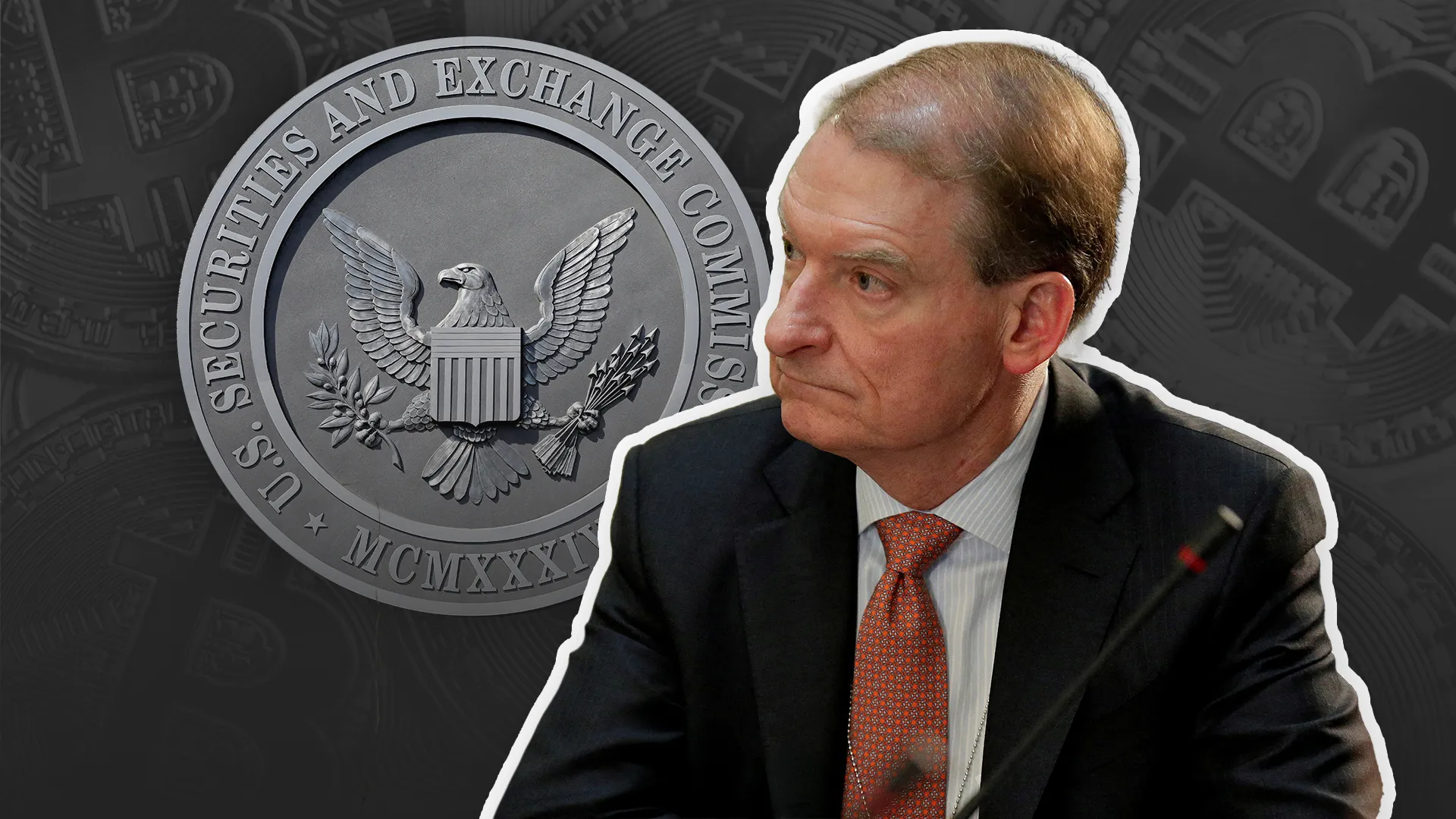

Paul Atkins’ SEC Nomination Faces Scrutiny Over Crypto Ties and Wealth Disclosures

26.03.2025 11:00 2 min. read Alexander Zdravkov

Paul Atkins, nominated to head the U.S. Securities and Exchange Commission (SEC) under Donald Trump, has come under scrutiny ahead of his confirmation hearing.

A recent financial disclosure revealed that he and his wife, Sarah Humphreys, control a substantial fortune, with assets surpassing $327 million. Their wealth stems from Humphreys’ family business, Tamko Building Products, and Atkins’ consulting firm, Patomak Global Partners.

Atkins’ holdings include a significant stake in Patomak, stock options in blockchain company Securitize, and investments in fintech firm Pontoro. With the confirmation process underway, he has pledged to step down from his role at Patomak and divest certain assets to comply with SEC regulations. Having previously served as an SEC commissioner from 2002 to 2008, his return to the agency is being closely watched.

The nomination has sparked concerns over Atkins’ involvement in the crypto sector. Senator Elizabeth Warren has indicated plans to challenge him on past connections with industry players, including any potential links to the collapsed exchange FTX. At the same time, some Republican lawmakers, such as Senator Cynthia Lummis, have expressed support, hoping Atkins will push for clearer crypto regulations.

Atkins’ confirmation hearing comes amid broader controversy surrounding Trump’s approach to financial regulation. David Sacks, tapped as an advisor on crypto and AI, recently liquidated over $200 million in digital assets to preempt conflict-of-interest accusations. Trump himself has also faced scrutiny over financial dealings, including his family’s involvement in World Liberty Financial and the rollout of a memecoin.

If confirmed, Atkins would succeed former SEC Chair Gary Gensler, who stepped down in January, leaving Commissioner Mark Uyeda in charge on an interim basis. His appointment could shape the agency’s direction on crypto and financial oversight for years to come.

-

1

Chinese Tech Firms Turn to Crypto for Treasury Diversification

26.06.2025 17:00 1 min. read -

2

FTX Halts Recovery Payments in 49 Countries: Here Is the List

04.07.2025 18:00 2 min. read -

3

What Are the Key Trends in European Consumer Payments for 2024?

29.06.2025 8:00 2 min. read -

4

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read -

5

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

05.07.2025 9:56 2 min. read

U.S. Public Pension Giant Boosts Palantir and Strategy Holdings in Q2

According to a report by Barron’s, the Ohio Public Employees Retirement System (OPERS) made notable adjustments to its portfolio in Q2 2025, significantly increasing exposure to Palantir and Strategy while cutting back on Lyft.

Key Crypto Events to Watch in the Next Months

As crypto markets gain momentum heading into the second half of 2025, a series of pivotal regulatory and macroeconomic events are poised to shape sentiment, liquidity, and price action across the space.

Here is Why Stablecoins Are Booming, According to Tether CEO

In a recent interview with Bankless, Tether CEO Paolo Ardoino shed light on the growing adoption of stablecoins like USDT, linking their rise to global economic instability and shifting generational dynamics.

U.S. Dollar Comes Onchain as GENIUS Act Ushers in Digital Era

In a statement that marks a major policy shift, U.S. Treasury Secretary Scott Bessent confirmed that blockchain technologies will play a central role in the future of American payments, with the U.S. dollar officially moving “onchain.”

-

1

Chinese Tech Firms Turn to Crypto for Treasury Diversification

26.06.2025 17:00 1 min. read -

2

FTX Halts Recovery Payments in 49 Countries: Here Is the List

04.07.2025 18:00 2 min. read -

3

What Are the Key Trends in European Consumer Payments for 2024?

29.06.2025 8:00 2 min. read -

4

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read -

5

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

05.07.2025 9:56 2 min. read