Pi is Heading for $2 – Will it Recover?

24.02.2025 12:06 2 min. read Alexander Zdravkov

Pi Network's PI Token officially debuted on February 20, marking a major milestone for the project.

However, the long-awaited launch led to intense selling pressure as early adopters tried to cash in, causing a sharp drop in value.

By February 21, the PI had collapsed to $0.60, but the decline was short-lived. The token recovered with strong momentum, fueled by renewed investor interest.

At the time of writing, PI is trading at $1.52, reflecting a 160% recovery from the low point. This surge is mainly due to rising demand, with speculation surrounding a possible listing on Binance playing a key role.

As of February 22, over 212,000 votes had been cast on whether PI should be listed on Binance, with over 86% in favor. As the voting comes to a close, many investors are anticipating an official listing, which could further boost the token’s price.

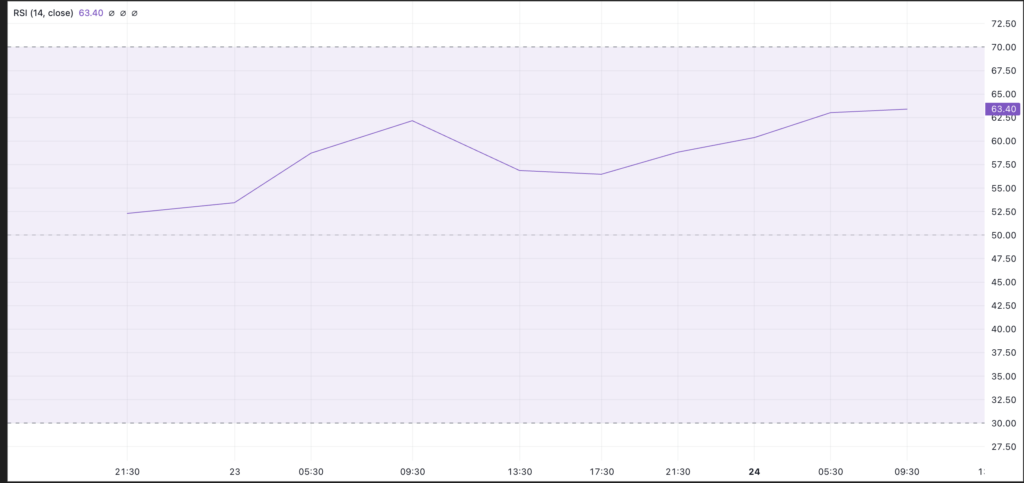

Technical indicators also point to growing bullish sentiment. The PI Relative Strength Index (RSI), which tracks momentum, is at 63.40 on the four-hour chart, signaling strong buying pressure.

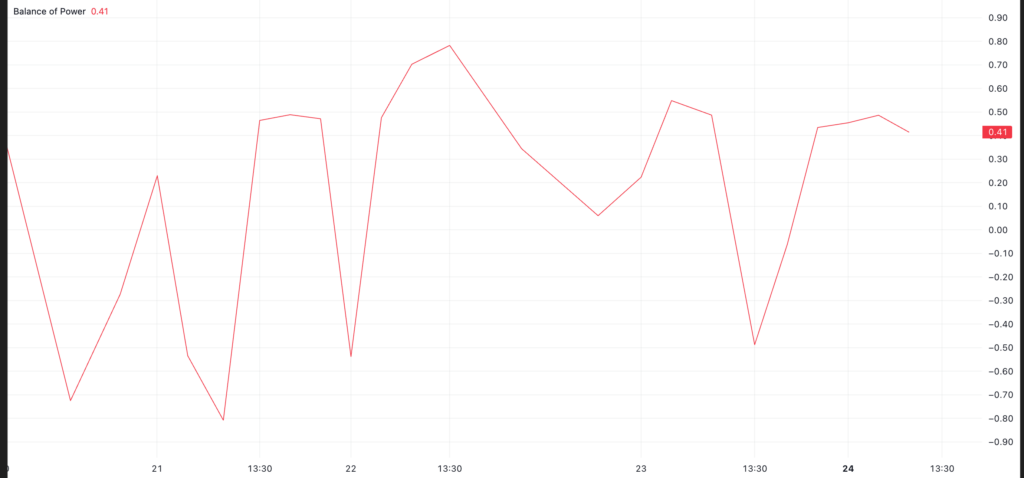

Furthermore, the Balance of Power (BoP) indicator, which measures the strength of buyers versus sellers, is at 0.41, reinforcing the positive outlook. When this indicator is positive, it suggests that buyers are in control, increasing the likelihood of continued price gains.

Since its launch, PI has maintained an upward trajectory, trading above a key uptrend line. This sustained bullish momentum is evidence that investors continue to support higher prices. If the trend holds, PI could break the $2 mark and eventually reach its previous high of $2.20.

However, any sharp increase in profit-taking could disrupt this outlook. If selling pressure intensifies, PI could break below $1.50, with further declines leading to $1.34.

For now, movement in the PI market remains strong, with traders watching closely for any signs of further gains – or an imminent correction.

-

1

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

06.07.2025 15:00 1 min. read -

2

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

3

Top 10 Institutional ETH Holders

10.07.2025 17:00 2 min. read -

4

Ethereum Surges Above $3,420 While XRP Stays Stable Over $3

17.07.2025 10:39 1 min. read -

5

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

17.07.2025 15:30 2 min. read

21Shares Files for ETF Tracking Ondo’s Real-World Asset Token

21Shares has submitted an application to launch an exchange-traded product (ETP) that tracks Ondo (ONDO), the native token of Ondo Finance.

BNB Hits New All-time High Above $803 Amid Altcoin Surge

BNB soared past $803, setting a new all-time high before pulling back slightly.

Altcoin Volume on Binance Hits Highest Level Since February

Altcoin trading volume on Binance Futures surged to $100.7 billion in a single day, reaching its highest level since February 3, 2025, according to data from CryptoQuant.

Bitcoin Exchange Inflows Spike — What Does it Means for Altcoins?

Bitcoin just recorded its largest net inflow to exchanges since July 2024, signaling a potential shift in market behavior.

-

1

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

06.07.2025 15:00 1 min. read -

2

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

3

Top 10 Institutional ETH Holders

10.07.2025 17:00 2 min. read -

4

Ethereum Surges Above $3,420 While XRP Stays Stable Over $3

17.07.2025 10:39 1 min. read -

5

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

17.07.2025 15:30 2 min. read