Ripple CEO Optimistic About Crypto Future Under Trump, Calls for Clearer Regulations

21.11.2024 19:30 1 min. read Kosta Gushterov

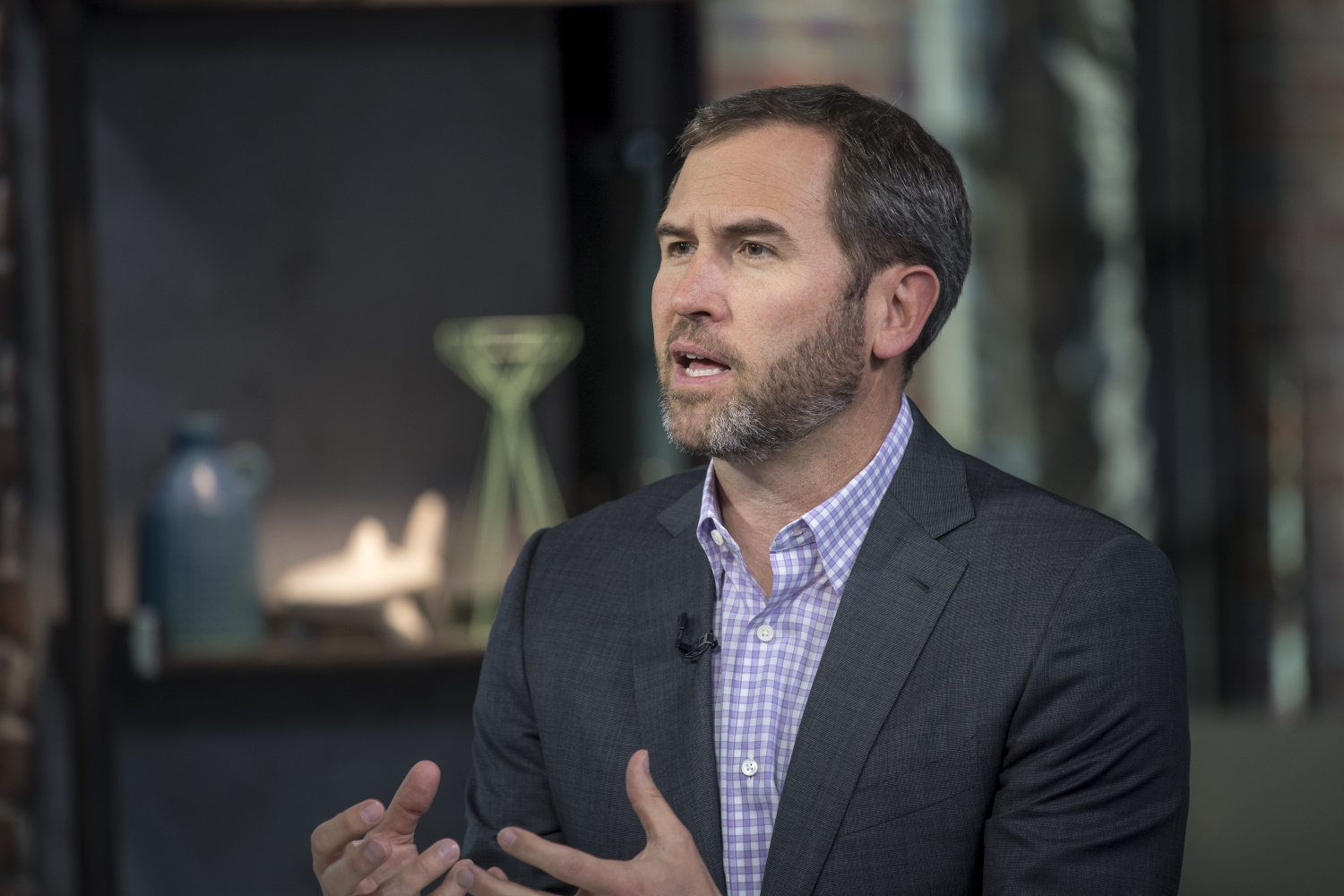

Brad Garlinghouse, CEO of Ripple Labs, recently discussed the future of cryptocurrency under a potential Trump administration in an interview with Fox Business.

He criticized the Biden administration’s approach to crypto and expressed optimism about the market’s potential with Trump in power. Garlinghouse believes Trump’s leadership could lead to clearer, more favorable regulations, helping the industry recover from the political challenges it faced under Biden.

He also touched on Ripple’s ongoing legal issues with the SEC, which have hindered the company despite its strong international market presence. Garlinghouse is hopeful that Trump’s “Make America Great Again” agenda could align with a “Make Crypto Great Again” movement, benefiting the industry.

Trump’s prior establishment of a pro-crypto transition committee and his promise of a Strategic Bitcoin Reserve have further fueled optimism among crypto advocates, with expectations that a more crypto-friendly SEC leadership could emerge.

Garlinghouse highlighted that while the U.S. is a major market for cryptocurrency, regulatory clarity is still lacking. He believes that clearer laws, aligned with the new crypto economy, could unlock new opportunities for Ripple and the broader industry. As the crypto space looks for stability, Garlinghouse’s comments underscore the need for regulatory reforms to foster innovation and growth, making the U.S. an attractive destination for digital assets.

-

1

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

27.06.2025 8:00 1 min. read -

2

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

30.06.2025 9:00 1 min. read -

3

Whales Buy the Dip as Retail Panics: This Week in Crypto

29.06.2025 14:00 3 min. read -

4

History Shows War Panic Selling Hurts Crypto Traders

28.06.2025 18:30 3 min. read -

5

How to Earn Yield Holding USDC: A 2025 Guide

15.07.2025 18:10 2 min. read

Kraken Launches U.S. Crypto Derivatives Platform, Eyes Broader Market Expansion

Kraken has officially launched its U.S.-regulated crypto derivatives platform, marking a major step toward merging traditional finance tools with digital asset markets.

How to Earn Yield Holding USDC: A 2025 Guide

If you’re holding USDC and want to maximize your yield, Deribit now offers rewards for eligible users who store USDC on its platform.

U.S. Regulators Define Crypto Custody Rules for Banks

U.S. banking regulators have issued fresh clarity on how financial institutions should handle cryptocurrency custody.

Kazakhstan May Invest Gold Reserves in Crypto Sector

Kazakhstan is considering allocating a portion of its gold and foreign currency reserves, along with National Fund assets, into crypto-related investments.

-

1

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

27.06.2025 8:00 1 min. read -

2

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

30.06.2025 9:00 1 min. read -

3

Whales Buy the Dip as Retail Panics: This Week in Crypto

29.06.2025 14:00 3 min. read -

4

History Shows War Panic Selling Hurts Crypto Traders

28.06.2025 18:30 3 min. read -

5

How to Earn Yield Holding USDC: A 2025 Guide

15.07.2025 18:10 2 min. read