Ripple Price Prediction: Can XRP Surge to $10 in February & What Are Analysts Saying?

21.02.2025 19:13 3 min. read Alexander ZdravkovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

XRP has been drawing attention lately, and now traders are wondering—could it really surge to $10 this month?

With speculation heating up, all eyes are on key drivers like institutional adoption, increasing regulatory clarity, and whale accumulation.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Meanwhile, PlutoChain ($PLUTO) could fix some of Bitcoin’s biggest issues, like slow transactions, high fees, and lack of flexibility. If it works as planned, Bitcoin could finally become useful for everyday spending instead of just being something people hold.

Let’s break down the details.

Can XRP Reach $10 in February? Analyst Insights

Could XRP be gearing up for a massive breakout? Binance analysts are weighing in, and opinions are divided.

Some believe XRP’s growing institutional adoption, expanding financial partnerships, and clearer regulatory landscape could fuel a major rally. Others point to key resistance levels that need to be breached before any significant price movement.

Technically, XRP must clear strong resistance zones to sustain momentum.

If bullish trends persist and whale accumulation continues, market conditions could support a push toward $10. However, broader macroeconomic factors and overall sentiment in the digital asset space will also play a crucial role in determining XRP’s trajectory this month.

Here’s How PlutoChain Might Improve Bitcoin’s Performance with Layer-2 Innovation

Bitcoin remains the most dominant network in the blockchain space, but its scalability challenges have been a long-standing issue. Slow transaction speeds and high fees have made everyday transactions inefficient.

That’s what PlutoChain might solve by offering a Layer-2 solution designed to potentially improve Bitcoin’s efficiency while expanding its functionality.

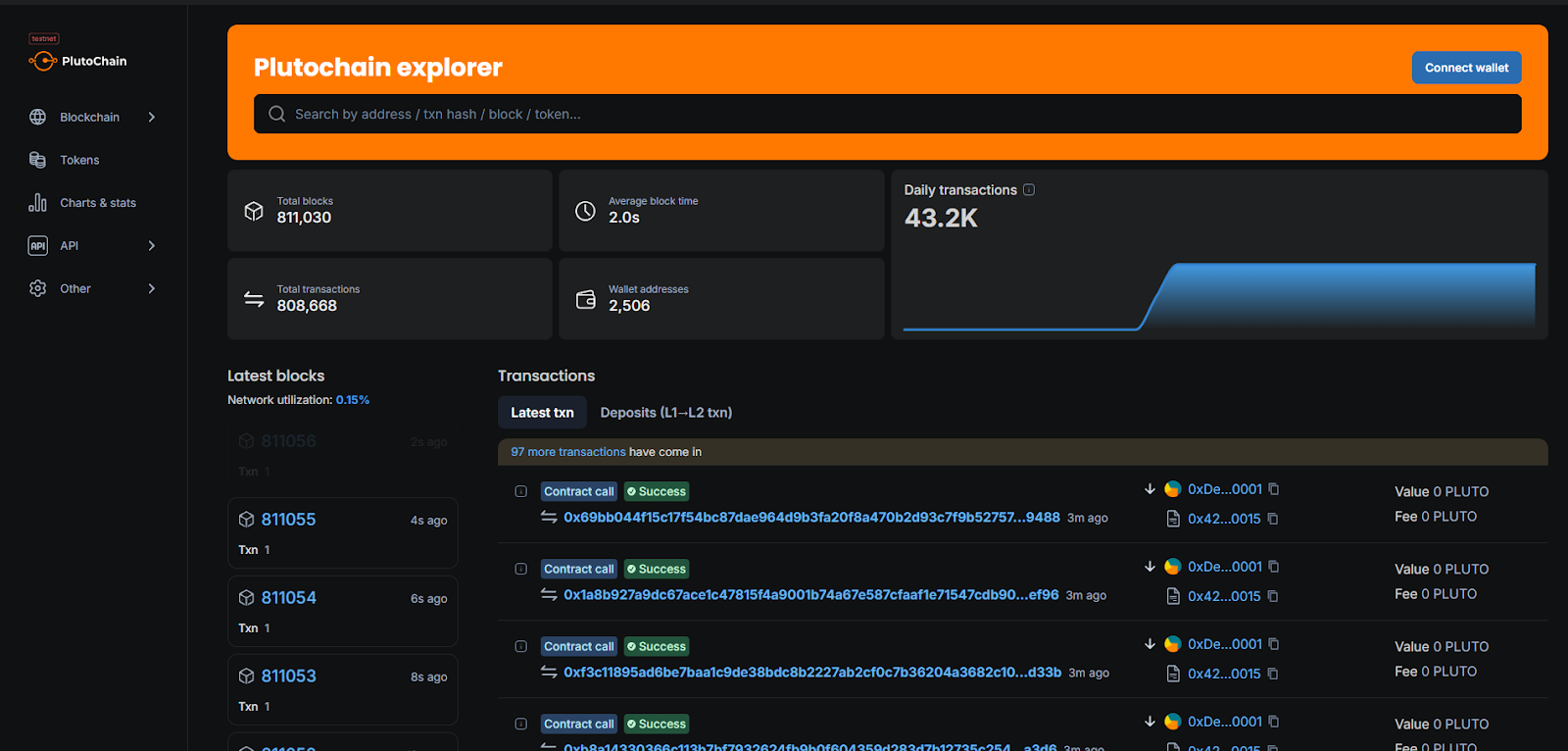

PlutoChain implements 2-second block times on its own Layer-2 chain and potentially improves transaction efficiency. This speed improvement could make Bitcoin more practical for high-volume transactions.

