Pump.fun Faces Decline Amid Lawsuits and Hacking Scandals

30.03.2025 10:00 2 min. read Alexander Stefanov

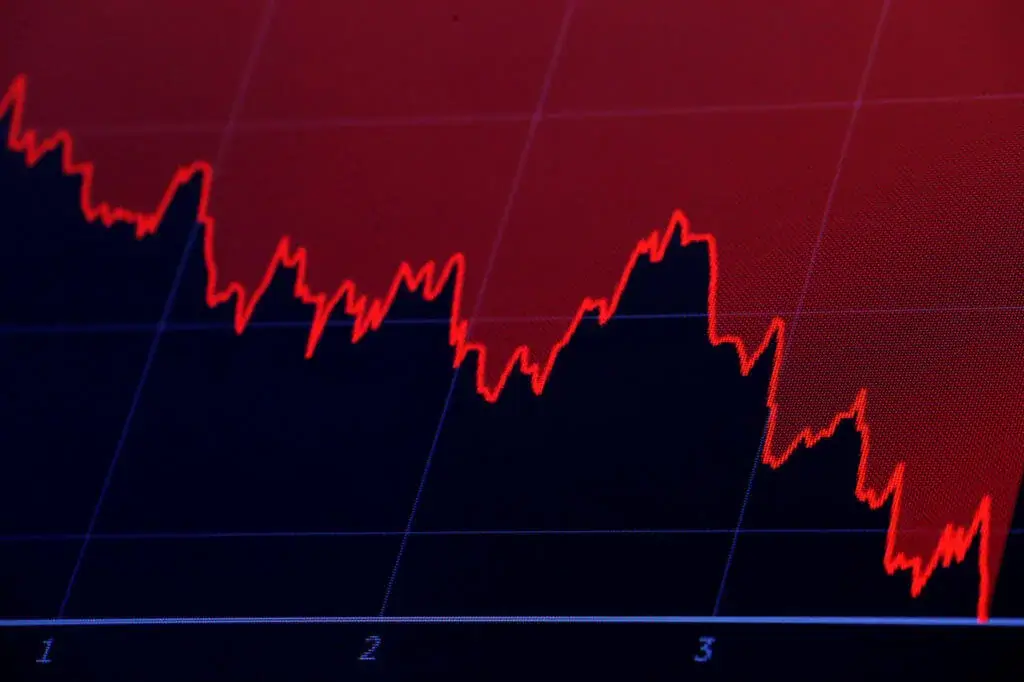

Pump.fun, a key player in Solana’s meme coin market surge last year, has seen a sharp decline in both protocol fees and trading volume.

Once at the center of the meme coin boom, the platform’s current data reflects a stark contrast to its earlier success.

As of March 28, Pump.fun’s protocol fee revenue dropped to $1.2 million, a significant fall from the $7.07 million seen in January, marking an 83% decrease over the past three months.

Though this is an improvement from the near $671k recorded just last week, it still reflects a considerable decrease in user engagement. The platform, once integral to the Solana meme coin ecosystem, is now struggling with reduced revenue and diminishing market influence.

This decline coincides with a broader downturn in the meme coin market, which had previously surged in popularity in 2024. According to Binance, meme coins led the crypto sector with average gains exceeding 212%, and Solana became the go-to blockchain for trading these assets.

Pump.fun had been at the heart of this movement, facilitating the launch of millions of meme coin projects and generating substantial revenue. However, the market’s enthusiasm seems to have waned in 2025, with growing concerns over fraud and manipulation.

Additionally, Pump.fun’s difficulties have been compounded by a series of setbacks. In late February, the platform’s official account was hacked, and fraudulent tokens were promoted under its name, including a fake governance token.

The platform is also facing multiple lawsuits, including one accusing it of facilitating the launch of unregistered securities through its token creation process. These lawsuits allege that influencers misled investors, resulting in significant losses. The platform’s legal troubles further add to the mounting pressure on its operations.

-

1

Crypto Sector H1 2025 Roundup: Binance Report Shows Institutional Surge and Tech Growth

19.07.2025 11:00 2 min. read -

2

Binance Founder Says Bloomberg’s USD1 Report is False, Threatens Lawsuit

13.07.2025 8:30 2 min. read -

3

Binance CEO Issues Urgent Crypto Security Reminder

09.07.2025 17:30 2 min. read -

4

Top 7 Crypto Project Updates This Week

19.07.2025 18:15 3 min. read -

5

EU Risks Falling Behind in Digital Finance, Warns Former ECB Board Member

06.07.2025 13:00 2 min. read

Bank of Korea Launches New Division to Oversee Crypto and Stablecoin Developments

The Bank of Korea (BOK) has taken a significant step toward deepening its involvement in the digital asset ecosystem by establishing a dedicated virtual asset division, according to a report from local media outlet News1.

JPMorgan: Coinbase Could Gain $60B From USDC-Circle Ecosystem

A new report from JPMorgan is shedding light on the staggering upside potential of Coinbase’s partnership with Circle and its deep exposure to the USDC stablecoin.

5 Major US Events and How They Can Shape Crypto Market in The Next Days

The week ahead is shaping up to be one of the most pivotal for global markets in months. With five major U.S. economic events scheduled between July 30 and August 1, volatility is almost guaranteed—and the crypto market is bracing for impact.

eToro Launches 24/5 Stock Trading, Unlocking Round-the-clock Access to Top US Shares

Global fintech platform eToro has officially rolled out 24/5 trading on its 100 most popular U.S. stocks, giving users the ability to buy and sell equities at any time from Monday to Friday.

-

1

Crypto Sector H1 2025 Roundup: Binance Report Shows Institutional Surge and Tech Growth

19.07.2025 11:00 2 min. read -

2

Binance Founder Says Bloomberg’s USD1 Report is False, Threatens Lawsuit

13.07.2025 8:30 2 min. read -

3

Binance CEO Issues Urgent Crypto Security Reminder

09.07.2025 17:30 2 min. read -

4

Top 7 Crypto Project Updates This Week

19.07.2025 18:15 3 min. read -

5

EU Risks Falling Behind in Digital Finance, Warns Former ECB Board Member

06.07.2025 13:00 2 min. read