Pectra is Boosting Ethereum Network, Pushing the Price Toward $2,000

08.05.2025 17:00 1 min. read Alexander Zdravkov

The latest upgrade to Ethereum, Pectra, implemented on May 7, has begun to influence the dynamics of supply on the network.

On-chain data shows a significant contraction in the supply of Ethereum in circulation, which is currently at an 18-day low of approximately 120.69 million ETH.This decline is due to increased user activity on the first layer network.

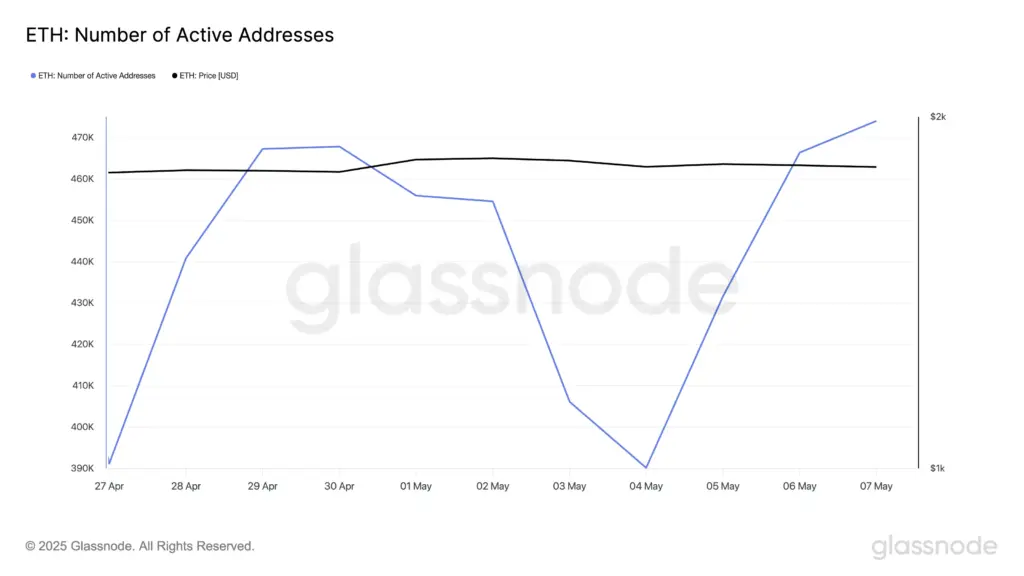

Glassnode reported that on May 7, the number of unique active addresses reached a 30-day high of 474,044, signaling a resumption of user activity.

The surge in activity also affected the burn rate of ETH. According to Etherscan, the daily amount rose to its highest level since early May, further tightening the supply in circulation.

Although these developments suggest potential upward pressure on the price of ETH, market analysts advise caution.

In summary, the Pectra upgrade has led to increased network activity and reduced circulating supply, factors that could influence Ethereum’s price trajectory. However, broader market conditions and investor sentiment will play a decisive role in determining the extent of price movements.

-

1

Top 10 Trending Cryptocurrencies, According to CoinGecko

18.07.2025 18:34 2 min. read -

2

SPX6900 Price Prediction: SPX Holders Jump and Trading Volumes Explode – Is $2 In Sight?

09.07.2025 17:44 3 min. read -

3

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read -

4

Whales Quietly Accumulate Four Altcoins: Early Signals of Potential Rally

08.07.2025 17:30 2 min. read -

5

What’s Ahead for Ethereum, According to Former Core Developer

05.07.2025 19:00 2 min. read

Altcoin Season Signals Strengthen as Institutional Flows Accelerate

According to QCP Capital’s latest report, altcoin season may have finally arrived.

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

Solana (SOL) has gone up by 35% in the past 30 days as multiple tailwinds have lifted the price of this top altcoin above the $190 level. A breakout above this level favors a bullish Solana price prediction as it could anticipate a big move ahead, especially at a point when market conditions are favorable. […]

Altcoin Market at Key Resistance as Capital Rotation Begins

According to Swissblock, the altcoin market has reached a critical inflection point, with 75% of altcoins now sitting at resistance levels.

The Ether Machine Targets Nasdaq Debut With $1.6B in Capital and 400K ETH

A newly formed Ethereum-focused company, The Ether Machine, is set to become the largest publicly traded vehicle dedicated solely to Ethereum following a definitive merger announcement on Monday.

-

1

Top 10 Trending Cryptocurrencies, According to CoinGecko

18.07.2025 18:34 2 min. read -

2

SPX6900 Price Prediction: SPX Holders Jump and Trading Volumes Explode – Is $2 In Sight?

09.07.2025 17:44 3 min. read -

3

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read -

4

Whales Quietly Accumulate Four Altcoins: Early Signals of Potential Rally

08.07.2025 17:30 2 min. read -

5

What’s Ahead for Ethereum, According to Former Core Developer

05.07.2025 19:00 2 min. read