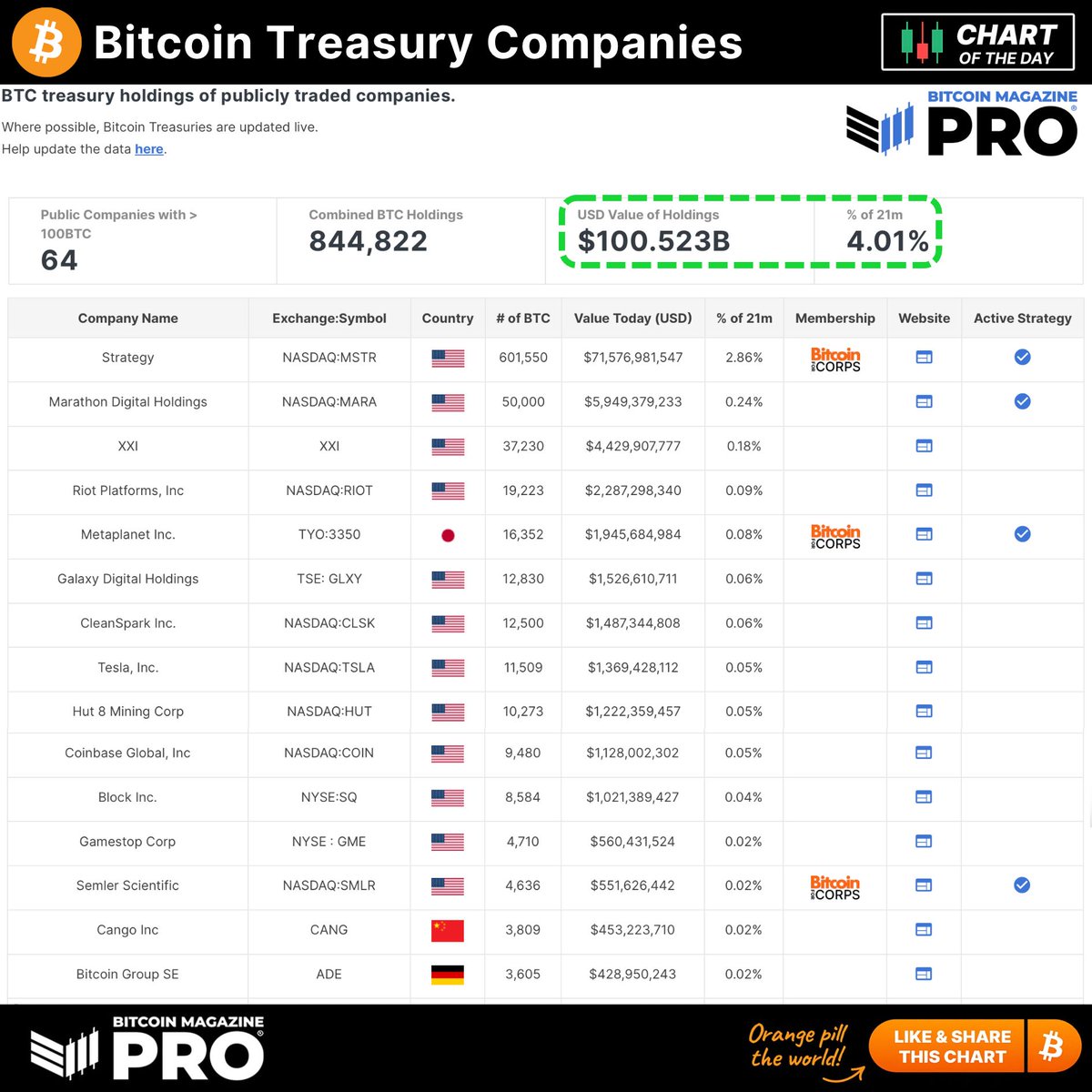

Public Companies Now hold Over $100 Billion in Bitcoin — 4% of Total Supply

21.07.2025 19:30 2 min. read Kosta Gushterov

According to new data shared by Bitcoin Magazine Pro, publicly traded companies now collectively hold over 844,822 BTC, valued at more than $100.5 billion, marking a historic milestone for institutional Bitcoin adoption.

This represents more than 4% of all Bitcoin that will ever exist, underscoring a powerful shift in treasury strategy across the corporate landscape.

Strategy leads with over 600,000 BTC

Michael Saylor’s Strategy (NASDAQ: MSTR) remains the undisputed leader, holding 601,550 BTC worth more than $71.5 billion—accounting for 2.86% of the total Bitcoin supply. Marathon Digital, XXII, Riot Platforms, and Metaplanet round out the top five, each holding between 16,000 and 50,000 BTC.

Metaplanet, often dubbed “Asia’s MicroStrategy,” has rapidly increased its BTC position, while other firms like Tesla, Coinbase, and Block continue to maintain sizable reserves as part of their long-term balance sheet strategies.

1 million BTC by year-end?

With current momentum accelerating, Bitcoin Magazine Pro poses the question: Could publicly listed firms collectively surpass 1 million BTC in holdings by the end of 2025? As more corporations seek hedges against fiat depreciation and regulatory clarity improves, such a milestone may be closer than expected.

The shift highlights Bitcoin’s transformation from a speculative asset to a core strategic reserve. From tech giants to miners and FinTech innovators, public companies are increasingly treating Bitcoin as a financial backbone rather than a fringe experiment.

With over 4% of Bitcoin’s fixed 21 million supply now sitting in corporate treasuries, the trend suggests deepening institutional conviction—and growing scarcity for retail and late institutional adopters alike.

-

1

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

2

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

07.07.2025 17:00 2 min. read -

3

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

4

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

5

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read

Trump Media Holds $2B in Bitcoin as Crypto Plan Expands

Trump Media and Technology Group, the parent company of Truth Social, Truth+, and Truth.Fi, has officially disclosed that it now holds approximately $2 billion in Bitcoin and Bitcoin-related securities.

Strategy Adds 6,220 BTC, Pushing Total Holdings Past 607,000

Michael Saylor’s Strategy has confirmed another major Bitcoin purchase, acquiring 6,220 BTC last week for approximately $739.8 million.

Bitcoin Open Interest Hits $42B as Funding Rates Signal Bullish Overextension

Bitcoin’s derivatives market is heating up, with open interest climbing back to $42 billion while funding rates continue to surge.

Tim Draper Predicts Bitcoin Will Replace U.S. Dollar

Tim Draper isn’t just betting on Bitcoin—he’s forecasting the death of the U.S. dollar.

-

1

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

2

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

07.07.2025 17:00 2 min. read -

3

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

4

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

5

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read