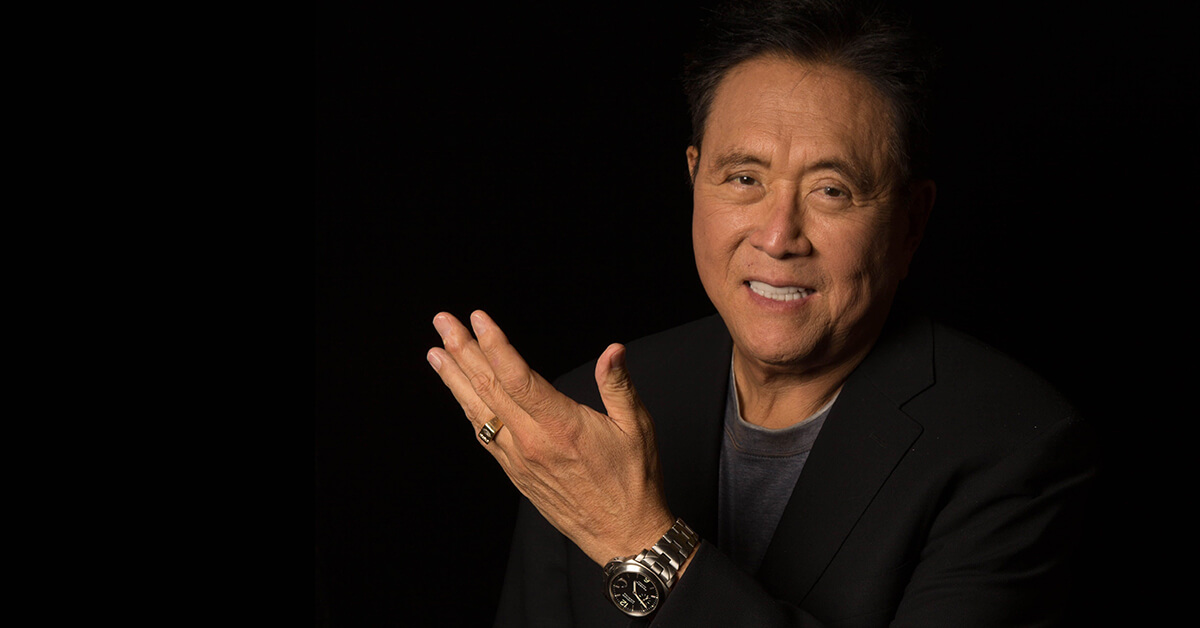

Robert Kiyosaki Criticizes Trump’s Memecoin, Questions Crypto’s Direction

20.01.2025 21:00 1 min. read Alexander Stefanov

Donald Trump’s recent launch of the TRUMP memecoin has stirred debate in the cryptocurrency world, with both its meteoric rise and ethical questions taking center stage.

The coin debuted on the Solana network, skyrocketing by 30,000% before suffering a significant correction. Meanwhile, author Robert Kiyosaki expressed skepticism, describing the crypto sector’s shift towards speculative assets as undermining its potential as the future of finance.

Kiyosaki, known for advocating tangible assets like gold, silver, and Bitcoin, suggested that memecoins like TRUMP reflect a troubling trend. Despite his concerns, TRUMP gained traction quickly, peaking at $75 before falling to $40. The drop coincided with investor interest shifting to MELANIA, another memecoin launched by incoming First Lady Melania Trump.

The coin’s structure, with 80% of its supply reportedly held in Trump’s wallet and no lockup period, has sparked criticism over potential manipulation. Platforms like Robinhood and KuCoin have still opted to list TRUMP, contributing to its partial recovery.

As Trump prepares to take office, his promises to promote crypto growth have raised questions about whether initiatives like TRUMP help or harm the industry. Critics remain divided on whether such speculative ventures detract from or contribute to crypto’s long-term legitimacy.

-

1

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

03.07.2025 20:00 2 min. read -

2

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

3

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

4

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read

XRP Hits All-time High Amid Regulatory Breakthrough and Whale Surge

XRP officially entered uncharted price territory on July 18, surging past its previous record to hit a new all-time high of $3.64, fueled by a powerful combination of U.S. regulatory progress, technical breakouts, and heavy whale accumulation.

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

BlackRock is seeking to enhance its iShares Ethereum Trust (ticker: ETHA) by incorporating staking features, according to a new filing with the U.S. Securities and Exchange Commission (SEC) submitted Thursday.

IMF Disputes El Salvador’s Bitcoin Purchases, Cites Asset Consolidation

A new report from the International Monetary Fund (IMF) suggests that El Salvador’s recent Bitcoin accumulation may not stem from ongoing purchases, but rather from a reshuffling of assets across government-controlled wallets.

Sberbank Moves to Dominate Russia’s Crypto Custody Sector

Sberbank, Russia’s largest state-owned bank, is preparing to launch custody services for digital assets, marking a significant expansion into the country’s evolving crypto landscape.

-

1

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

03.07.2025 20:00 2 min. read -

2

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

3

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

4

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read