Beyond faster transactions, PlutoChain introduces EVM compatibility, which may allow Ethereum-based applications to seamlessly integrate with Bitcoin.

This could bridge the gap between the two ecosystems and enable DeFi applications, smart contracts, and other decentralized services to function within Bitcoin’s network.

During its testnet phase, it processed 43,200 transactions per day, which showcases its scalability potential.

Decentralized governance also plays a key role and gives its users the ability to propose and vote on network upgrades.

Meanwhile, security remains a priority, with PlutoChain undergoing audits by SolidProof, QuillAudits, and Assure DeFi to maintain trust and reliability.

With its ability to unlock new use cases such as DeFi, NFTs, and enhanced cross-chain functionality, PlutoChain could position itself as a go-to solution for Bitcoin’s scalability and usability in the broader blockchain ecosystem.

Final Words

Whether XRP can reach $10 in February remains a hot topic, with institutional demand, regulatory clarity, and key resistance levels all playing a role in its price movement. If momentum builds and market sentiment stays bullish, a breakout could be within reach.

Meanwhile, PlutoChain could completely reimagine what’s possible with Bitcoin.

The project could open the door for greater interoperability and new use cases within the Bitcoin ecosystem by integrating Ethereum-based applications and enabling decentralized governance.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy: SPX6900 Registers 294% Gain in Q2, TOKEN6900 to Explode Next in Q3?

16.07.2025 14:13 5 min. read -

2

Ethereum Price Prediction: ETH Soars 20% as Bitcoin Dominance Drops, Can Ethereum Hit $4,000 in Altcoin Season?

16.07.2025 14:46 4 min. read -

3

ChatGPT Predicts the Price of XRP, Solana, and Dogecoin by End of 2025

21.07.2025 2:01 5 min. read -

4

Best Crypto to Buy Now as Capitol Hill Ignites a High-Stakes Crypto Showdown

14.07.2025 1:26 7 min. read -

5

Ethereum Price Prediction: ETH to Could Soar to $3.5K as Trading Volumes Hit $33.7B

15.07.2025 0:45 4 min. read

SharpLink Just Bought More Ethereum – Is ETH The Best Crypto To Buy Now?

Ever since MicroStrategy’s Bitcoin sprint set the corporate world buzzing, a trend of on-chain accumulation has swept through institutional treasuries. This time, it’s all about ETH. Major players are quietly stacking Ethereum, drawn by its staking yields and ETF tailwinds. 2 companies hold over $1 billion in $ETH, more than the Ethereum Foundation. Top ETH […]

ChatGPT Predicts the Price of XRP, Solana, and Dogecoin by End of 2025

The crypto market has been on fire over the past week, and XRP, Solana, and Dogecoin have been among the top gainers. XRP hit a new high of $3.6, Solana is nearing $200, while Dogecoin is up 38% in seven days. But how far could these coins go in the current cycle? We decided to […]

As Cardano and XRP Soar, This New Meme Coin Could be the Best Crypto to Buy Now

Following Bitcoin’s all-time high of $123,000, the crypto market is heating up again. Among the top gainers, Cardano (ADA) jumped over 17% in the last seven days, while XRP surged by over 22%, setting a record high above $3.6. Alongside the major alts, meme coins are also catching fire again. Dogecoin has risen 38% in […]

Best Crypto to Buy Now? Rich Dad Poor Dad Author Robert Kiyosaki’s Bitcoin Price Prediction

When Robert Kiyosaki, a name synonymous with bold financial advice, revealed his precise rules for adding Bitcoin to his portfolio, the crypto community sat up and took notice. He pledged to scoop up more BTC once prices cleared $117,000, only to slam the brakes when Bitcoin rocketed past $120,000 and hit fresh all-time highs. YAY: […]

-

1

Best Crypto to Buy: SPX6900 Registers 294% Gain in Q2, TOKEN6900 to Explode Next in Q3?

16.07.2025 14:13 5 min. read -

2

Ethereum Price Prediction: ETH Soars 20% as Bitcoin Dominance Drops, Can Ethereum Hit $4,000 in Altcoin Season?

16.07.2025 14:46 4 min. read -

3

ChatGPT Predicts the Price of XRP, Solana, and Dogecoin by End of 2025

21.07.2025 2:01 5 min. read -

4

Best Crypto to Buy Now as Capitol Hill Ignites a High-Stakes Crypto Showdown

14.07.2025 1:26 7 min. read -

5

Ethereum Price Prediction: ETH to Could Soar to $3.5K as Trading Volumes Hit $33.7B

15.07.2025 0:45 4 min. read