Retail Investors Fuel XRP Surge While Bitcoin Lags Behind

04.04.2025 15:00 1 min. read Alexander Stefanov

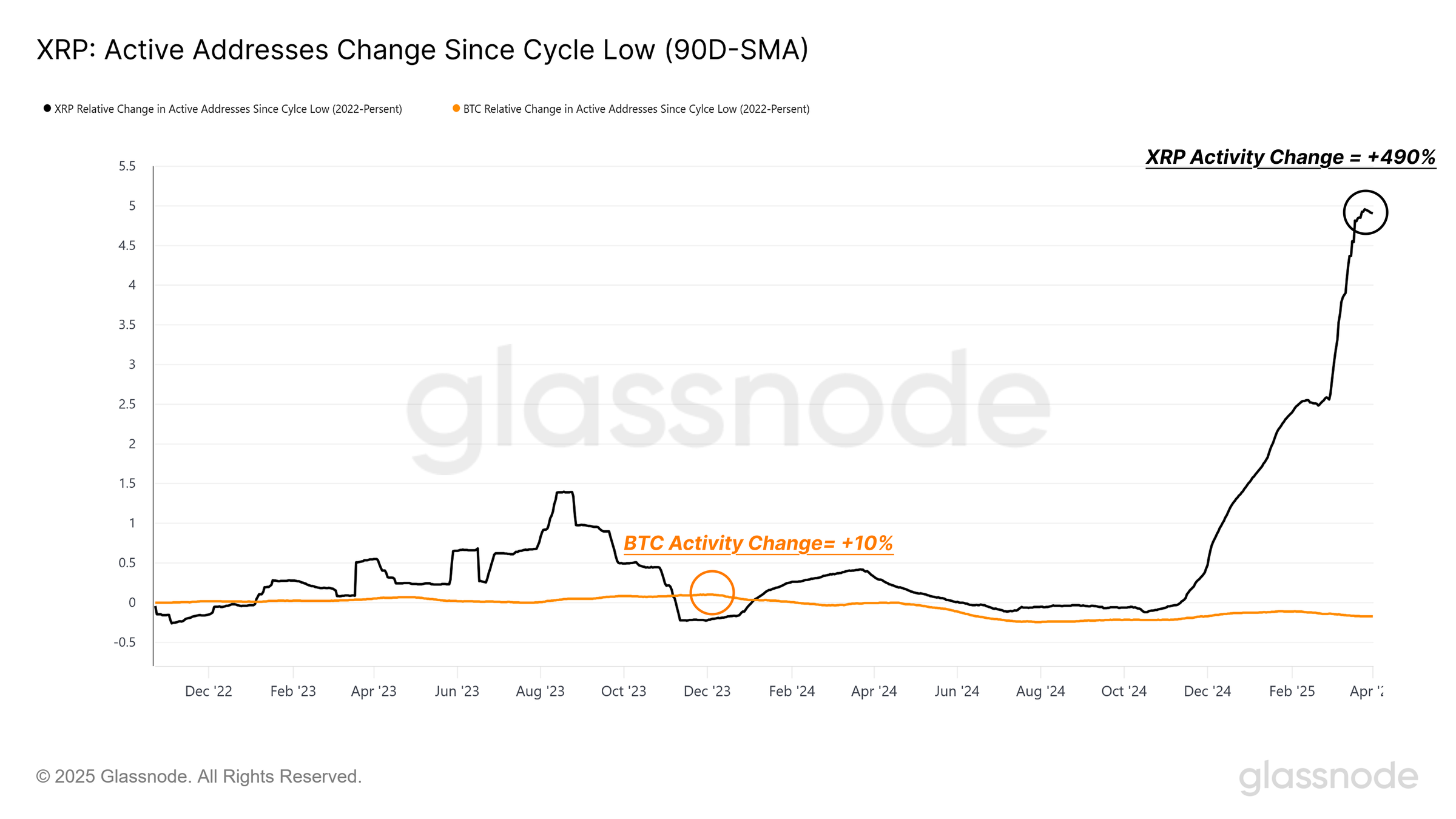

Retail investors are increasingly favoring XRP over Bitcoin, as Glassnode data shows a dramatic 490% increase in XRP’s daily active addresses, compared to just 10% for Bitcoin since the 2022 market low.

This surge suggests a speculative retail-driven rally for XRP, while Bitcoin’s growth remains mostly institutional.

XRP’s rise has been particularly rapid since December 2024, nearly doubling its realized market cap from $30.1 billion to $64.2 billion. However, much of this increase comes from newer investors, with nearly half of the new capital flowing from addresses created within the past six months.

This trend indicates a potentially fragile rally, as retail-driven growth can be volatile.

Geographically, the surge is concentrated in Western markets, mainly Europe and the U.S., while interest in Asia and Africa is limited. Despite the recent momentum, inflows have slowed since February 2025, and the profit-to-loss ratio has declined since January, hinting at waning confidence among new investors. Glassnode cautions that XRP’s peak demand might have already been reached.

Moreover, the high concentration of new investors raises concerns about market stability, as retail-driven rallies are often short-lived. If the momentum fades, there could be a sharp correction, especially since the current rally lacks substantial long-term support.

Market watchers are closely monitoring whether recent buyers will hold their positions or trigger a wave of sell-offs if prices start to decline.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read

Binance Launches New Airdrop and Trading Competition

Binance has officially launched a new airdrop event for Verasity (VRA) through its Binance Alpha platform, giving eligible users the chance to claim free tokens and compete for a massive prize pool.

XRP: What’s the Next Target After Bullish Breakout?

XRP has emerged from a months-long consolidation with renewed bullish momentum, reigniting trader interest in its next major price target.

Bitcoin Dominance Holds Firm as Altcoins Show Early Signs of Rotation

Despite recent gains across select DeFi and RWA tokens, Bitcoin continues to dominate the crypto landscape, with the Altcoin Season Index sitting at 43/100, according to today’s CoinMarketCap data.

XRP Eyes Next Target as Bullish Crossover Sparks 560% Surge

XRP is back in the spotlight after crypto analyst EGRAG CRYPTO highlighted a powerful historical pattern on the weekly timeframe—the bullish crossover of the 21 EMA and 55 SMA.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read