Record Hashrates Squeeze Bitcoin Mining Profits

17.07.2024 13:00 2 min. read Alexander Stefanov

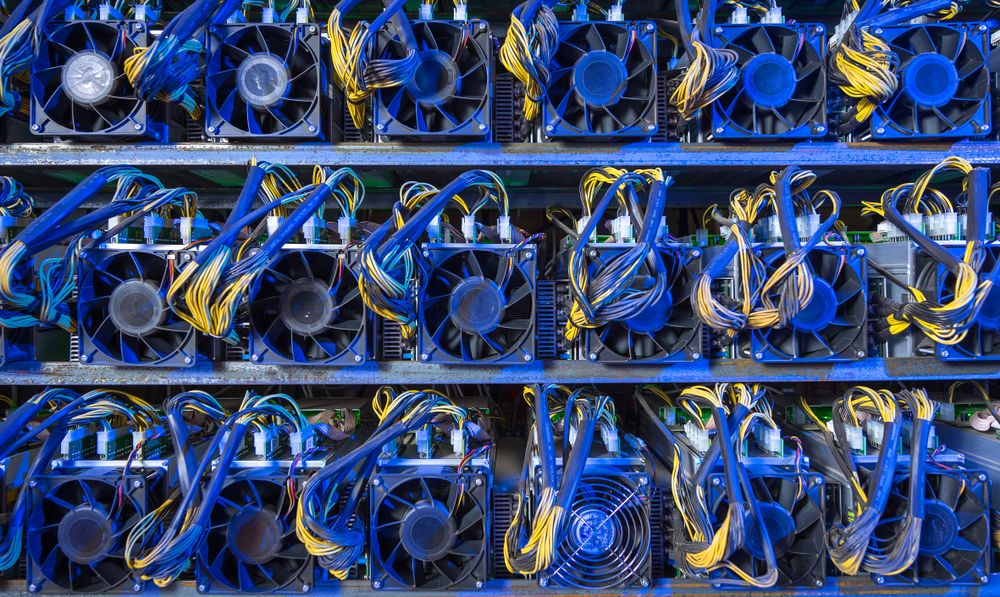

As Bitcoin mining becomes more challenging, miners face reduced profitability despite high trading values.

The network’s hashrate surged to 635 exahashes per second (EH/s) – at the time of writing it retraced to 594.43 EH/s) – increasing the competition and decreasing individual earnings. Although Bitcoin trades around $65,300, miners are not seeing significant gains due to the increased computing power required, which has tripled since November 2021.

This rise in hashrate has led to the lowest “hash price” in five years, now at $51.13 per terahash per second (TH/s), diminishing profitability for miners.

Industry experts are concerned about the future of Bitcoin mining. Kurt Wuckert Jr., CEO of Bitcoin SV mining pool Gorilla Pool, highlighted that profitability for miners is at a nearly six-year low.

He warned against investing in blockchain assets or mining equipment due to market uncertainties, emphasizing the role of electricity consumption and power arbitrage in mining profitability.

The centralization of mining power also raises concerns. Foundry and Antpool control 54% of all Bitcoin blocks mined in the past year, leading to questions about the network’s decentralization. This concentration of power among a few entities compromises Bitcoin’s distributed nature, posing potential security and governance risks.

Miners now navigate a competitive landscape with record-high hashrates and declining hash prices, squeezing profitability and making the future of Bitcoin mining uncertain.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read