Recession Fears Intensify as JPMorgan’s CEO Criticizes Bitcoin’s Worth

12.10.2024 16:00 2 min. read Kosta Gushterov

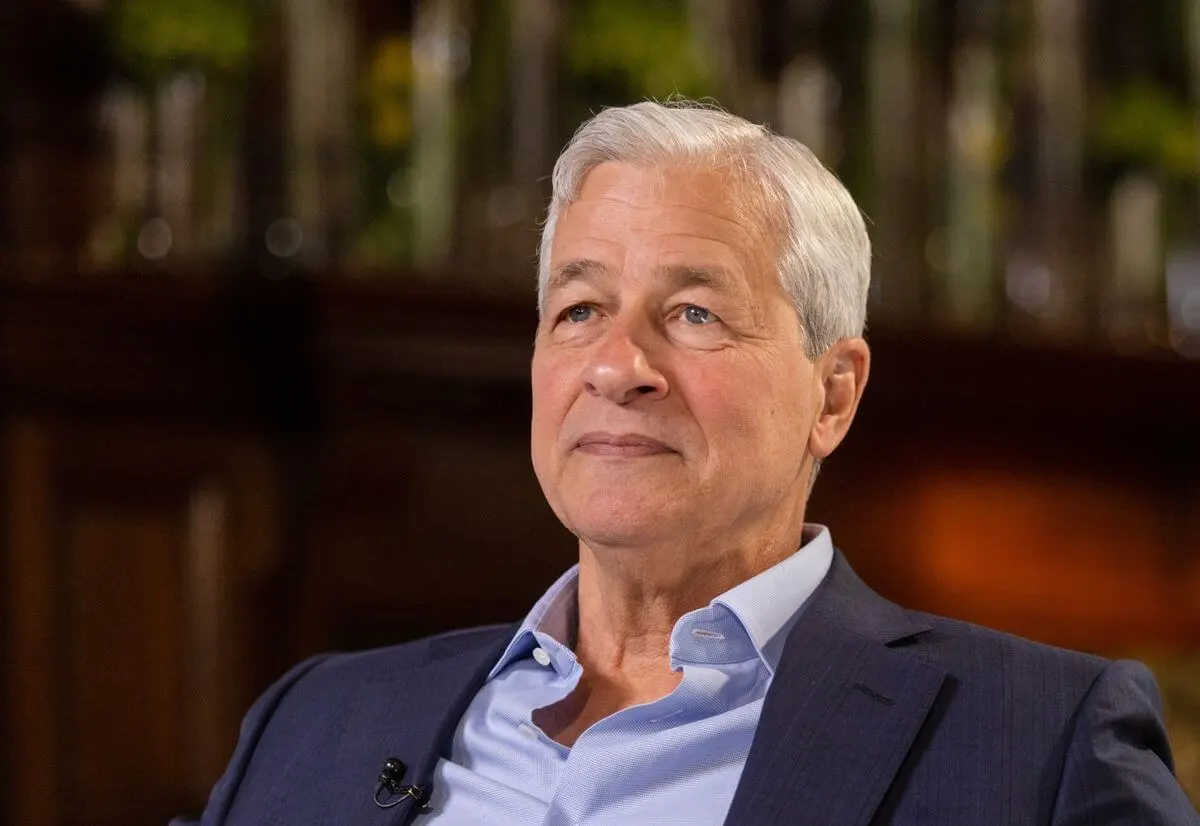

JPMorgan CEO Jamie Dimon has issued a stark warning about the looming threat of a global recession, even as he continues to criticize Bitcoin and other cryptocurrencies.

During the bank’s recent earnings report, Dimon conveyed deep concerns over escalating geopolitical tensions, stating, “Conditions are treacherous and getting worse.”

He pointed to ongoing conflicts, including the Russia-Ukraine war and the instability in the Middle East, highlighting a significant deterioration of the global order that has persisted since World War II. Dimon specifically mentioned the dangers posed by nuclear threats from nations like Iran and North Korea, labeling the current crisis as unprecedented in his experience.

While the Middle East is engulfed in turmoil, with escalating violence between Israel and Hamas, Dimon fears that retaliatory actions could destabilize the already shaky global economy. In Ukraine, Russia’s increased military budget signals an extended conflict, which could further impact Europe’s economic stability.

Despite these global challenges, Dimon maintains a staunch opposition to cryptocurrencies. Although JPMorgan has embraced blockchain technology and processed over $1 trillion in transactions, Dimon has called Bitcoin a “pet rock” and a “hyped-up fraud.” He remains particularly wary of the potential for digital currencies to facilitate criminal activity.

As JPMorgan reports a 7% rise in revenue this quarter, challenges persist, especially in consumer banking. Dimon’s dismissal of Bitcoin raises questions about the future of cryptocurrencies, which many believe will become increasingly relevant, regardless of his resistance.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

3

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

4

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read -

5

Bitcoin Struggles as Selling Pressure Mounts Amid Geopolitical Turmoil

13.06.2025 15:00 2 min. read

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

3

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

4

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read -

5

Bitcoin Struggles as Selling Pressure Mounts Amid Geopolitical Turmoil

13.06.2025 15:00 2 min. read